Fill a Valid Stock Transfer Ledger Form

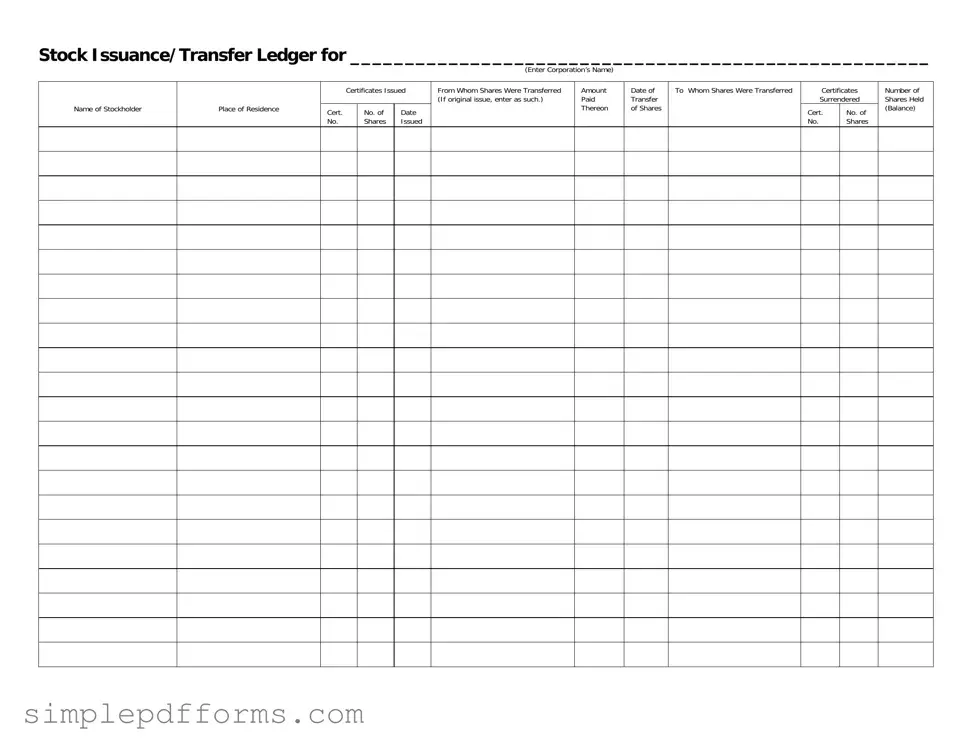

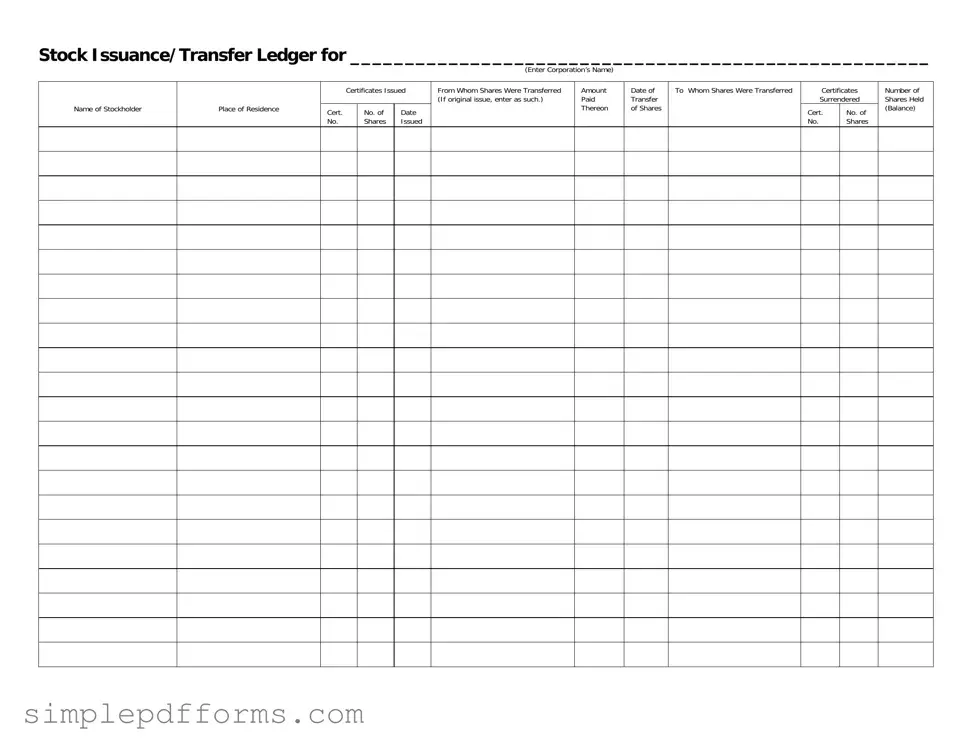

The Stock Transfer Ledger form is a crucial document used to record the issuance and transfer of shares within a corporation. This form provides a clear account of stockholder details, including names, addresses, and the specifics of stock transactions. Accurate completion of this form ensures transparency and compliance in corporate share management.

Open Stock Transfer Ledger Editor Now

Fill a Valid Stock Transfer Ledger Form

Open Stock Transfer Ledger Editor Now

Open Stock Transfer Ledger Editor Now

or

Get Stock Transfer Ledger PDF Form

Your form is waiting for completion

Complete Stock Transfer Ledger online in minutes with ease.