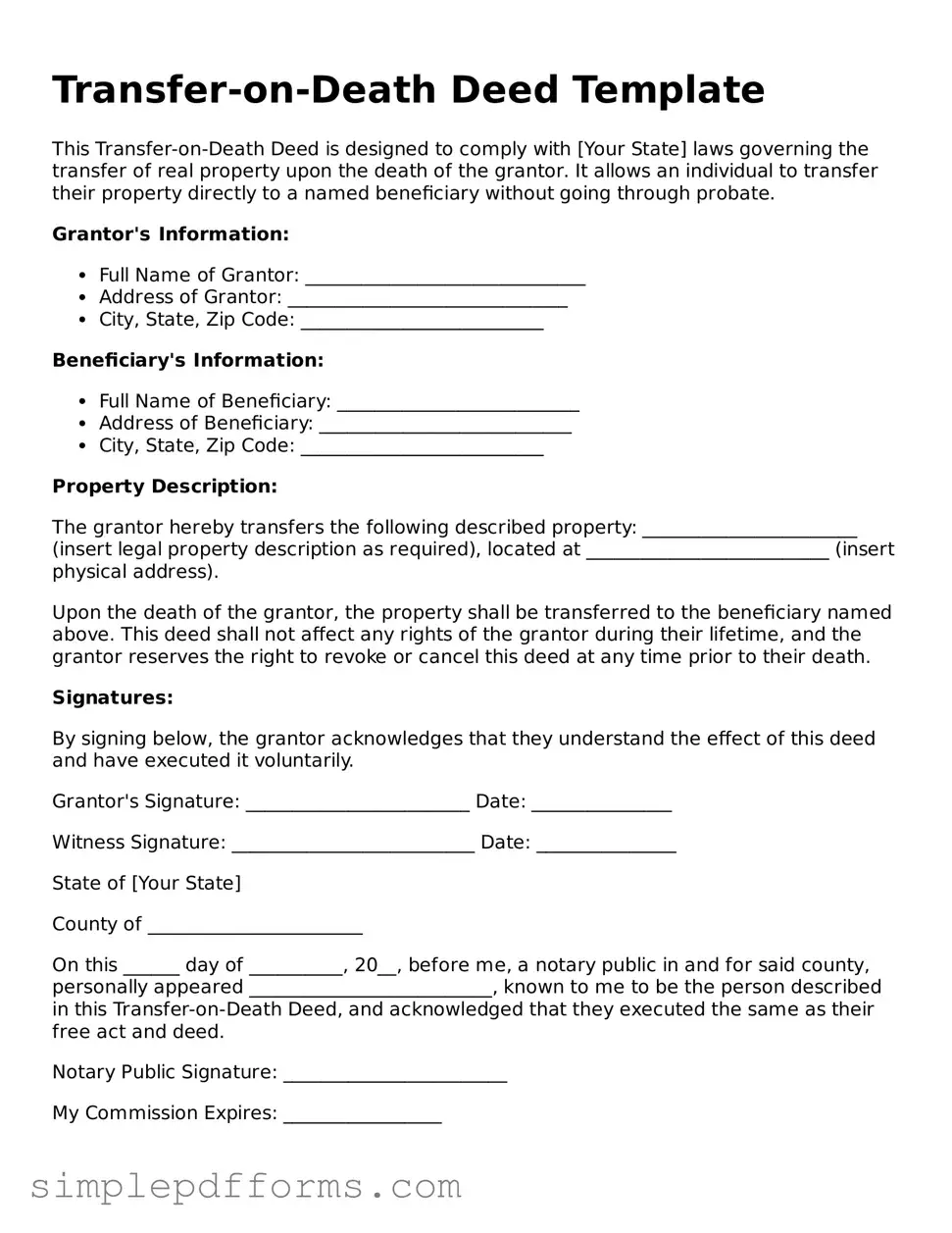

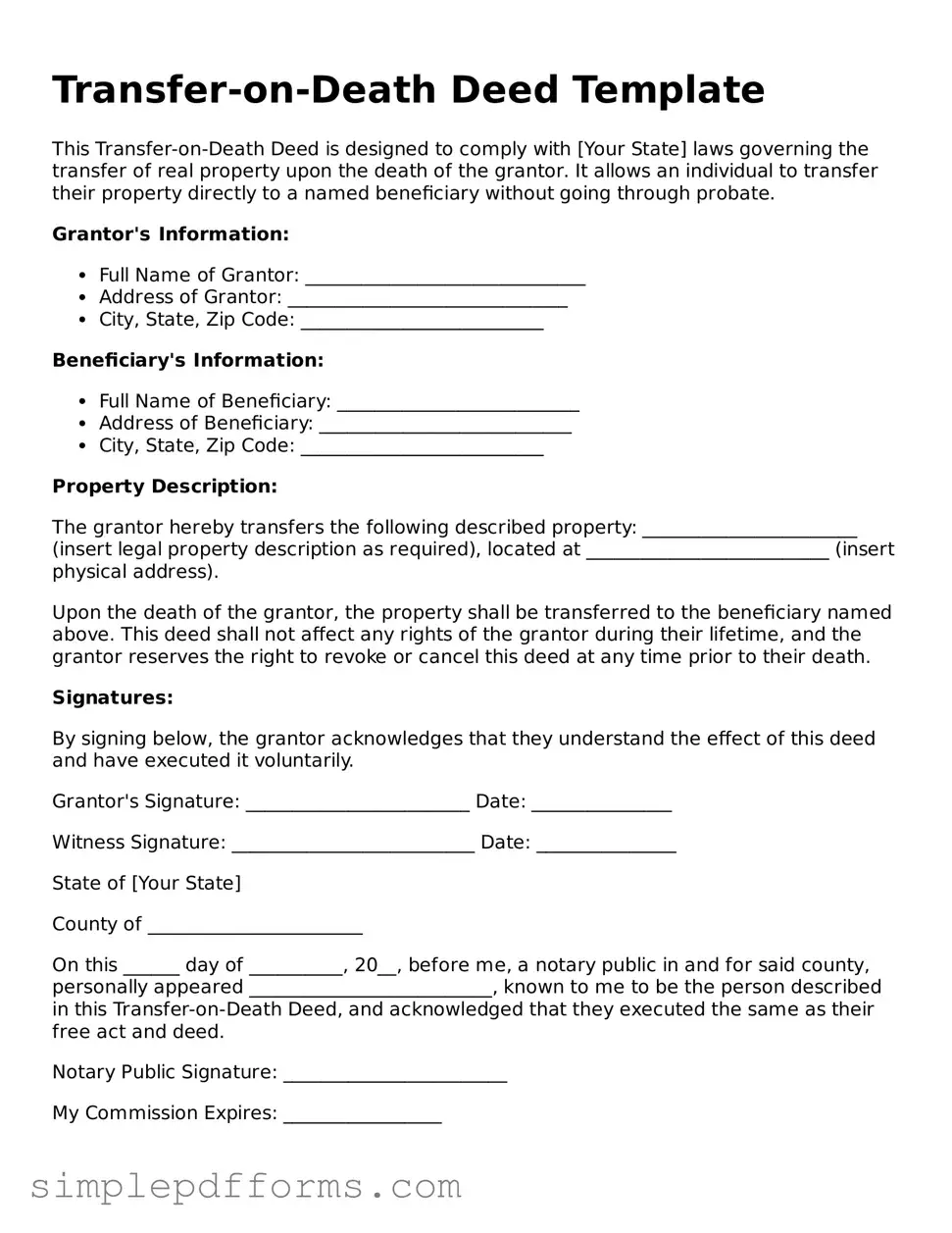

Free Transfer-on-Death Deed Form

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners to designate a beneficiary who will receive their real estate upon their death, bypassing the probate process. This deed ensures that the transfer of property is straightforward and efficient, providing peace of mind for both the owner and their loved ones. By using a TOD, individuals can retain control of their property during their lifetime while simplifying the transition for their heirs.

Open Transfer-on-Death Deed Editor Now

Free Transfer-on-Death Deed Form

Open Transfer-on-Death Deed Editor Now

Open Transfer-on-Death Deed Editor Now

or

Get Transfer-on-Death Deed PDF Form

Your form is waiting for completion

Complete Transfer-on-Death Deed online in minutes with ease.