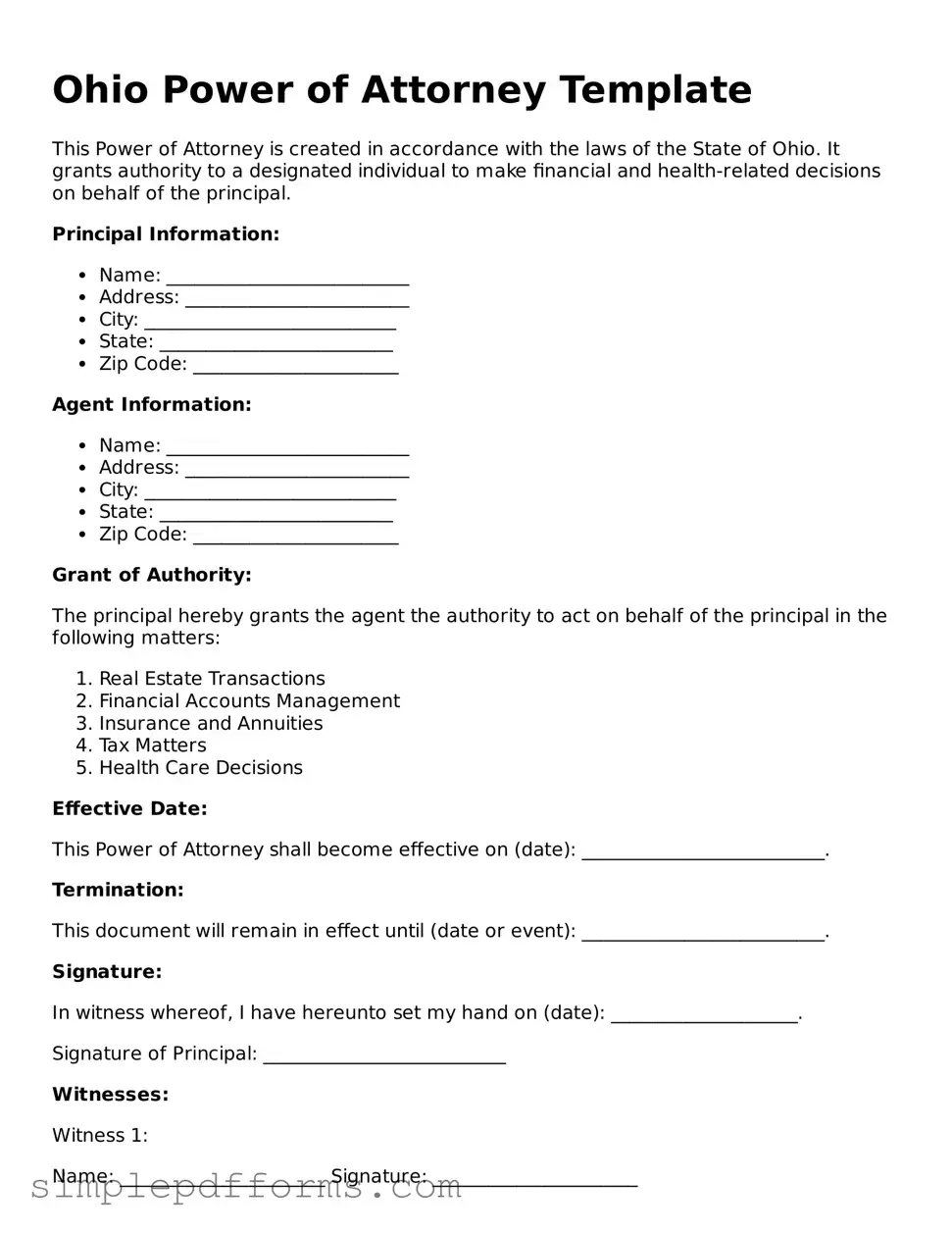

Filling out a Power of Attorney form in Ohio is a significant step in ensuring that your financial and healthcare decisions are managed according to your wishes. However, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help you navigate the process more smoothly.

One frequent error is not selecting the right agent. Your agent should be someone you trust implicitly, as they will have the authority to make important decisions on your behalf. Choosing someone without considering their ability to act in your best interest can lead to issues later. It is essential to have open discussions with your chosen agent about your wishes and expectations.

Another mistake often made is failing to specify the powers granted to the agent. The Power of Attorney form allows you to define the extent of authority your agent will have. Without clear specifications, your agent may not have the ability to act when needed, or they may have too much power, leading to potential misuse. Take the time to carefully consider and outline the specific powers you wish to grant.

Many individuals overlook the importance of signing and dating the document correctly. In Ohio, the Power of Attorney must be signed by you, the principal, and may require notarization. If the form is not signed or dated properly, it may not be considered valid. Always double-check that all signatures are in place and that the document is dated accurately.

Additionally, neglecting to inform relevant parties about the Power of Attorney can create confusion. Once the document is executed, it is crucial to share copies with your agent, financial institutions, and healthcare providers. This ensures that everyone is aware of your wishes and can act accordingly when necessary.

Another common oversight is not updating the Power of Attorney when circumstances change. Life events such as marriage, divorce, or the death of an agent can affect your choices. Regularly reviewing and updating your Power of Attorney can help ensure that it reflects your current situation and intentions.

Some individuals also fail to consider the implications of a durable Power of Attorney versus a non-durable one. A durable Power of Attorney remains effective even if you become incapacitated, while a non-durable one does not. Understanding the differences can help you choose the type that best meets your needs.

Moreover, people sometimes forget to include alternate agents. In the event that your primary agent is unable or unwilling to act, having a backup can prevent delays in decision-making. It is wise to designate one or more alternate agents to ensure continuity in managing your affairs.

Lastly, not seeking legal advice when needed can be a significant mistake. While it is possible to fill out the Power of Attorney form on your own, consulting with a legal professional can provide clarity and help avoid potential pitfalls. Legal experts can offer guidance tailored to your specific situation, ensuring that your document is both effective and compliant with Ohio law.