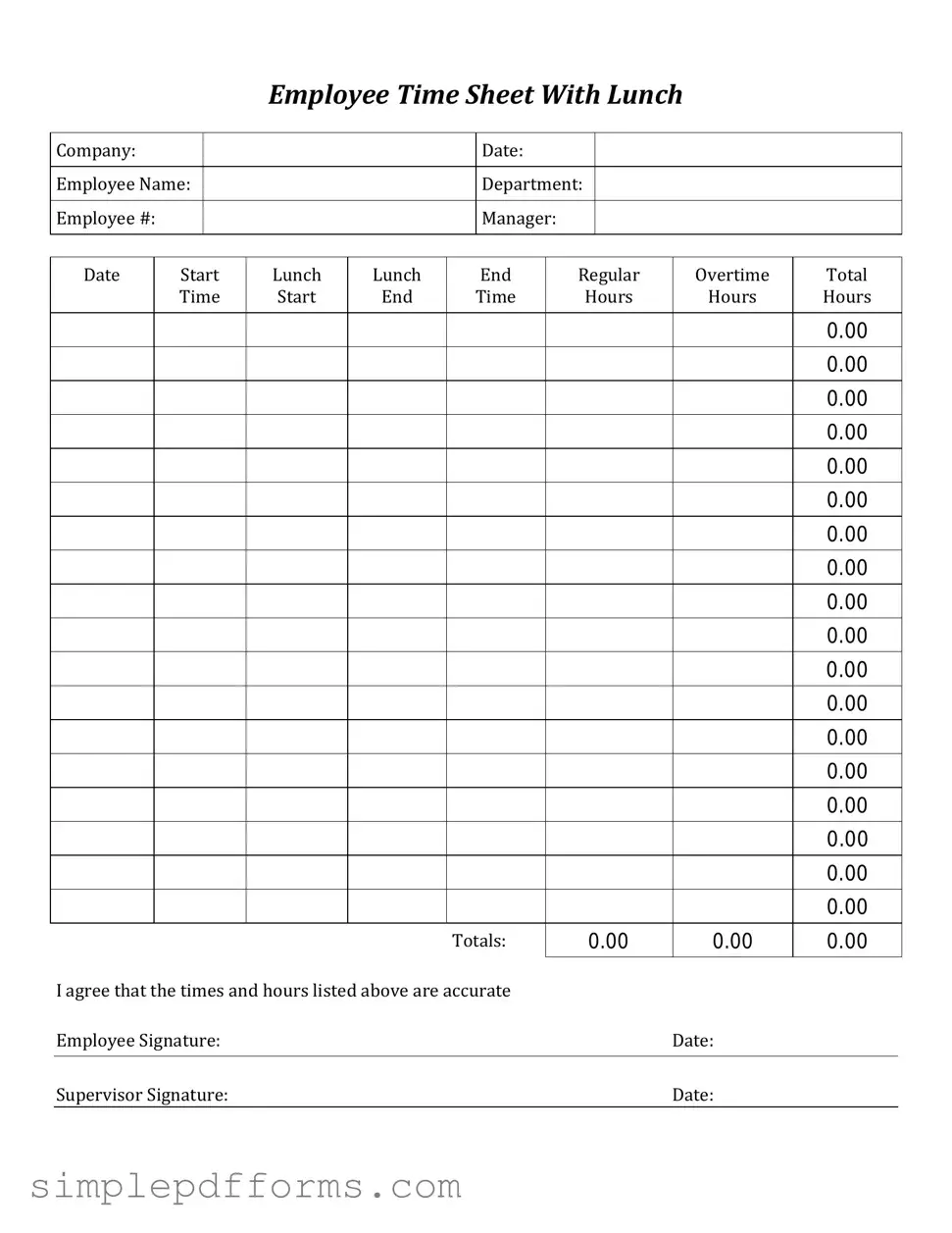

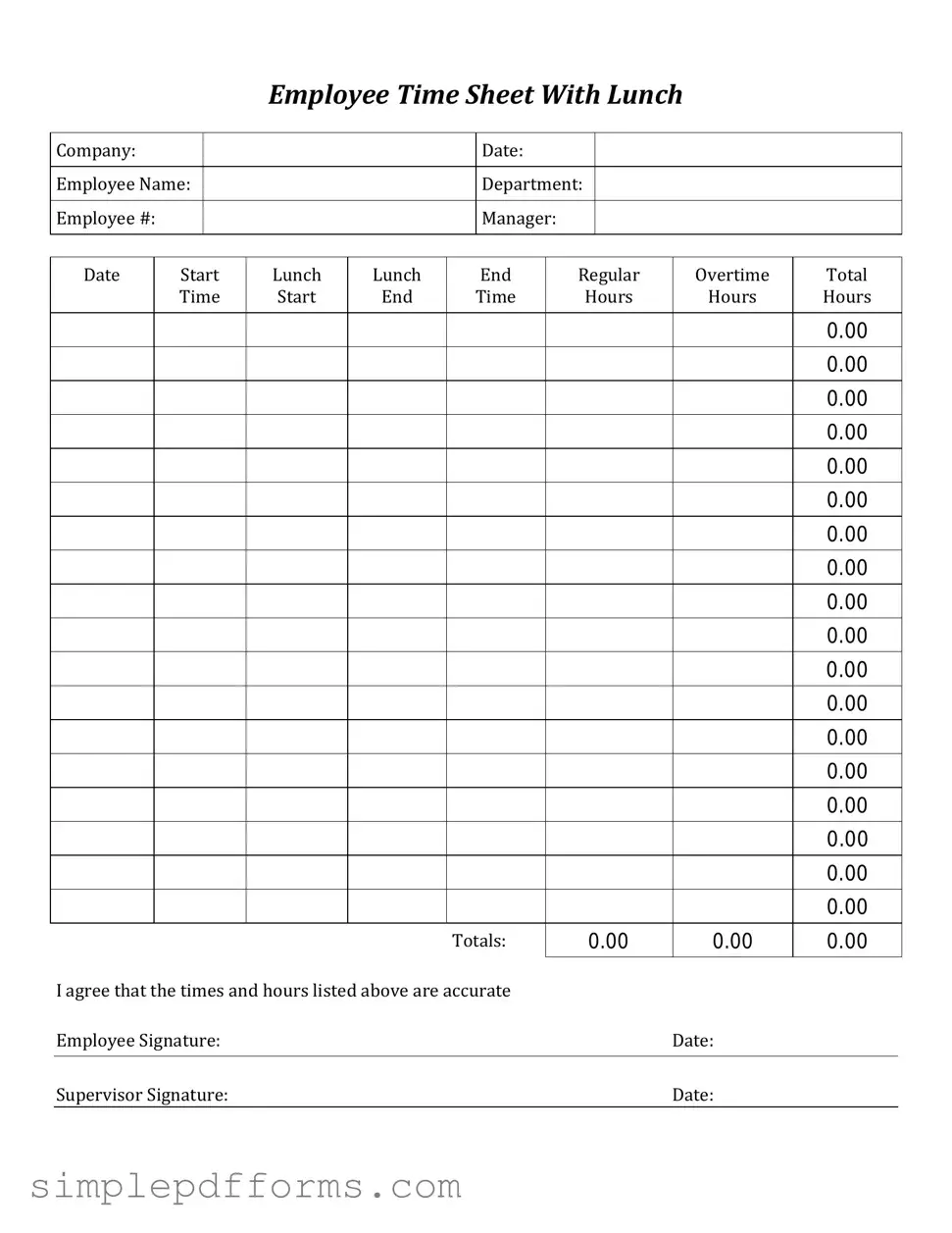

Fill a Valid Time Card Form

A Time Card form is a document used by employees to record their hours worked during a specific period. This form helps ensure accurate payroll processing and compliance with labor regulations. Understanding how to properly fill out and submit a Time Card form is essential for both employees and employers.

Open Time Card Editor Now

Fill a Valid Time Card Form

Open Time Card Editor Now

Open Time Card Editor Now

or

Get Time Card PDF Form

Your form is waiting for completion

Complete Time Card online in minutes with ease.