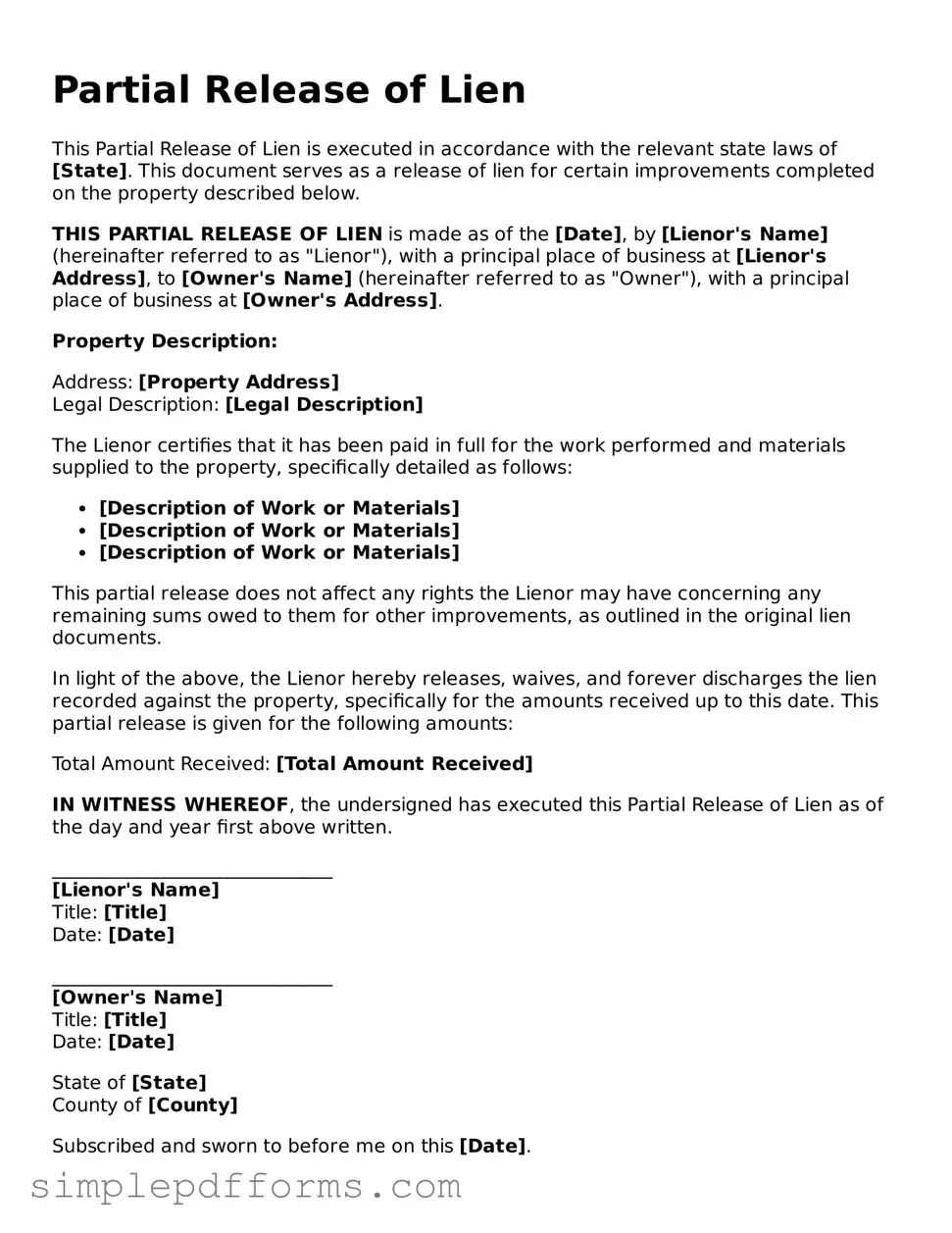

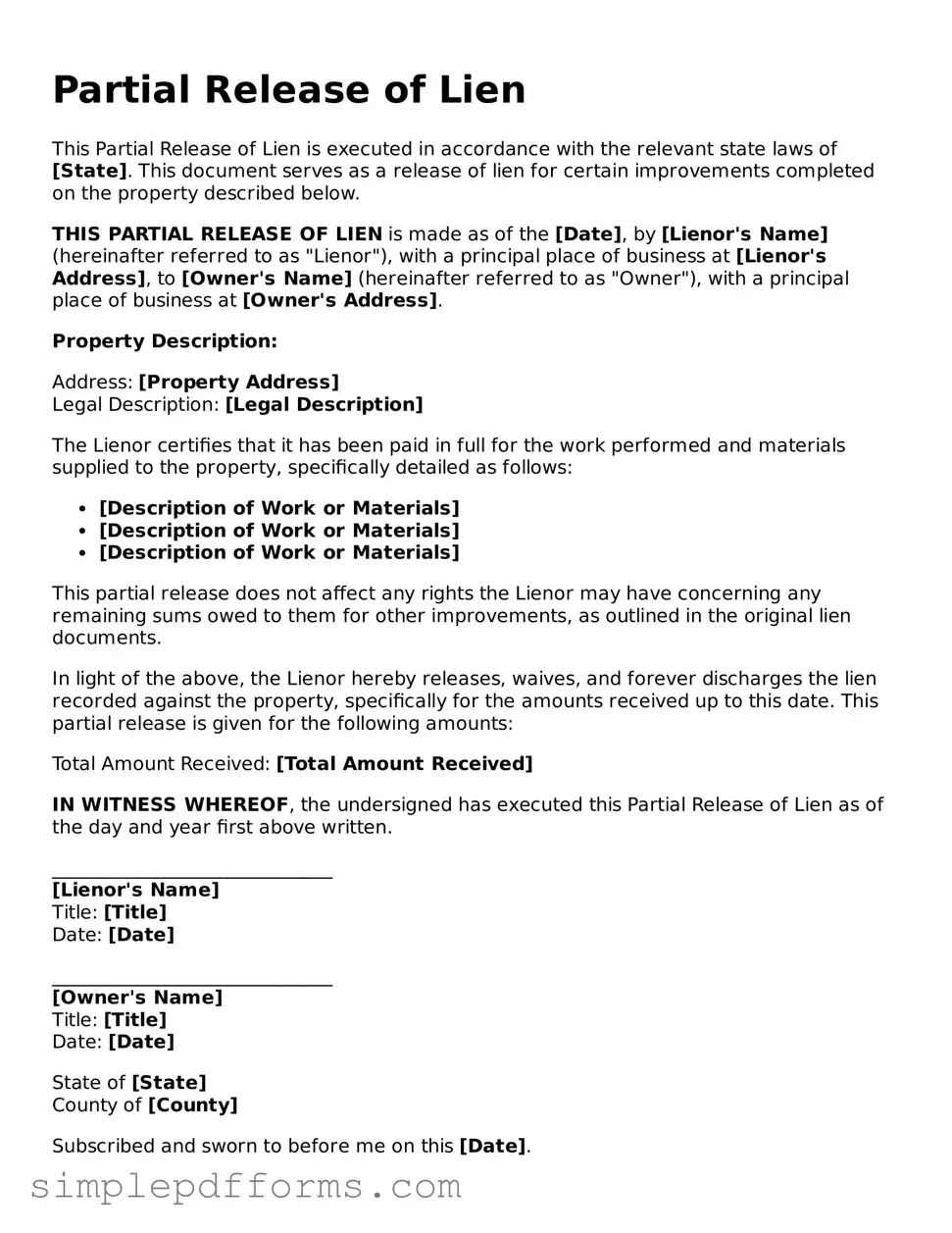

Free Partial Release of Lien Form

The Partial Release of Lien form is a legal document that allows a property owner to release a portion of a lien on their property, often in connection with a specific payment or completion of work. This form is crucial in construction and real estate transactions, as it helps clarify the financial obligations associated with a property. By utilizing this form, parties can ensure that the lien does not encumber the entire property, fostering smoother transactions and relationships.

Open Partial Release of Lien Editor Now

Free Partial Release of Lien Form

Open Partial Release of Lien Editor Now

Open Partial Release of Lien Editor Now

or

Get Partial Release of Lien PDF Form

Your form is waiting for completion

Complete Partial Release of Lien online in minutes with ease.