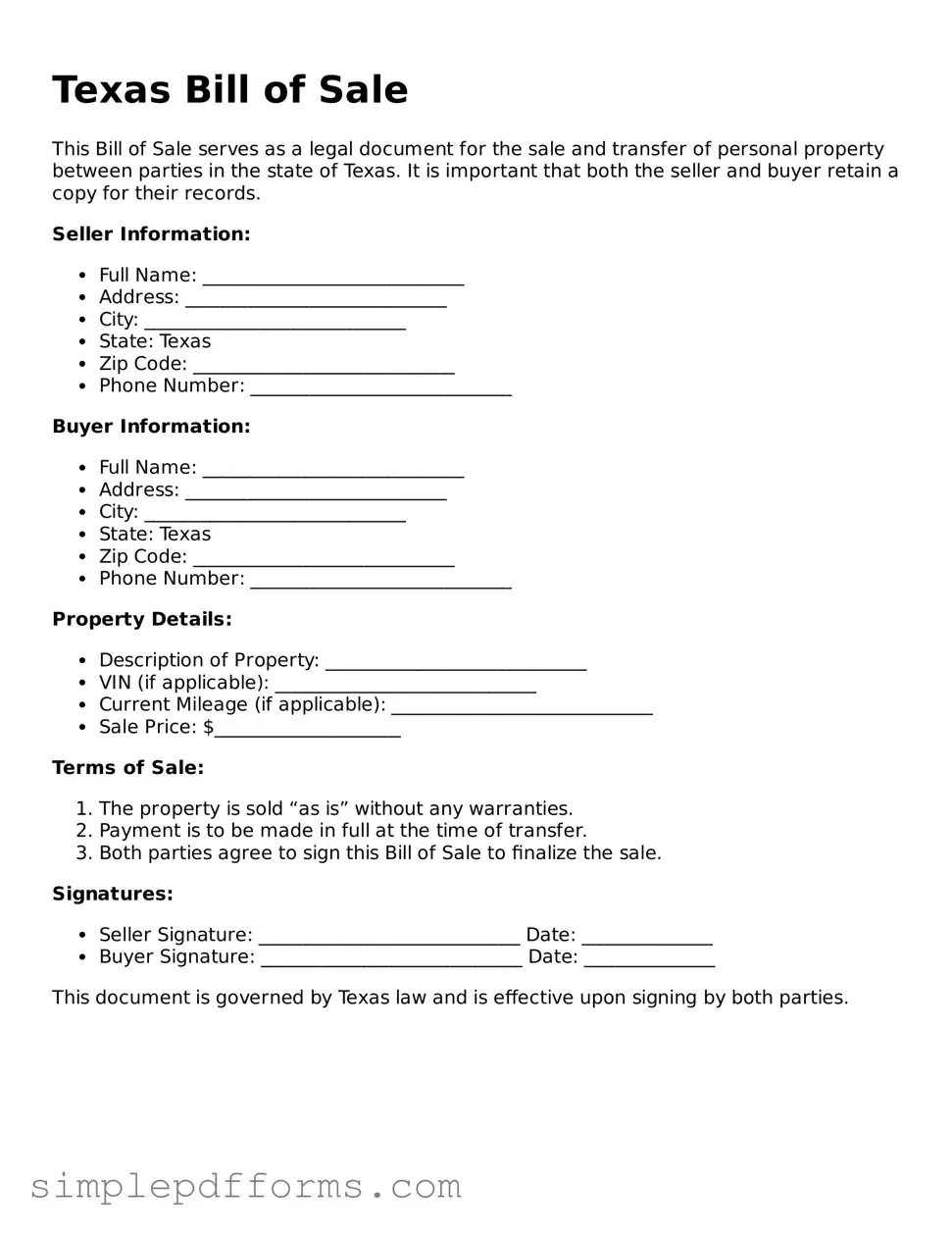

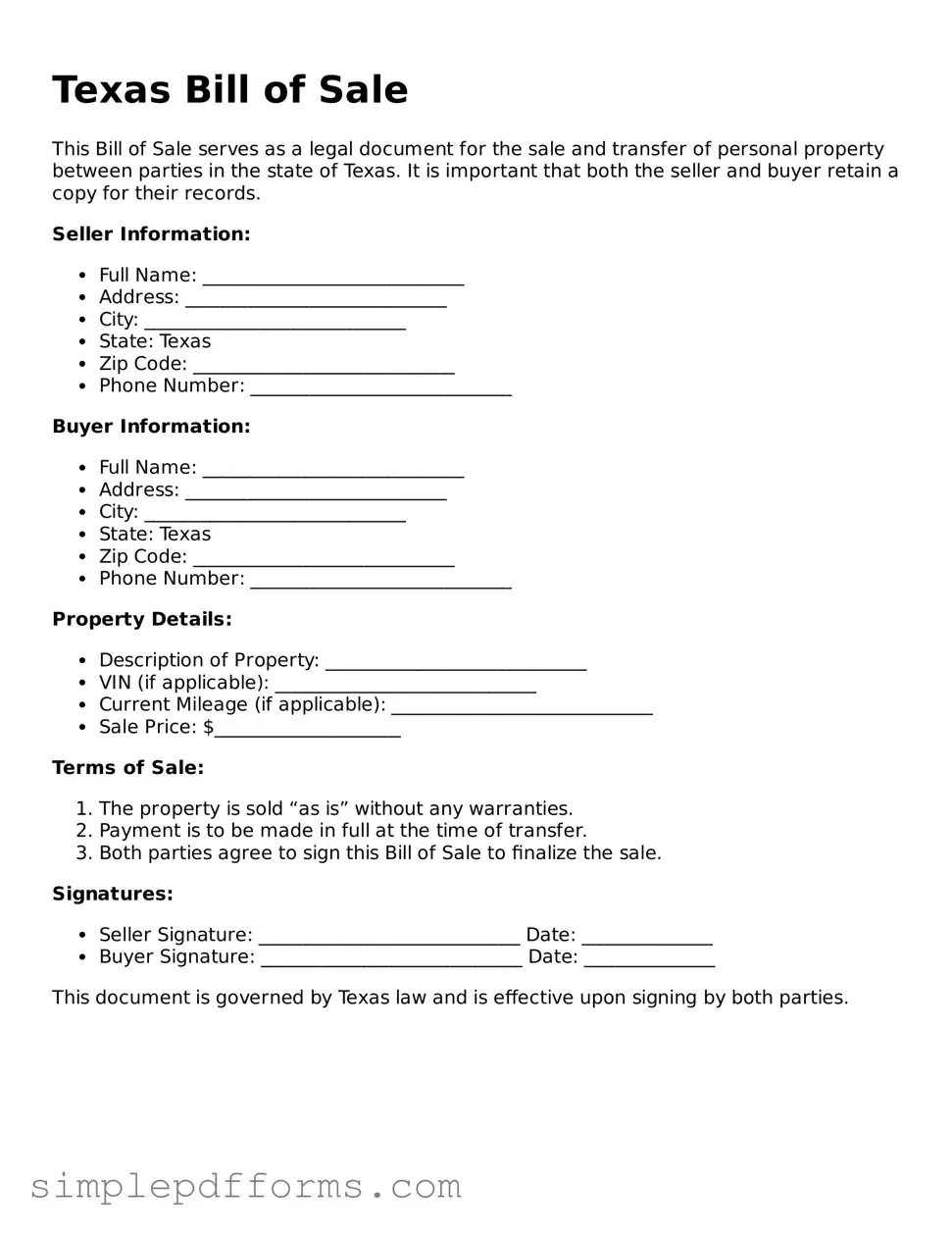

Filling out a Texas Bill of Sale form can be a straightforward process, but many individuals encounter common pitfalls that can lead to complications down the line. One frequent mistake is failing to provide complete and accurate information about the buyer and seller. Omitting essential details such as full names, addresses, or contact information can create confusion and may even affect the validity of the document.

Another common error involves not accurately describing the item being sold. A vague description can lead to misunderstandings regarding the condition and specifications of the item. It is crucial to include details such as the make, model, year, and identification numbers, if applicable. This information helps establish clarity and ensures both parties understand what is being exchanged.

People often neglect to include the purchase price in the Bill of Sale. Without this information, there may be disputes about the value of the transaction. Clearly stating the agreed-upon price not only protects both parties but also provides necessary documentation for tax purposes.

Additionally, some individuals forget to date the document. A date is essential as it establishes when the transaction took place. Without it, there may be confusion regarding the timeline of ownership, which can be particularly important in legal situations.

Not having the Bill of Sale signed by both parties is another significant mistake. A signature serves as a confirmation that both the buyer and seller agree to the terms outlined in the document. Failing to obtain signatures can render the agreement unenforceable.

Moreover, individuals sometimes overlook the need for witnesses or notarization, especially for more significant transactions. While not always required, having a witness or notary can add an extra layer of credibility to the document, which can be beneficial if disputes arise later.

Another issue arises when people do not keep a copy of the Bill of Sale for their records. It is essential for both the buyer and seller to retain a copy of the signed document. This serves as proof of the transaction and can be useful for future reference or legal matters.

Some individuals may also fail to check local laws regarding Bill of Sale requirements. Each state may have specific regulations that need to be followed. Understanding these laws can help ensure that the document meets all necessary criteria.

Lastly, neglecting to review the form for errors before submission can lead to significant issues. Simple typos or incorrect information can complicate matters later. Taking the time to double-check the document can save both parties from potential headaches in the future.