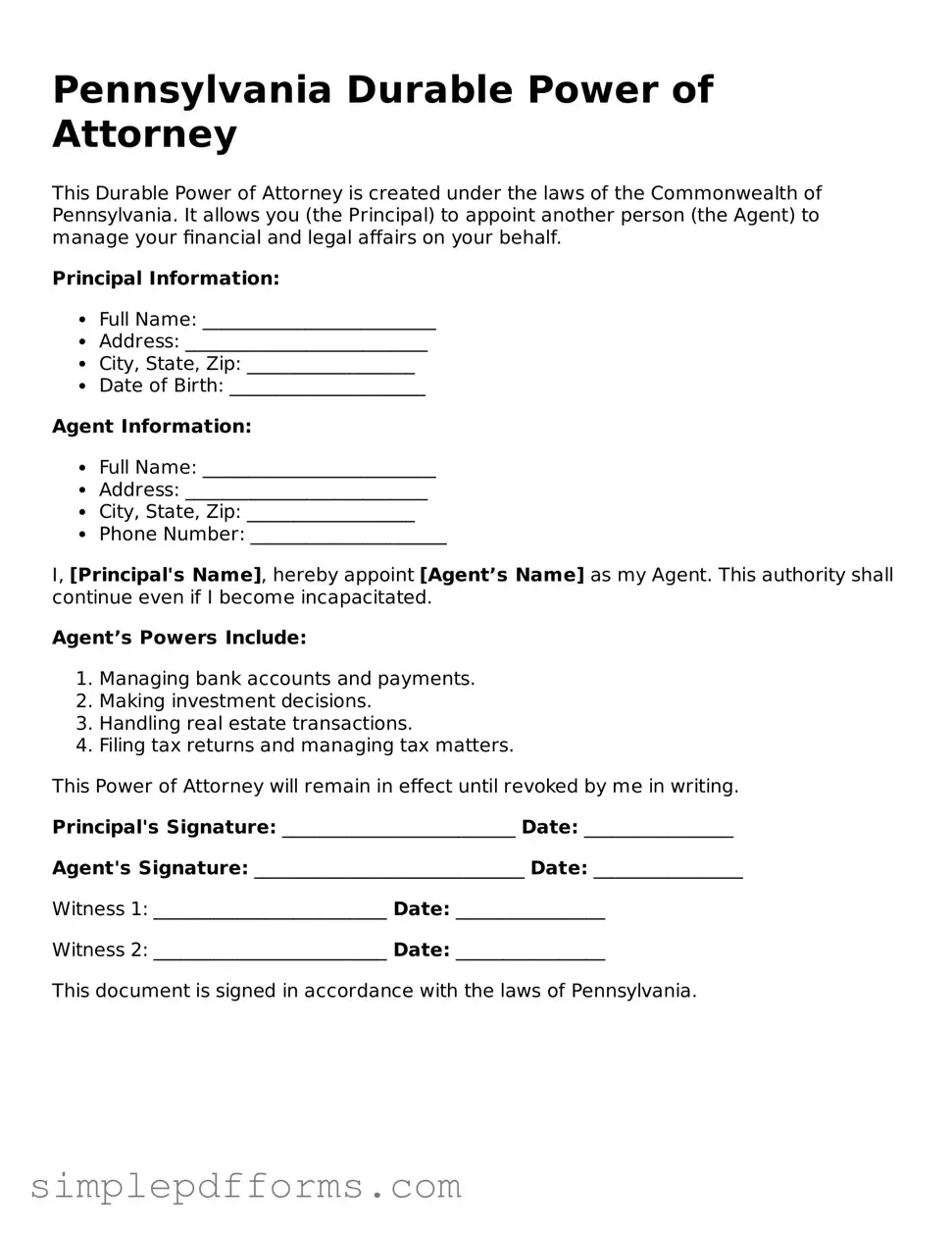

Filling out a Pennsylvania Durable Power of Attorney form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not clearly identifying the agent. It’s essential to choose someone trustworthy and capable of handling your financial matters. If the agent’s name isn’t clear, it can cause confusion and delays when it’s time to execute the document.

Another mistake is failing to specify the powers granted to the agent. While the form includes general powers, it’s wise to detail any specific powers you want to include or exclude. Omitting this information can lead to misunderstandings about what your agent can and cannot do on your behalf.

People often overlook the importance of signing the form in front of a notary. Pennsylvania law requires that the Durable Power of Attorney be notarized to be valid. Without this crucial step, the document may not hold up in legal situations, leaving your wishes unfulfilled.

Additionally, many individuals forget to date the document. A lack of a date can create uncertainty about when the powers take effect, potentially leading to disputes among family members or financial institutions. Always ensure that the date is clearly noted.

Another common error is not informing the agent about their designation. It’s vital to discuss this responsibility with your chosen agent beforehand. If they are unaware of their role, they may not be prepared to act when needed, which can create unnecessary stress during critical times.

Some people also neglect to review the form for accuracy after filling it out. Typos or incorrect information can invalidate the document. Taking the time to double-check every detail ensures that your intentions are clearly communicated.

Moreover, failing to update the Durable Power of Attorney when circumstances change is a mistake many make. Life events such as marriage, divorce, or the death of an agent can necessitate updates to the document. Keeping it current is essential for it to remain effective.

Another issue arises when individuals choose multiple agents without outlining how decisions will be made. If you name more than one agent, it’s crucial to specify whether they must act jointly or if they can make decisions independently. This clarity helps avoid conflicts later on.

People sometimes forget to include alternate agents. If the primary agent cannot serve for any reason, having an alternate ensures that your affairs can still be managed. This simple addition can save a lot of headaches in the future.

Finally, neglecting to discuss your wishes with family members can lead to confusion and disputes. Open communication about your decisions can help ensure that everyone understands your intentions and reduces the likelihood of conflict when the time comes to act on your behalf.