Attorney-Verified Real Estate Purchase Agreement Document for Texas State

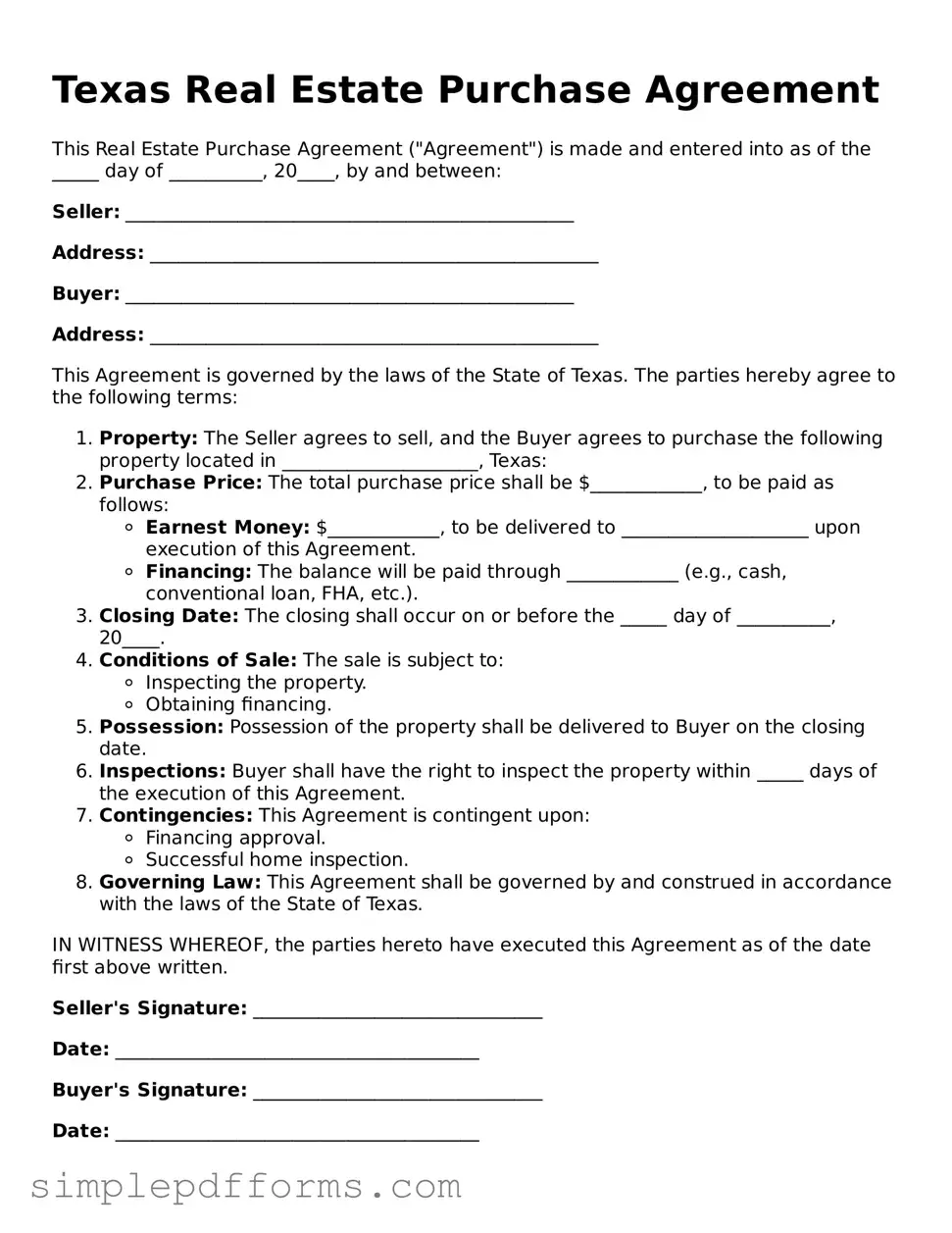

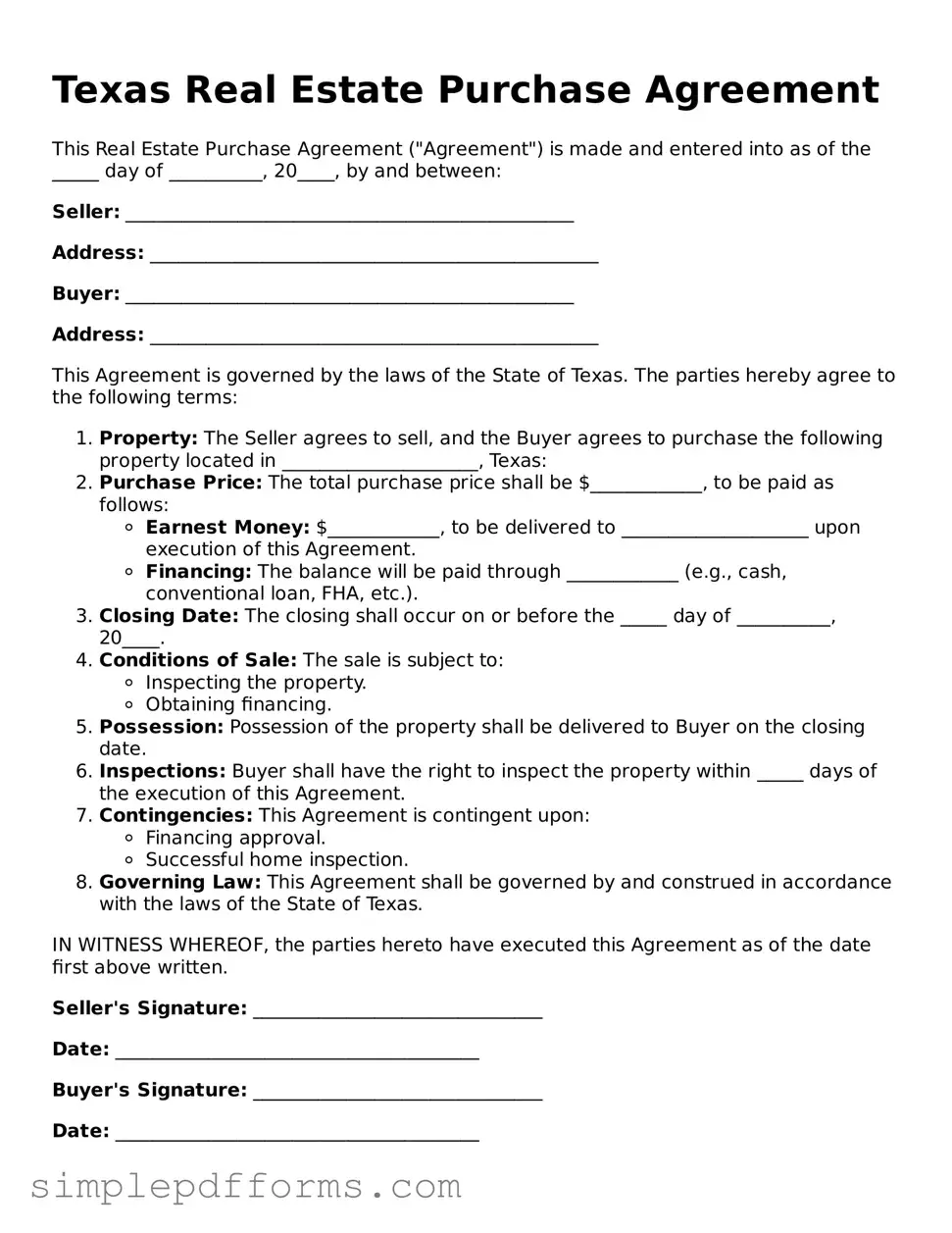

The Texas Real Estate Purchase Agreement form is a legal document used in real estate transactions to outline the terms and conditions of a property sale. This form serves as a binding contract between the buyer and seller, detailing essential elements such as the purchase price, closing date, and any contingencies. Understanding this agreement is crucial for anyone involved in buying or selling real estate in Texas.

Open Real Estate Purchase Agreement Editor Now

Attorney-Verified Real Estate Purchase Agreement Document for Texas State

Open Real Estate Purchase Agreement Editor Now

Open Real Estate Purchase Agreement Editor Now

or

Get Real Estate Purchase Agreement PDF Form

Your form is waiting for completion

Complete Real Estate Purchase Agreement online in minutes with ease.