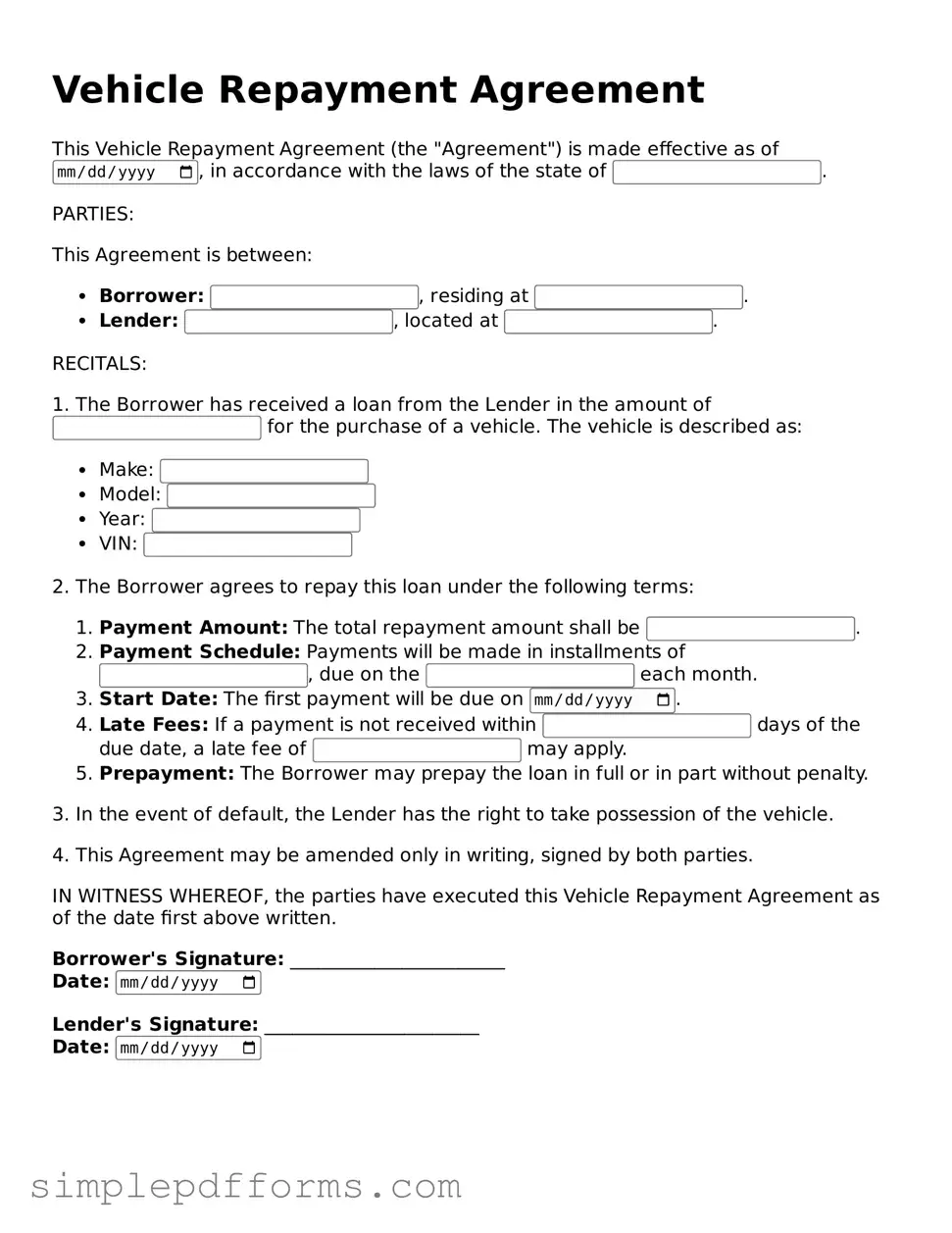

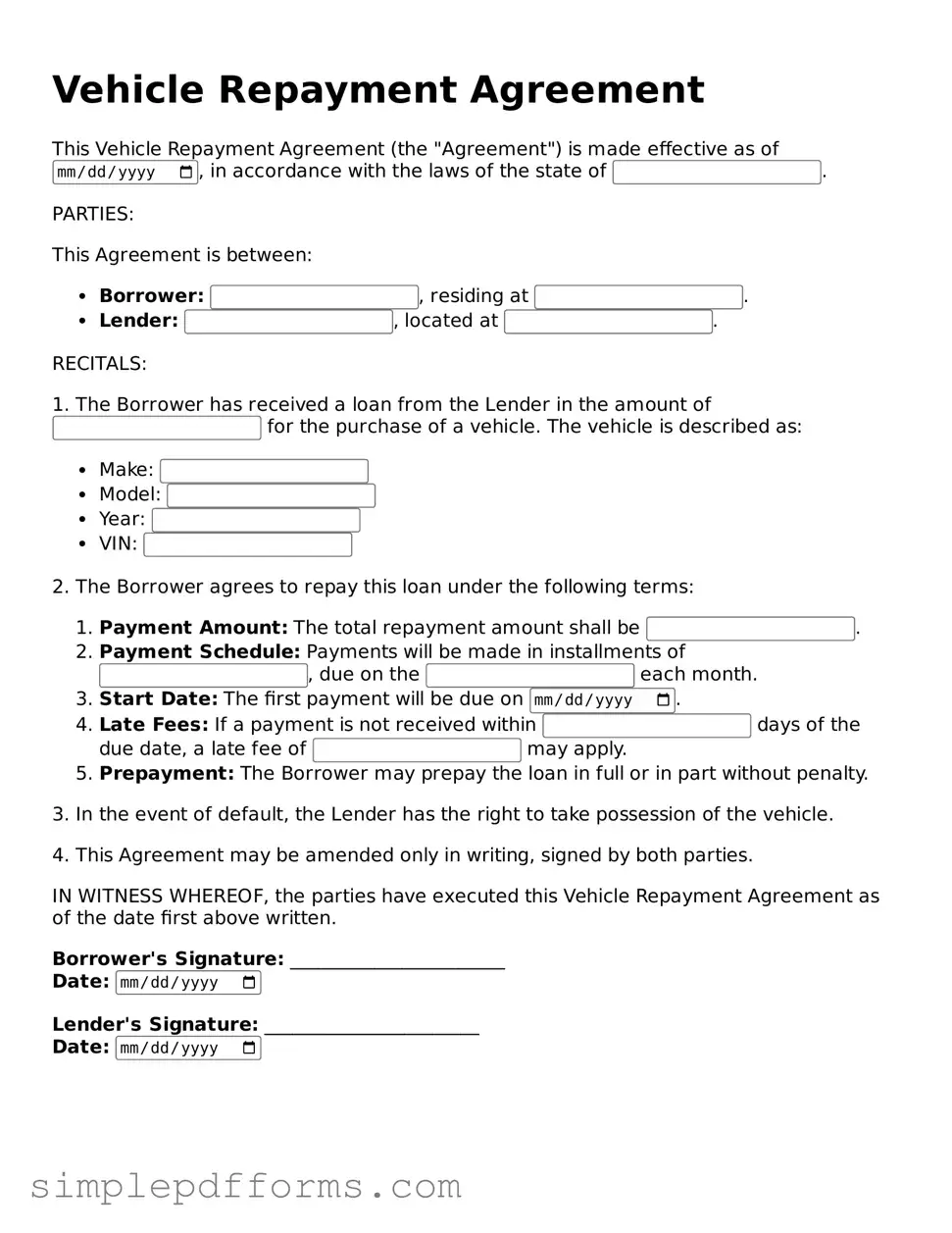

Free Vehicle Repayment Agreement Form

A Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan for a vehicle. This agreement serves to protect both the lender and the borrower by clearly defining payment schedules, interest rates, and consequences for missed payments. Understanding this form is essential for anyone involved in vehicle financing.

Open Vehicle Repayment Agreement Editor Now

Free Vehicle Repayment Agreement Form

Open Vehicle Repayment Agreement Editor Now

Open Vehicle Repayment Agreement Editor Now

or

Get Vehicle Repayment Agreement PDF Form

Your form is waiting for completion

Complete Vehicle Repayment Agreement online in minutes with ease.