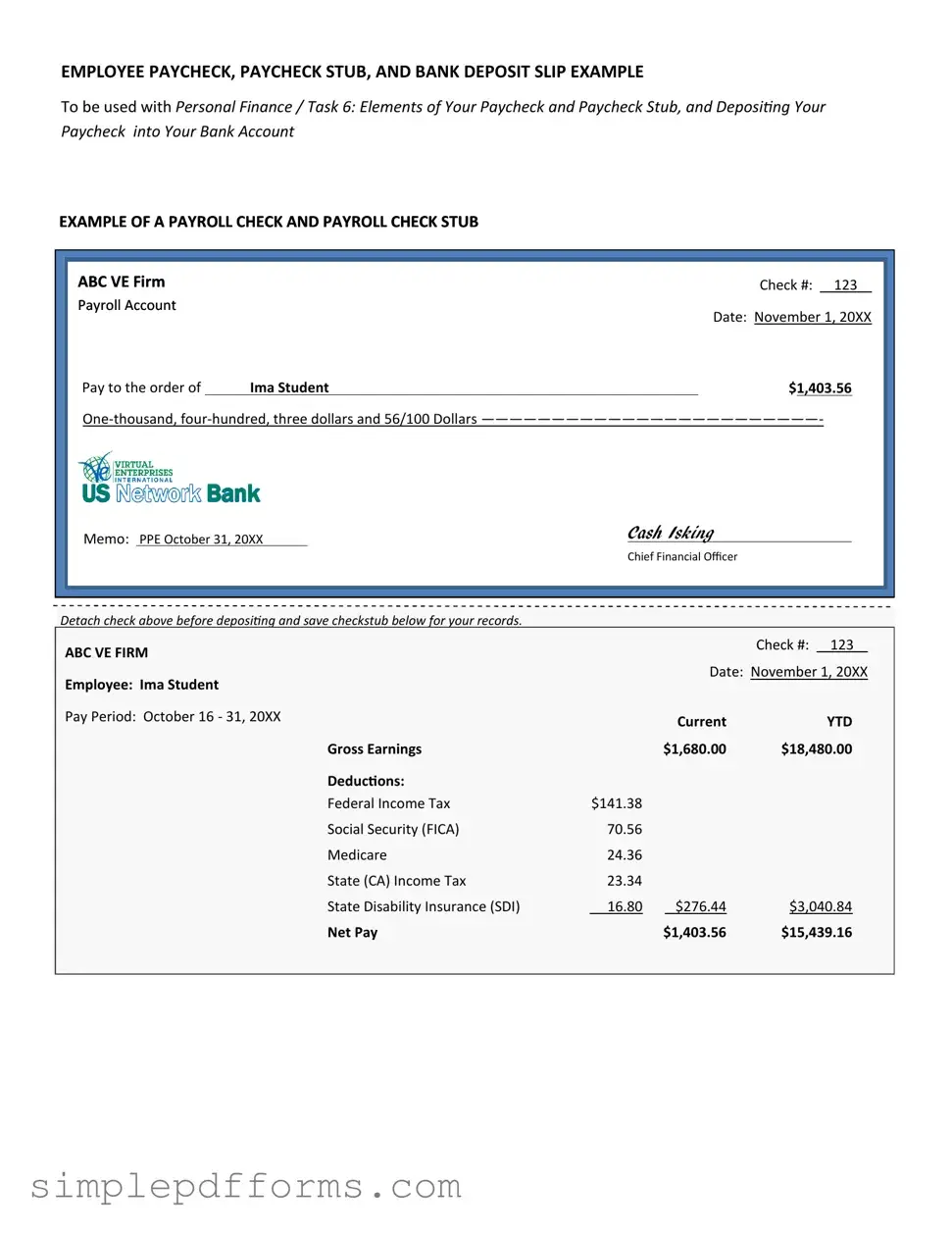

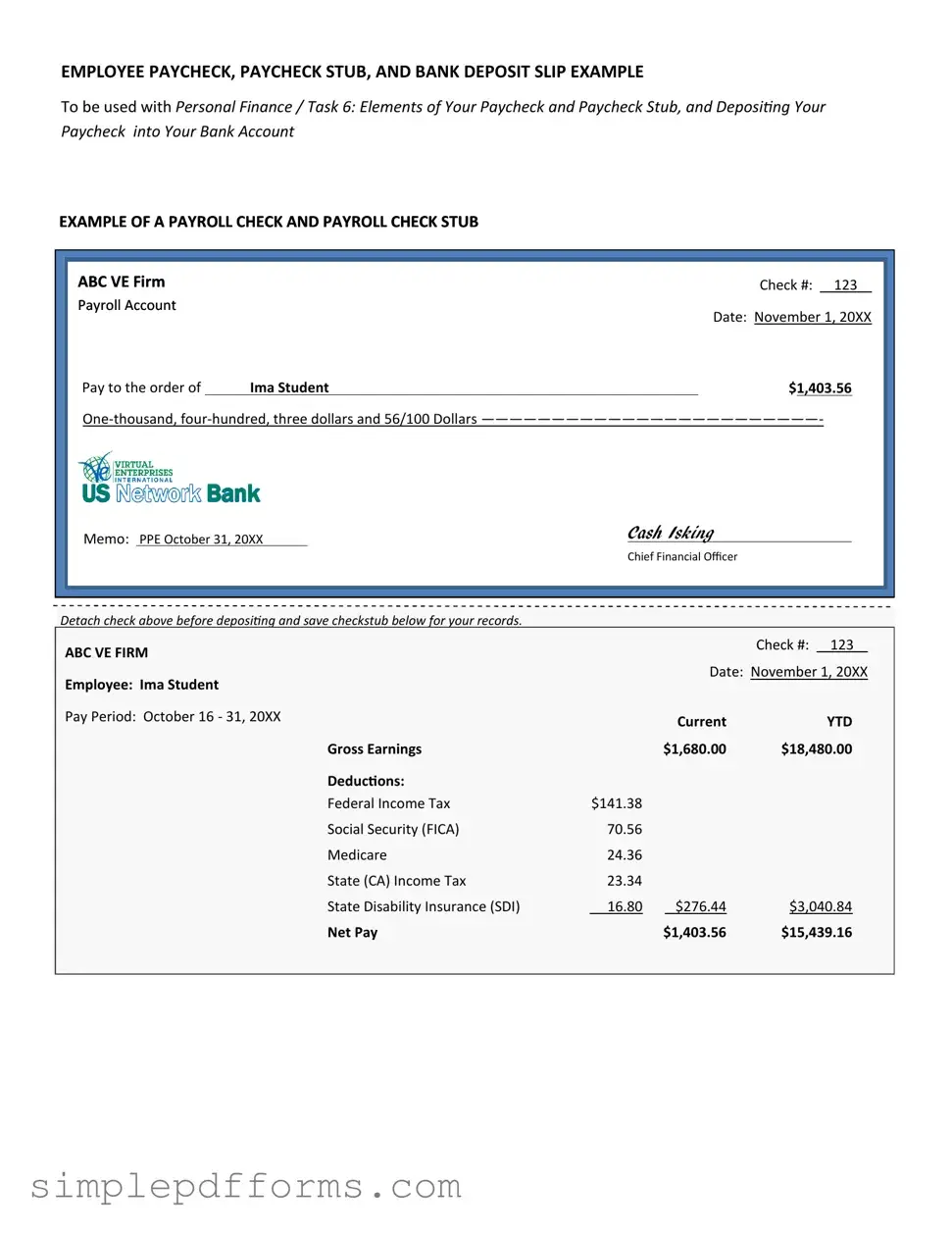

Fill a Valid Payroll Check Form

The Payroll Check form is a crucial document used by employers to distribute wages to their employees. This form outlines essential details such as the employee's name, the amount earned, and any deductions that may apply. Understanding how to properly fill out and manage this form can ensure that employees receive their pay accurately and on time.

Open Payroll Check Editor Now

Fill a Valid Payroll Check Form

Open Payroll Check Editor Now

Open Payroll Check Editor Now

or

Get Payroll Check PDF Form

Your form is waiting for completion

Complete Payroll Check online in minutes with ease.