Free Purchase Letter of Intent Form

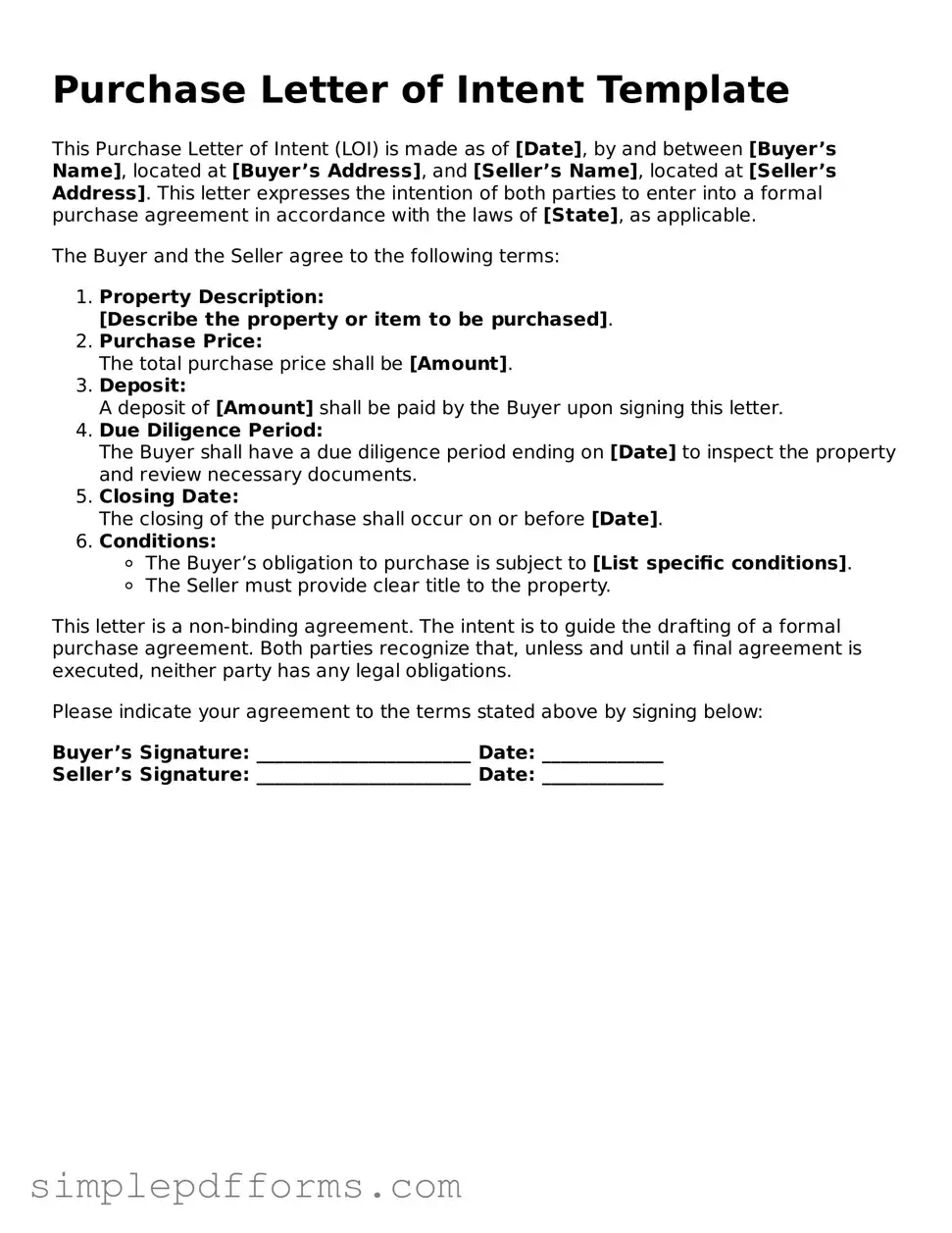

A Purchase Letter of Intent (LOI) is a document that outlines the preliminary terms and conditions between a buyer and seller before finalizing a purchase agreement. This form serves as a roadmap for negotiations, ensuring both parties understand their intentions and obligations. By clearly stating the key elements of the deal, the LOI helps facilitate a smoother transaction process.

Open Purchase Letter of Intent Editor Now

Free Purchase Letter of Intent Form

Open Purchase Letter of Intent Editor Now

Open Purchase Letter of Intent Editor Now

or

Get Purchase Letter of Intent PDF Form

Your form is waiting for completion

Complete Purchase Letter of Intent online in minutes with ease.