Attorney-Verified Employment Verification Document for Texas State

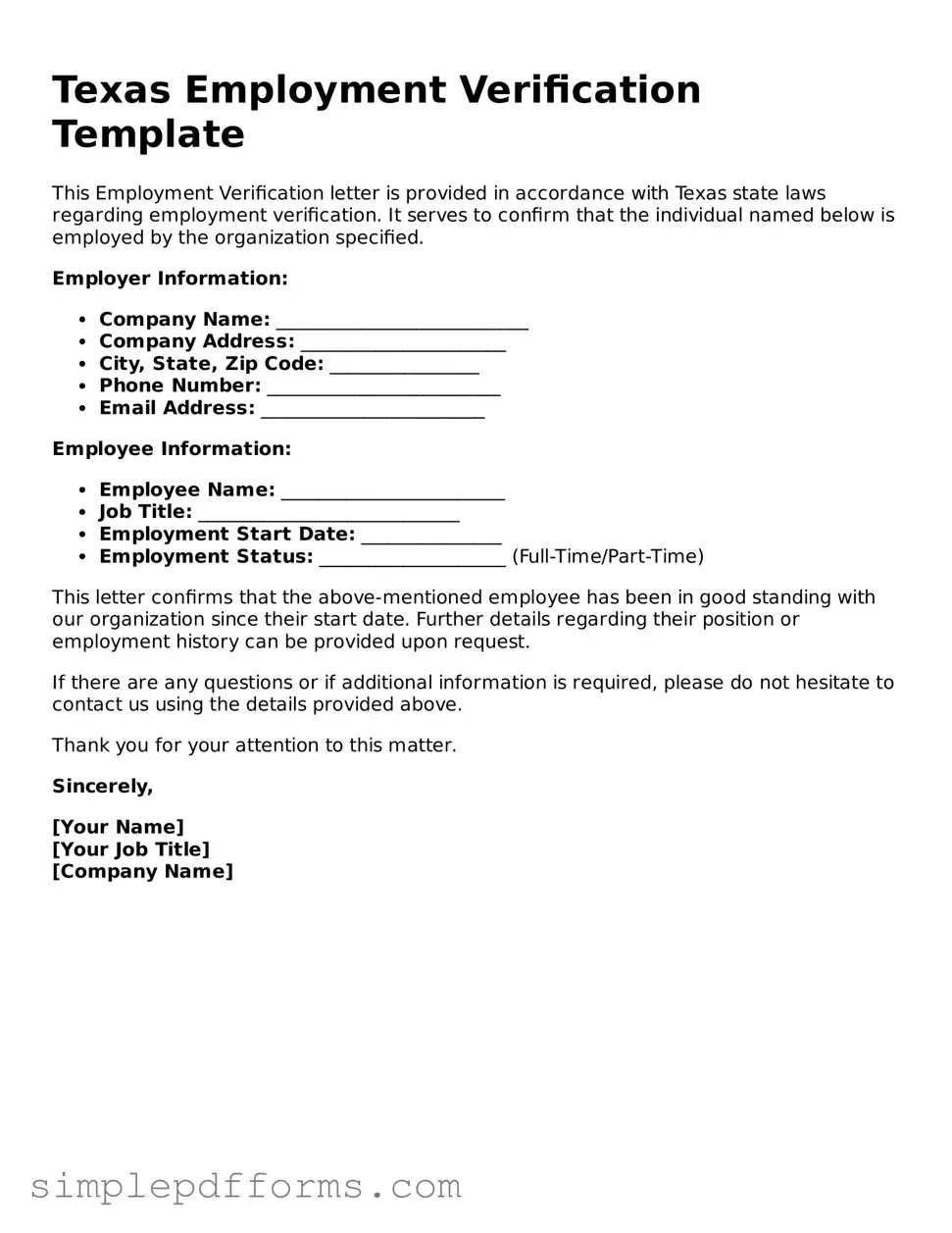

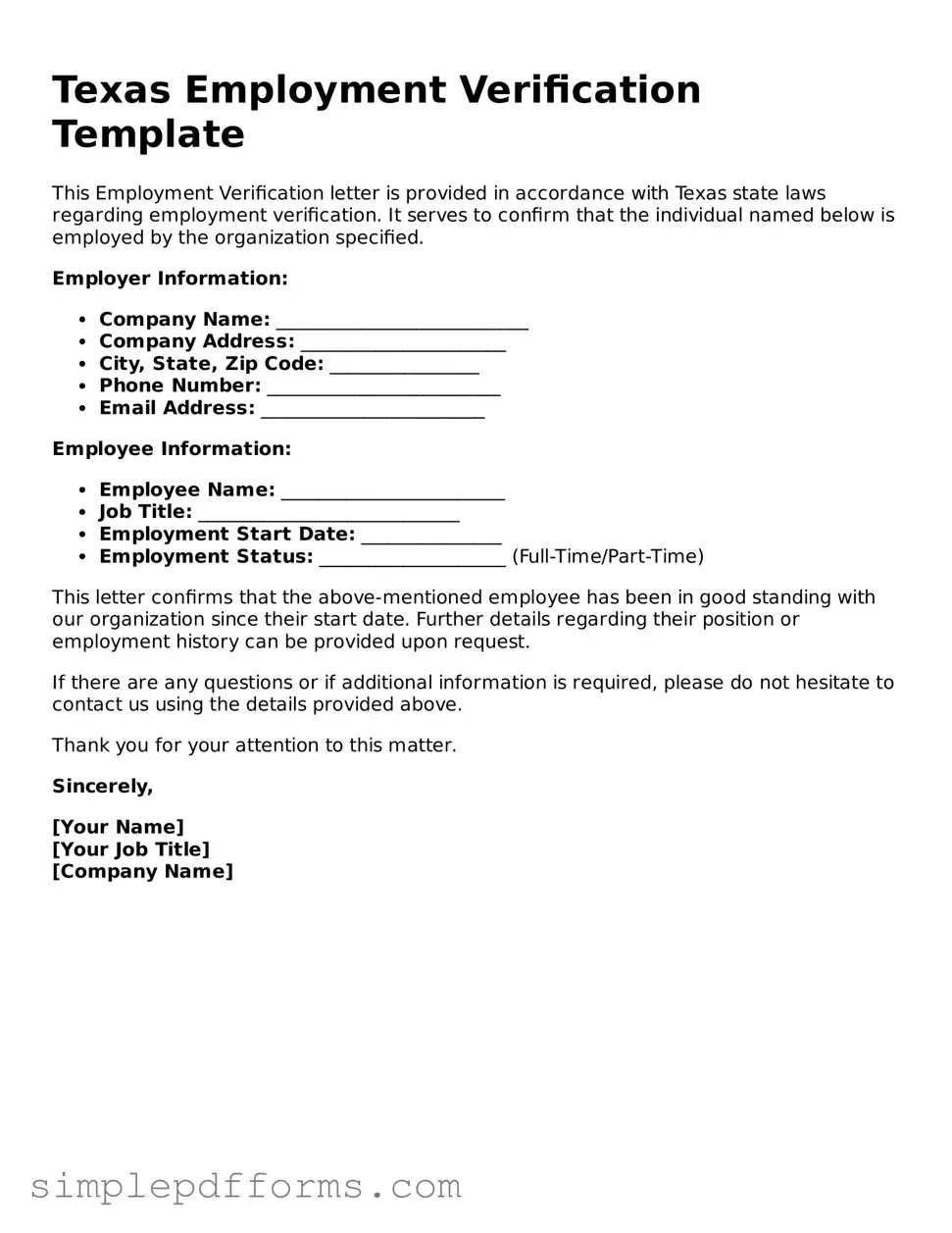

The Texas Employment Verification form is a document used to confirm an individual's employment status and history within the state. This form plays a crucial role in various situations, such as when applying for loans, housing, or government assistance. Understanding its purpose and the information required can help streamline the verification process.

Open Employment Verification Editor Now

Attorney-Verified Employment Verification Document for Texas State

Open Employment Verification Editor Now

Open Employment Verification Editor Now

or

Get Employment Verification PDF Form

Your form is waiting for completion

Complete Employment Verification online in minutes with ease.