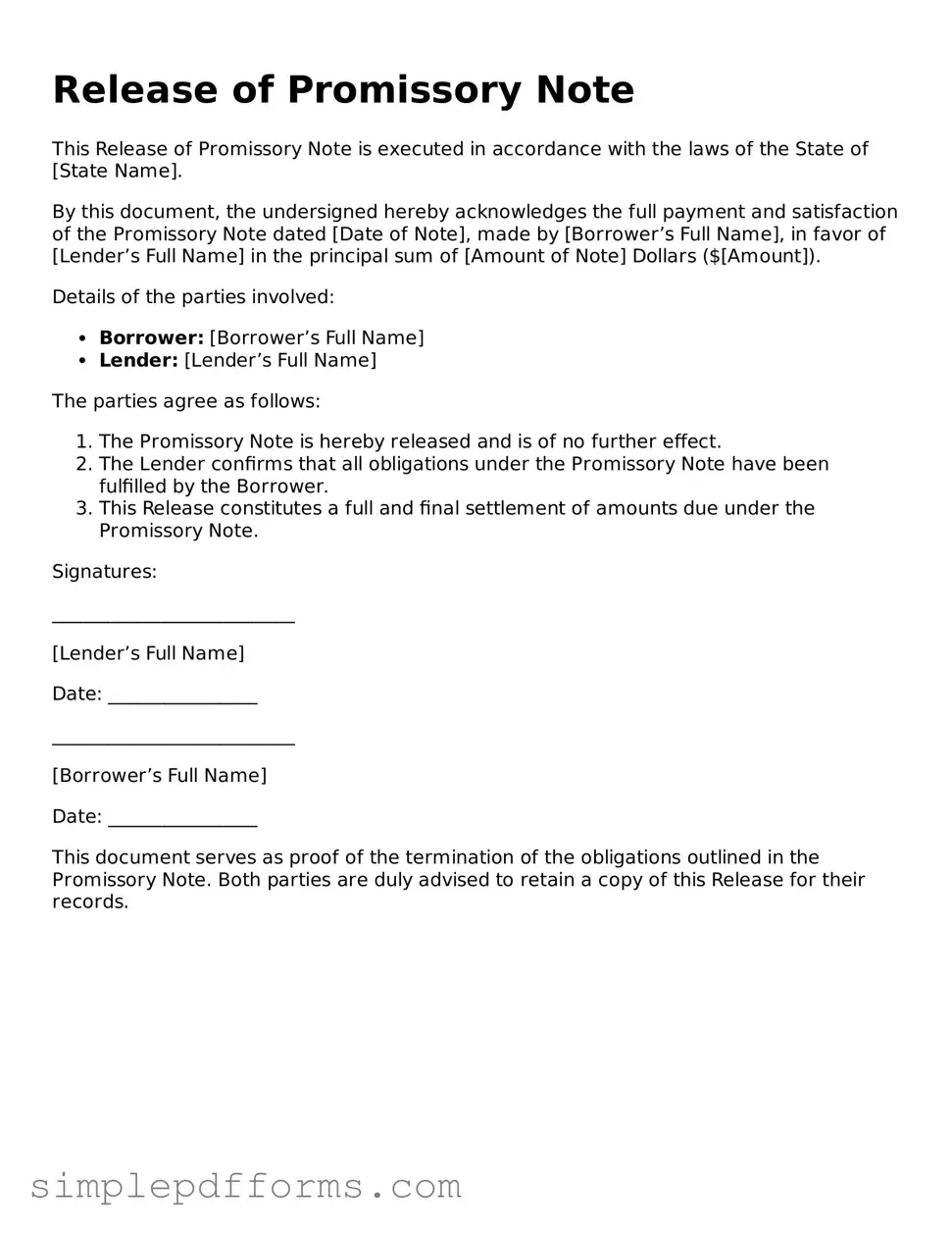

Free Release of Promissory Note Form

A Release of Promissory Note form is a legal document that signifies the satisfaction of a debt, confirming that the borrower has fulfilled their obligations under the promissory note. This form serves as a crucial step in formally releasing the borrower from any further liability. Understanding its significance can help both lenders and borrowers navigate their financial agreements with clarity and confidence.

Open Release of Promissory Note Editor Now

Free Release of Promissory Note Form

Open Release of Promissory Note Editor Now

Open Release of Promissory Note Editor Now

or

Get Release of Promissory Note PDF Form

Your form is waiting for completion

Complete Release of Promissory Note online in minutes with ease.