Fill a Valid Sample Tax Return Transcript Form

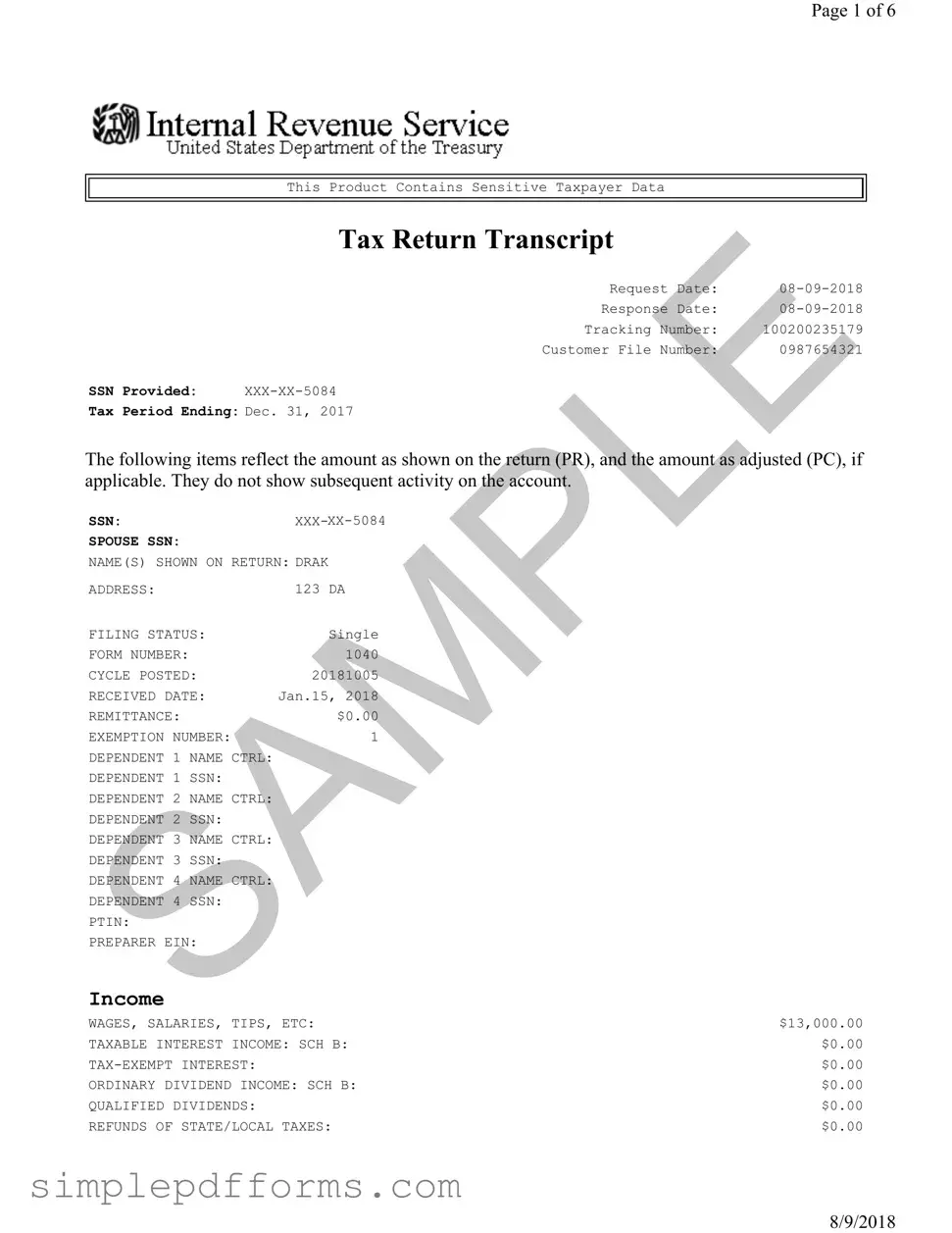

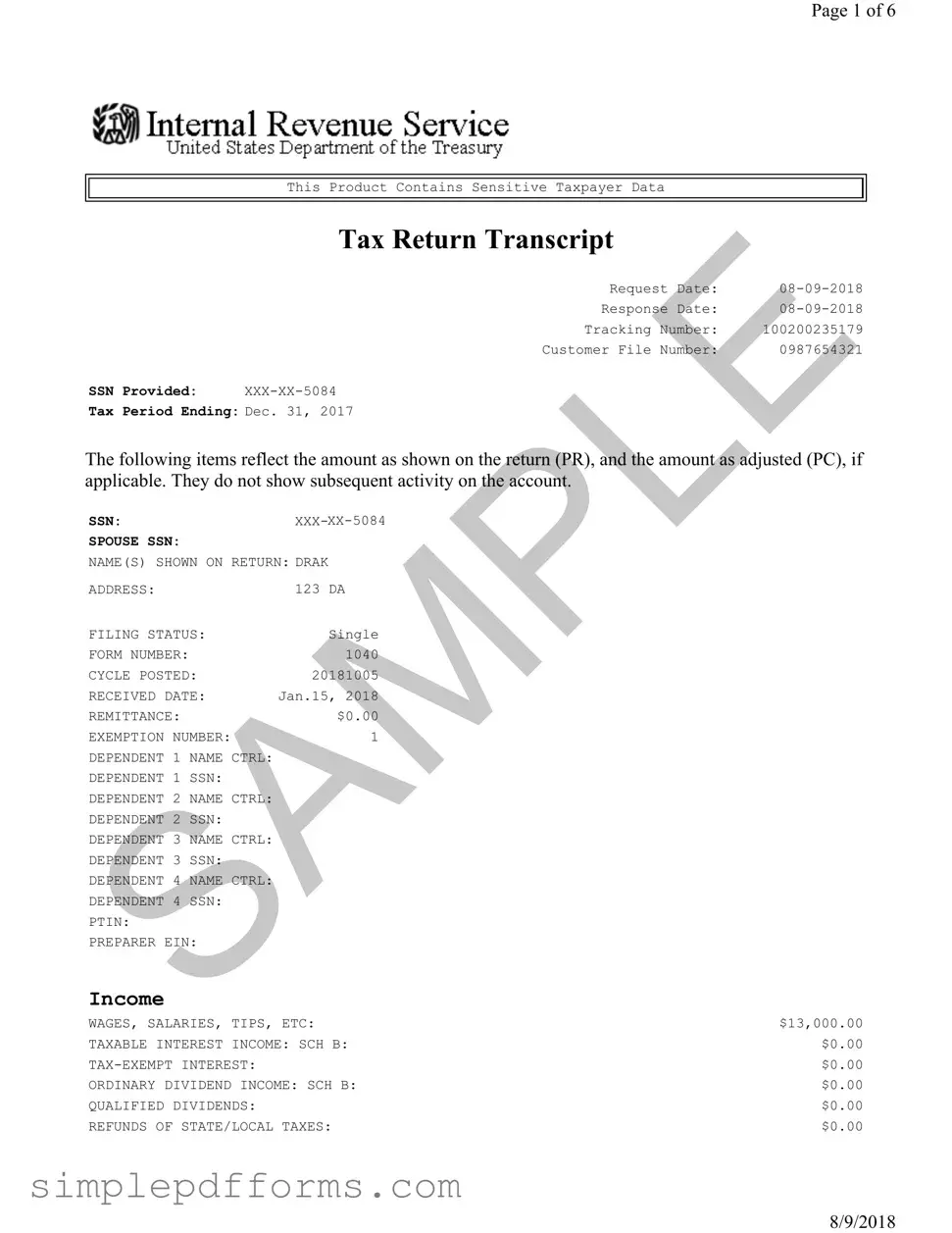

The Sample Tax Return Transcript is a document provided by the IRS that summarizes key information from an individual's tax return. This form includes details such as income, deductions, and tax credits, allowing taxpayers to verify their tax information. Understanding this transcript can be essential for various purposes, including loan applications and tax disputes.

Open Sample Tax Return Transcript Editor Now

Fill a Valid Sample Tax Return Transcript Form

Open Sample Tax Return Transcript Editor Now

Open Sample Tax Return Transcript Editor Now

or

Get Sample Tax Return Transcript PDF Form

Your form is waiting for completion

Complete Sample Tax Return Transcript online in minutes with ease.