Attorney-Verified Tractor Bill of Sale Document for Texas State

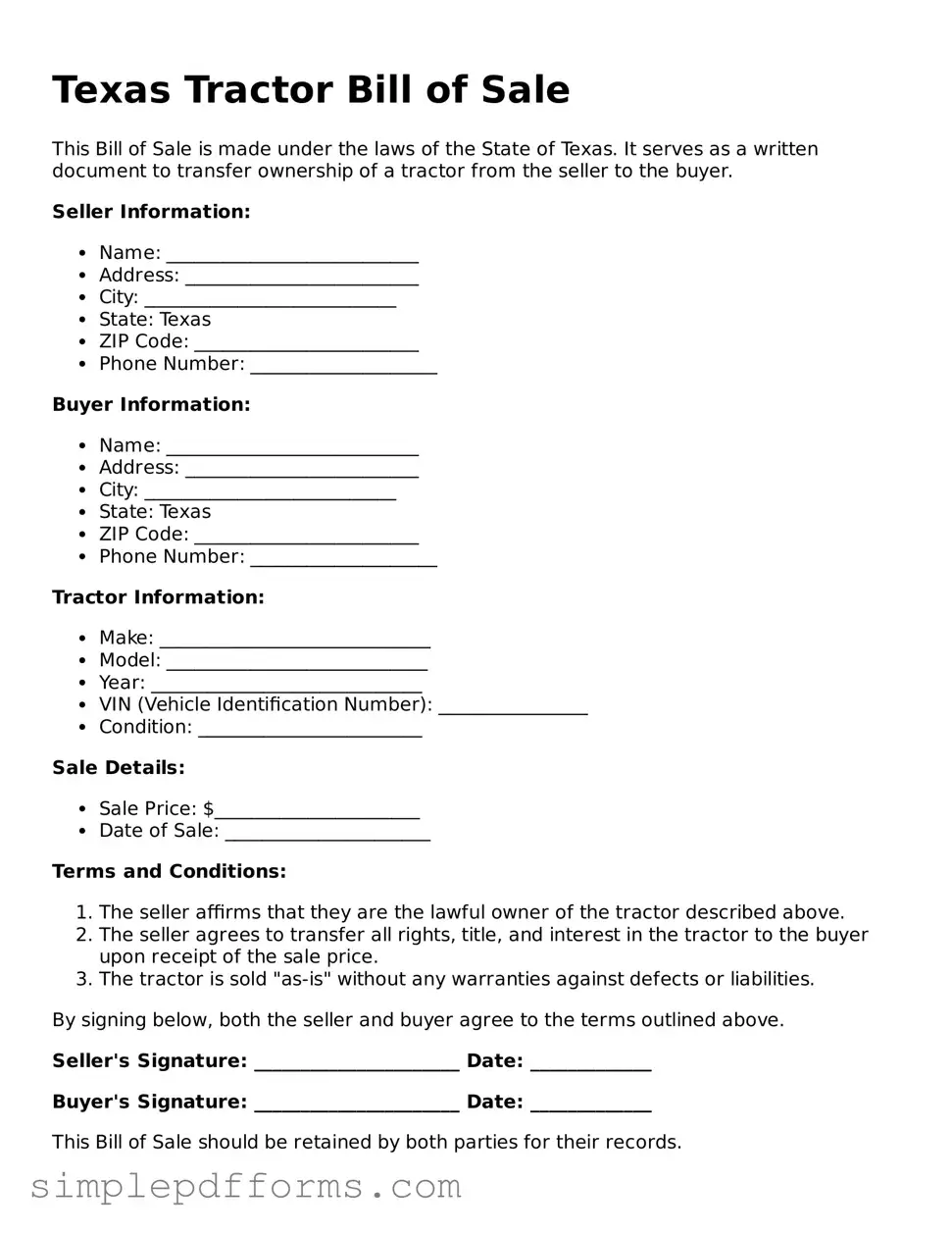

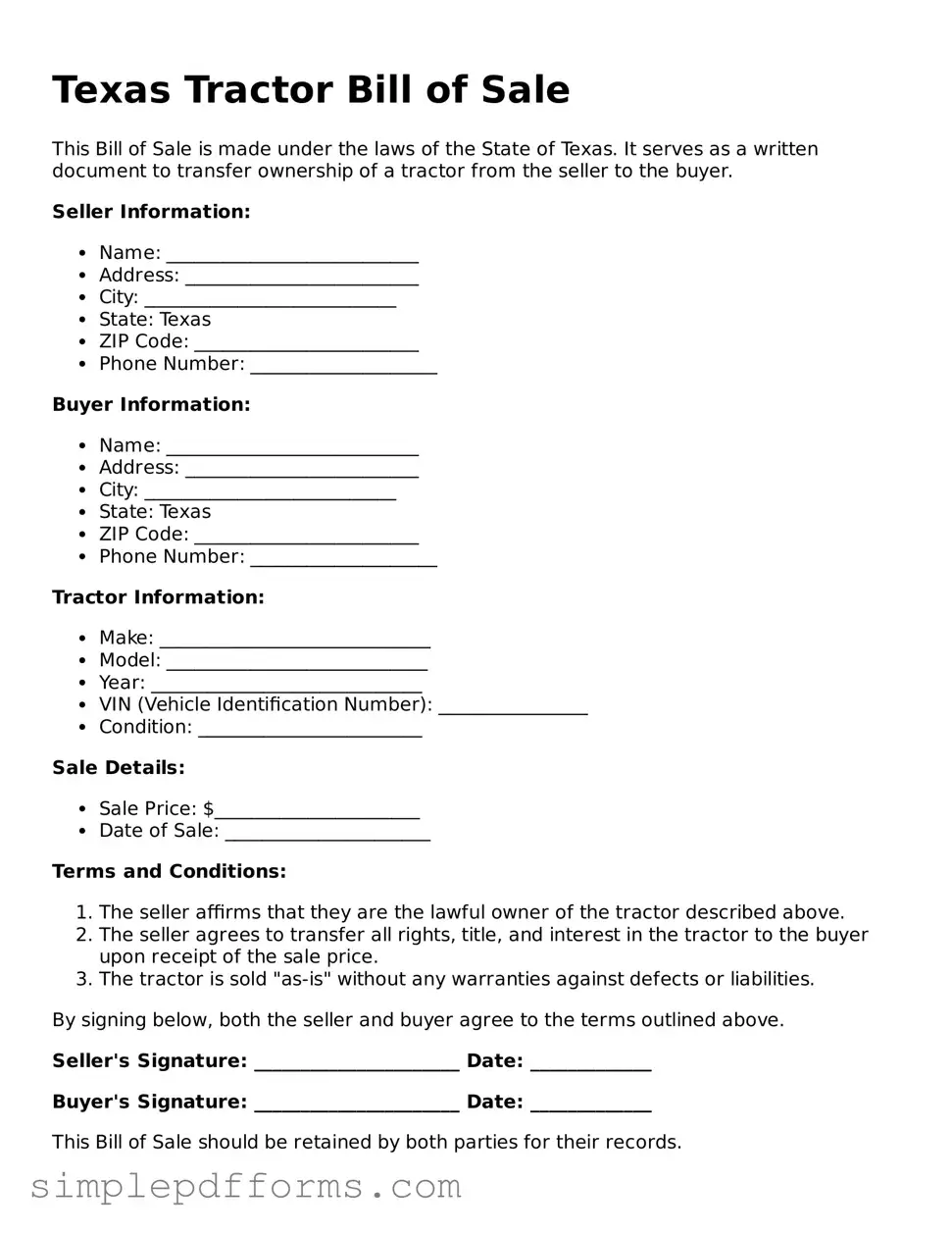

The Texas Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in Texas. This form provides essential details about the transaction, ensuring that both the buyer and seller have a clear understanding of their rights and responsibilities. Completing this form accurately is crucial for a smooth transfer of ownership and to avoid potential disputes in the future.

Open Tractor Bill of Sale Editor Now

Attorney-Verified Tractor Bill of Sale Document for Texas State

Open Tractor Bill of Sale Editor Now

Open Tractor Bill of Sale Editor Now

or

Get Tractor Bill of Sale PDF Form

Your form is waiting for completion

Complete Tractor Bill of Sale online in minutes with ease.