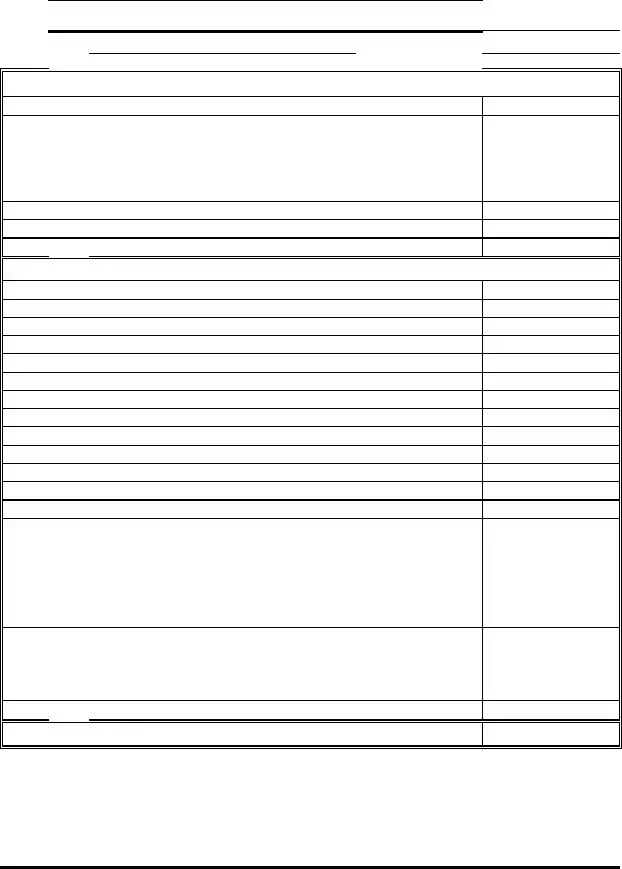

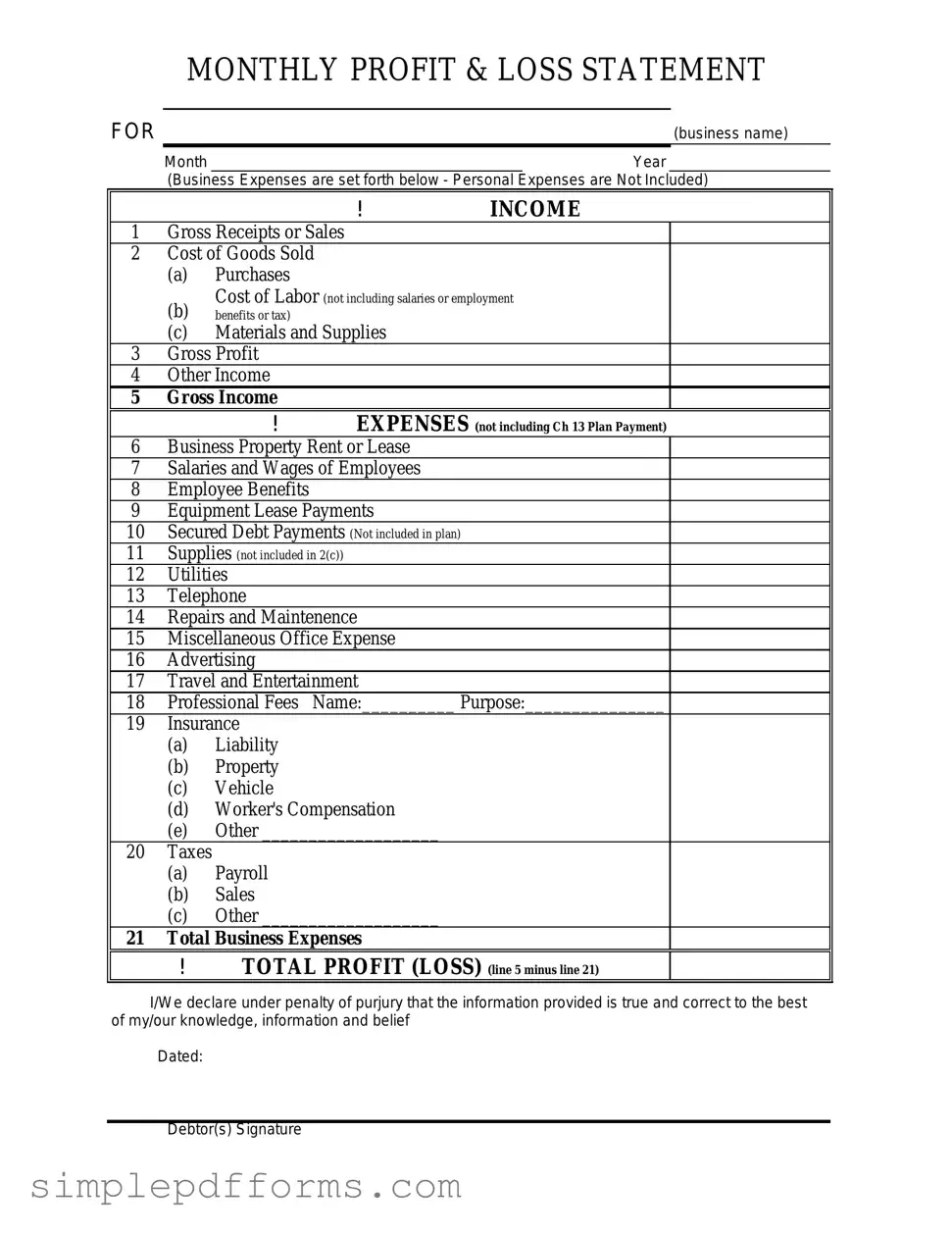

Fill a Valid Profit And Loss Form

The Profit and Loss form is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period. This document provides valuable insights into a company's financial performance, helping stakeholders assess profitability and operational efficiency. Understanding how to interpret this form is essential for making informed business decisions.

Open Profit And Loss Editor Now

Fill a Valid Profit And Loss Form

Open Profit And Loss Editor Now

Open Profit And Loss Editor Now

or

Get Profit And Loss PDF Form

Your form is waiting for completion

Complete Profit And Loss online in minutes with ease.