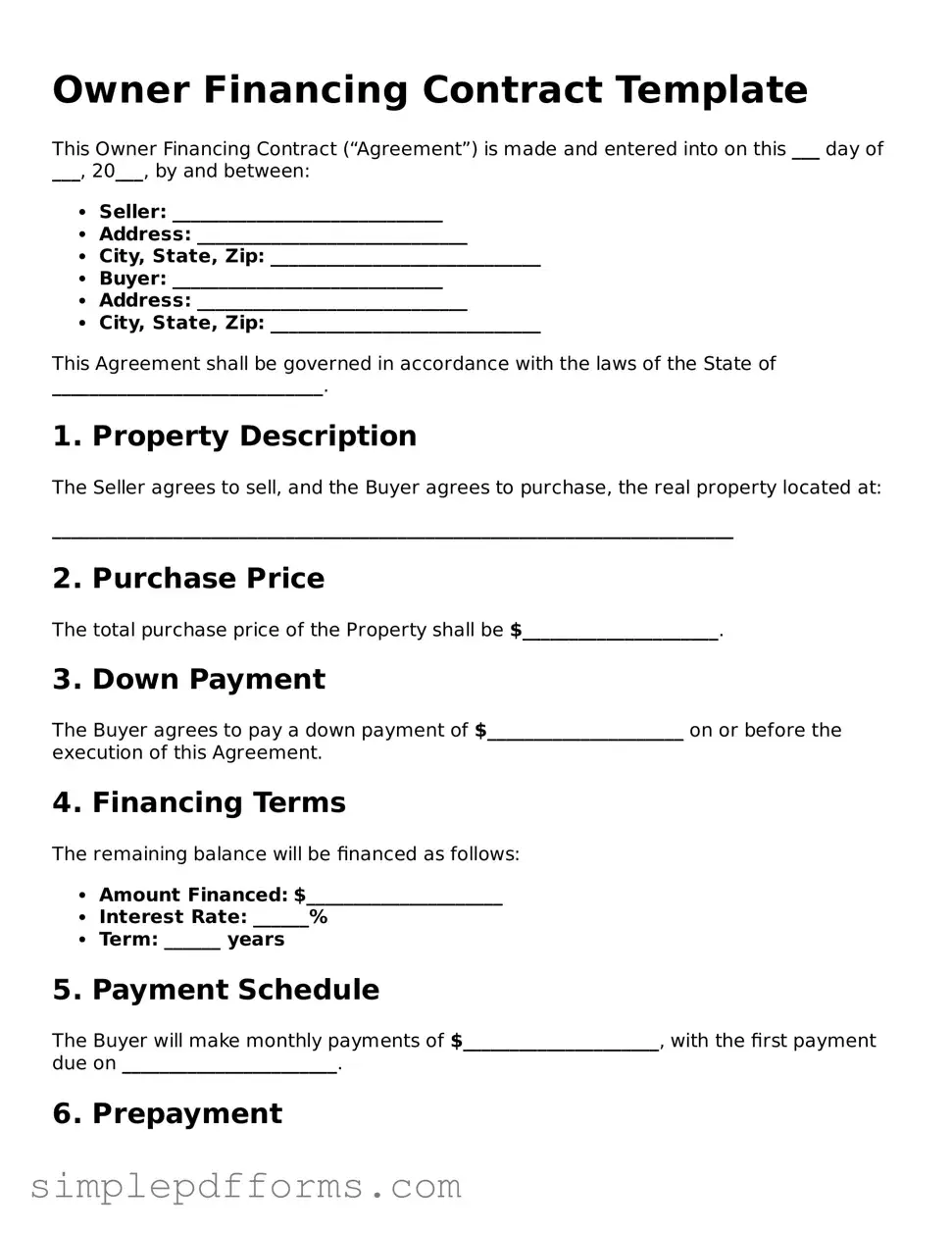

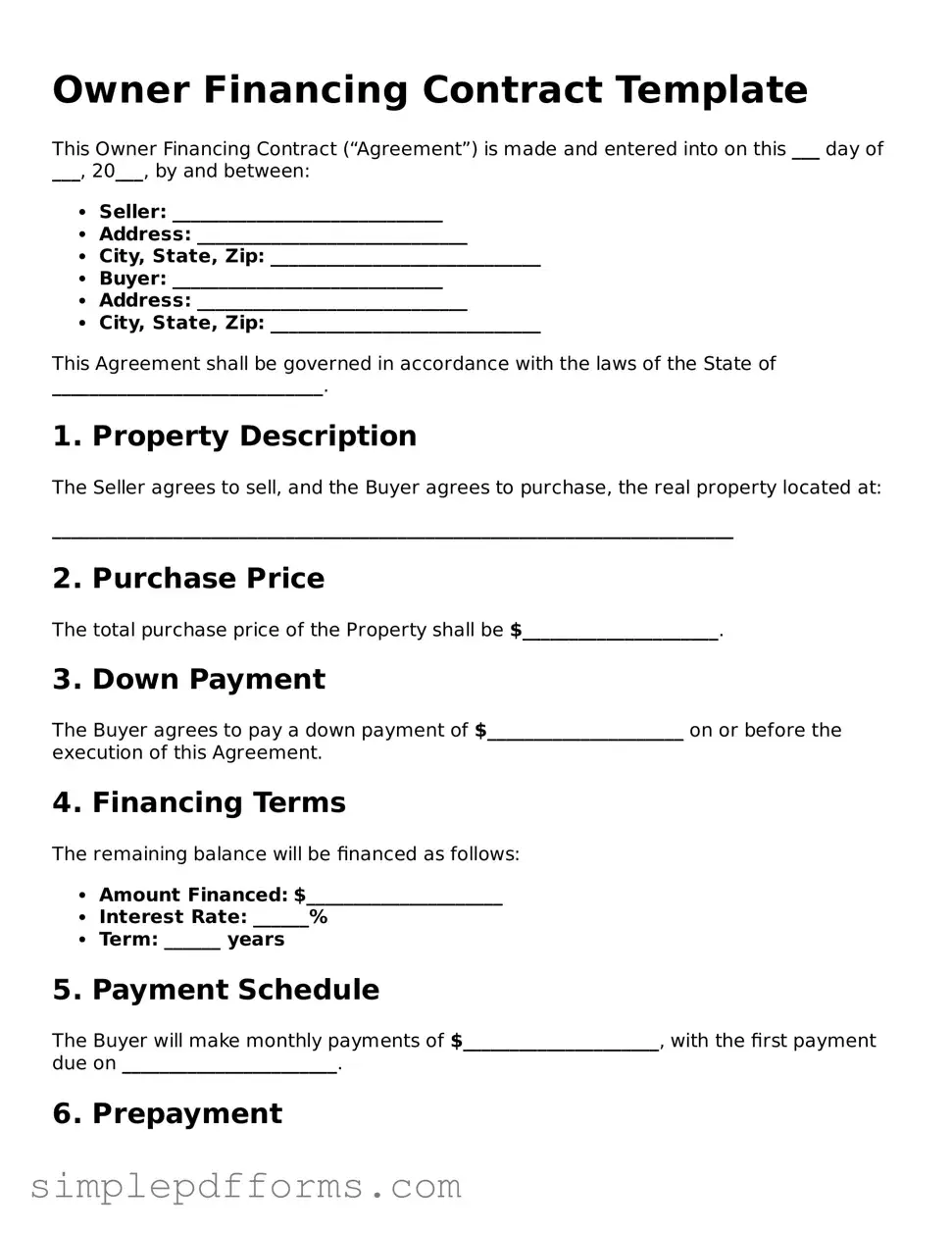

Free Owner Financing Contract Form

The Owner Financing Contract is a legal agreement between a property owner and a buyer, allowing the buyer to purchase the property directly from the owner instead of through a traditional mortgage lender. This arrangement can provide flexibility and ease for both parties, often making homeownership more accessible. Understanding the key elements of this contract is essential for anyone considering this financing option.

Open Owner Financing Contract Editor Now

Free Owner Financing Contract Form

Open Owner Financing Contract Editor Now

Open Owner Financing Contract Editor Now

or

Get Owner Financing Contract PDF Form

Your form is waiting for completion

Complete Owner Financing Contract online in minutes with ease.