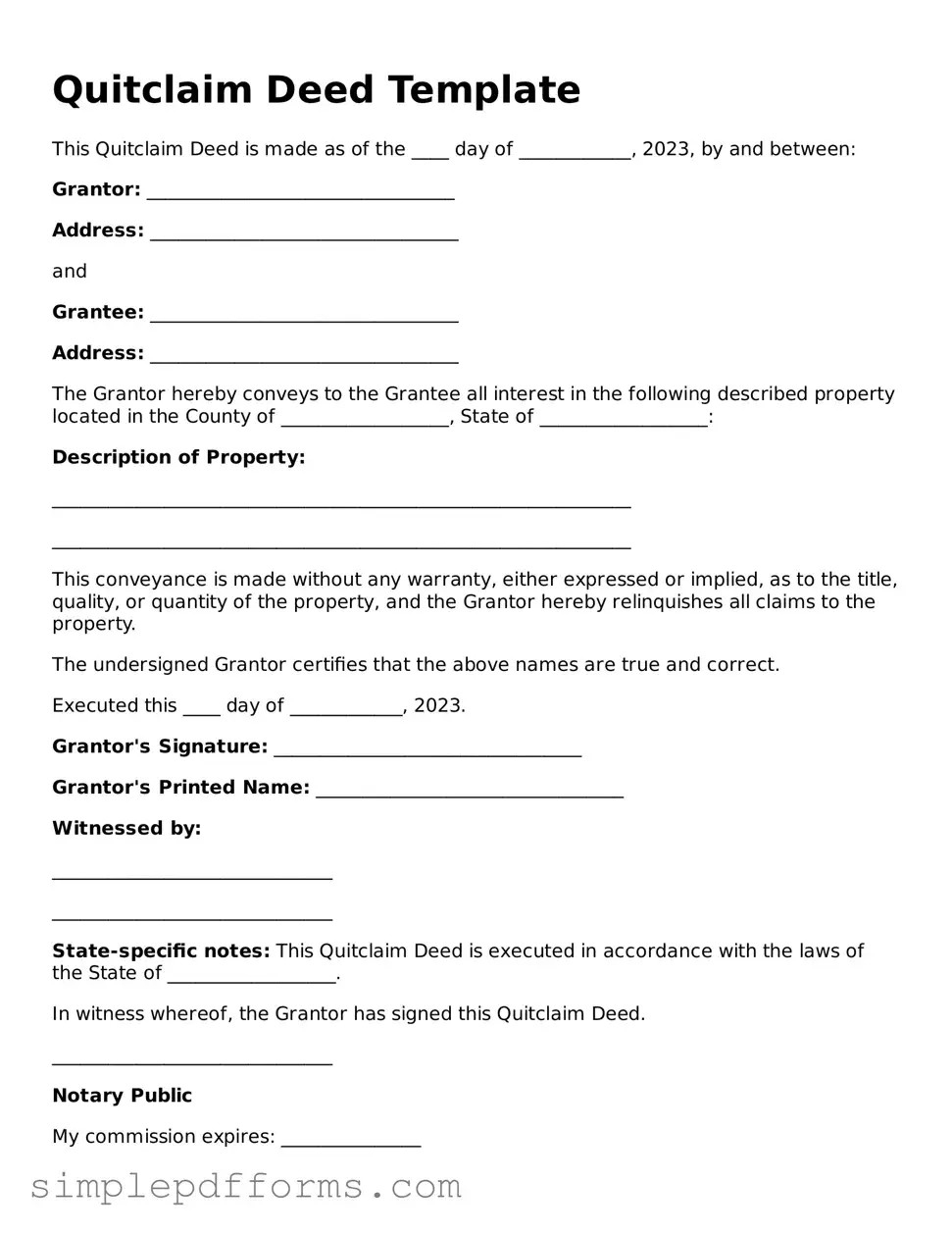

Free Quitclaim Deed Form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. This form is often employed in situations such as divorce settlements or when property is gifted between family members. Understanding the Quitclaim Deed is essential for anyone involved in property transactions, as it provides a straightforward method for transferring interest in real estate.

Open Quitclaim Deed Editor Now

Free Quitclaim Deed Form

Open Quitclaim Deed Editor Now

Open Quitclaim Deed Editor Now

or

Get Quitclaim Deed PDF Form

Your form is waiting for completion

Complete Quitclaim Deed online in minutes with ease.