Attorney-Verified Last Will and Testament Document for Texas State

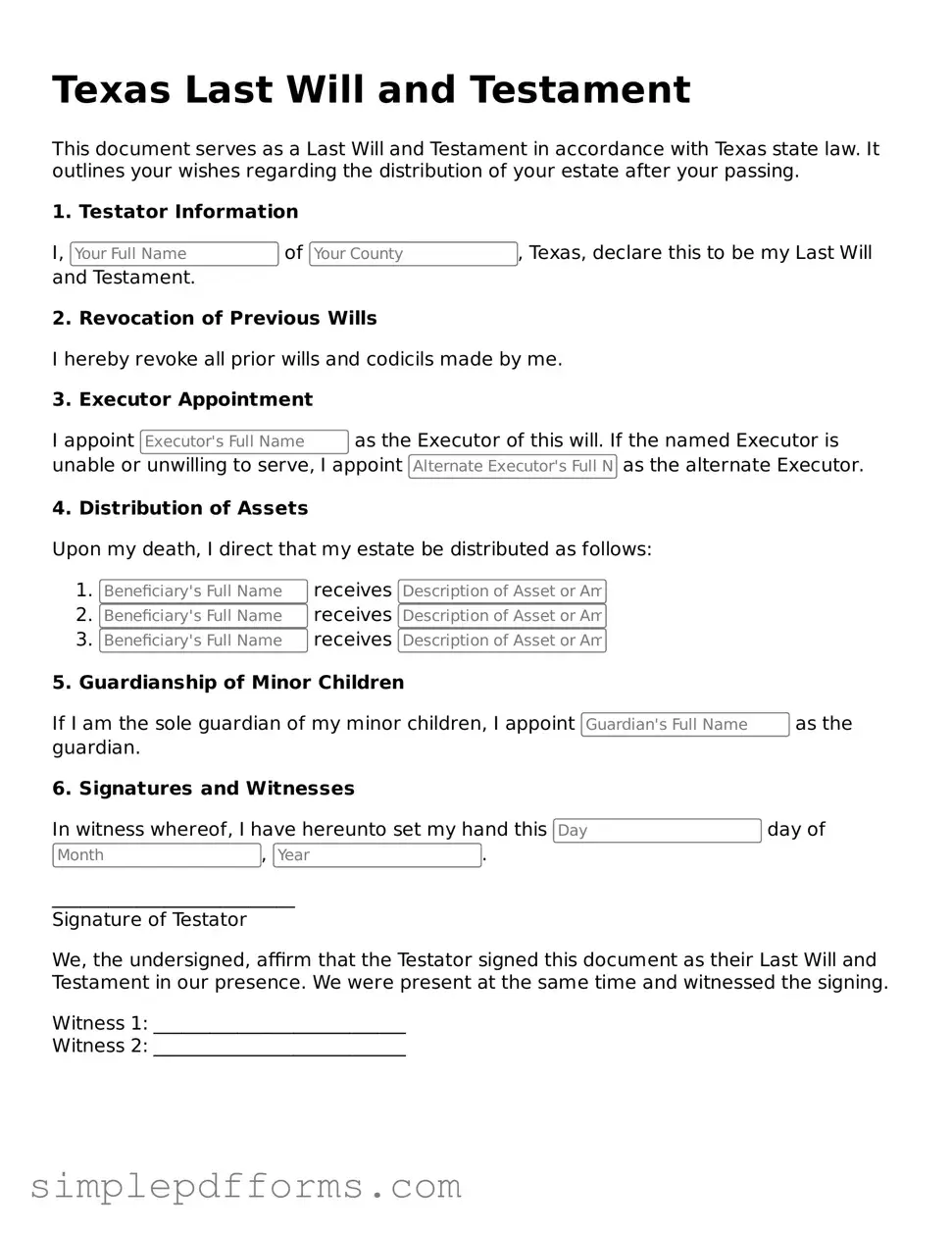

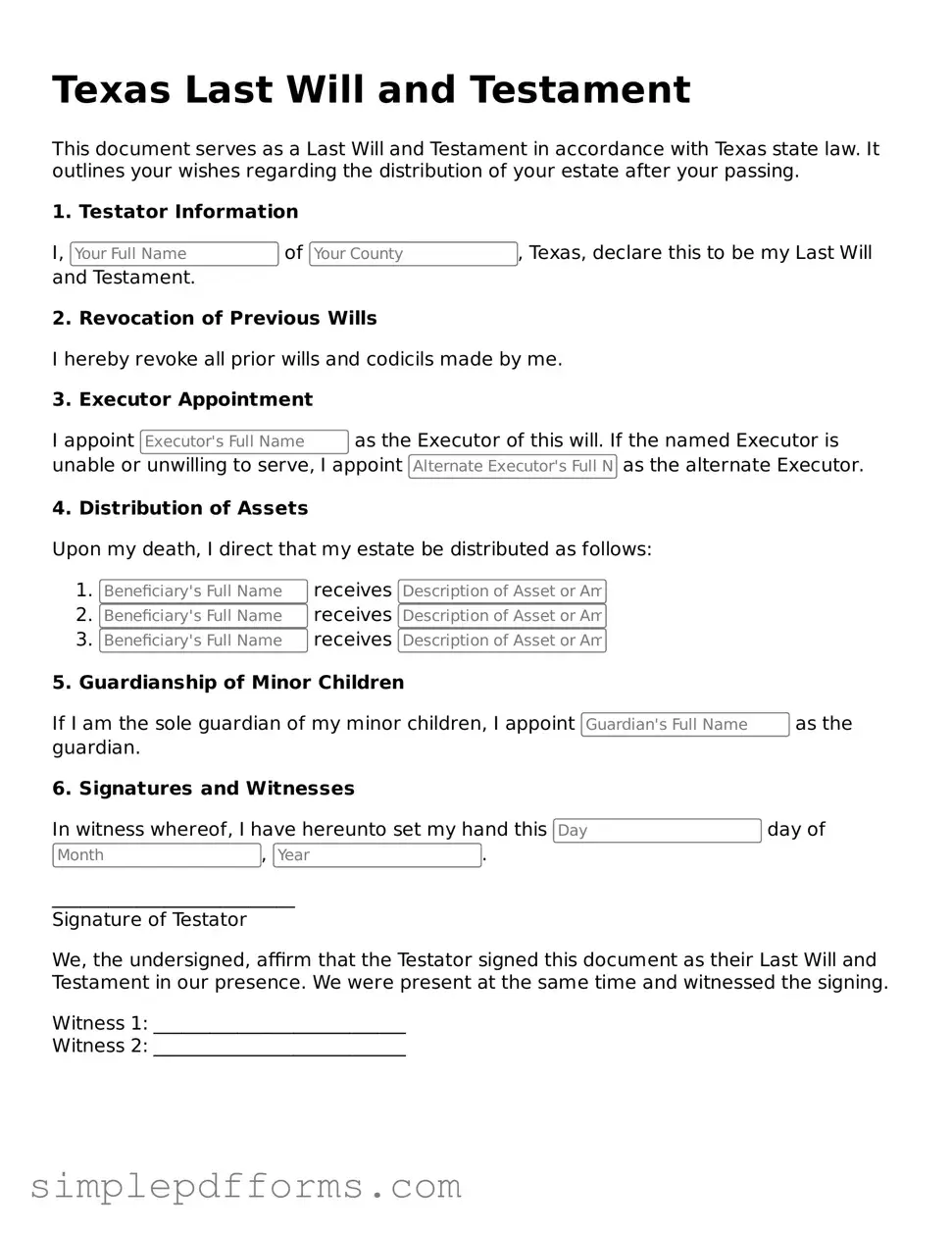

A Texas Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after their death. This form ensures that personal belongings and property are allocated according to the individual's preferences. Understanding its components and requirements is essential for anyone looking to create a valid will in Texas.

Open Last Will and Testament Editor Now

Attorney-Verified Last Will and Testament Document for Texas State

Open Last Will and Testament Editor Now

Open Last Will and Testament Editor Now

or

Get Last Will and Testament PDF Form

Your form is waiting for completion

Complete Last Will and Testament online in minutes with ease.