Attorney-Verified Employment Verification Document for Ohio State

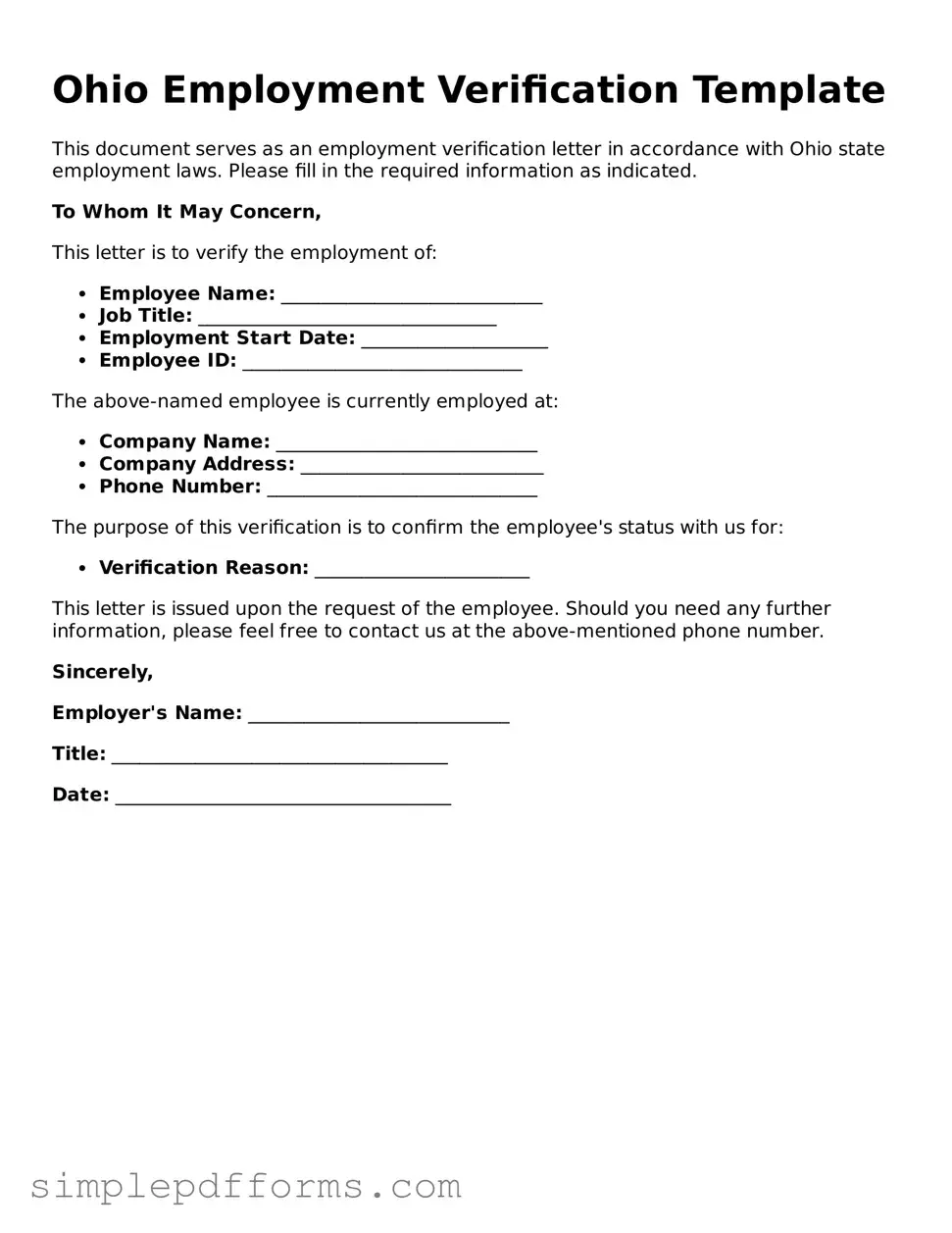

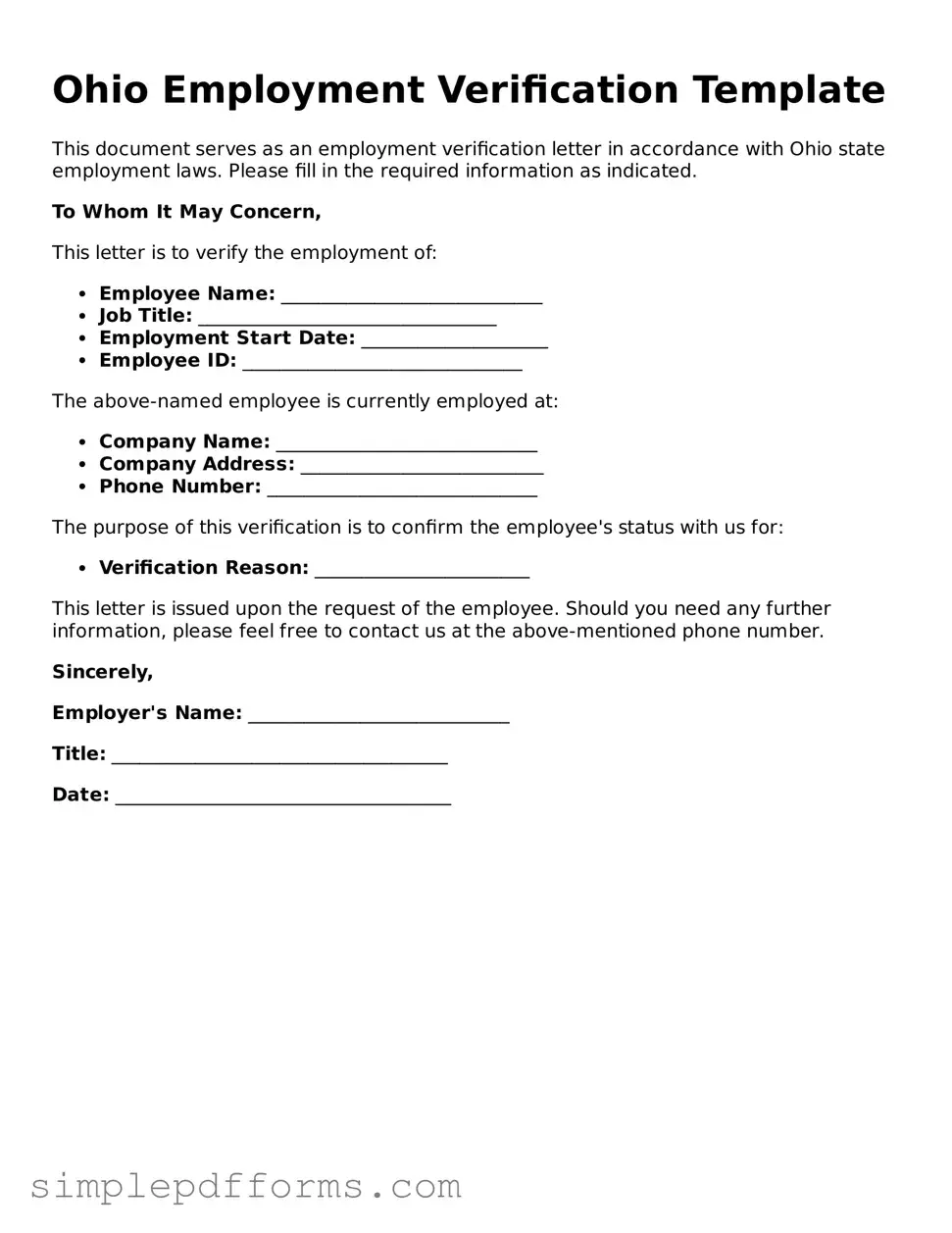

The Ohio Employment Verification form is a document used by employers to confirm an employee's job status and details. This form plays a crucial role in various employment-related processes, including background checks and loan applications. Understanding its purpose and how to complete it can benefit both employers and employees alike.

Open Employment Verification Editor Now

Attorney-Verified Employment Verification Document for Ohio State

Open Employment Verification Editor Now

Open Employment Verification Editor Now

or

Get Employment Verification PDF Form

Your form is waiting for completion

Complete Employment Verification online in minutes with ease.