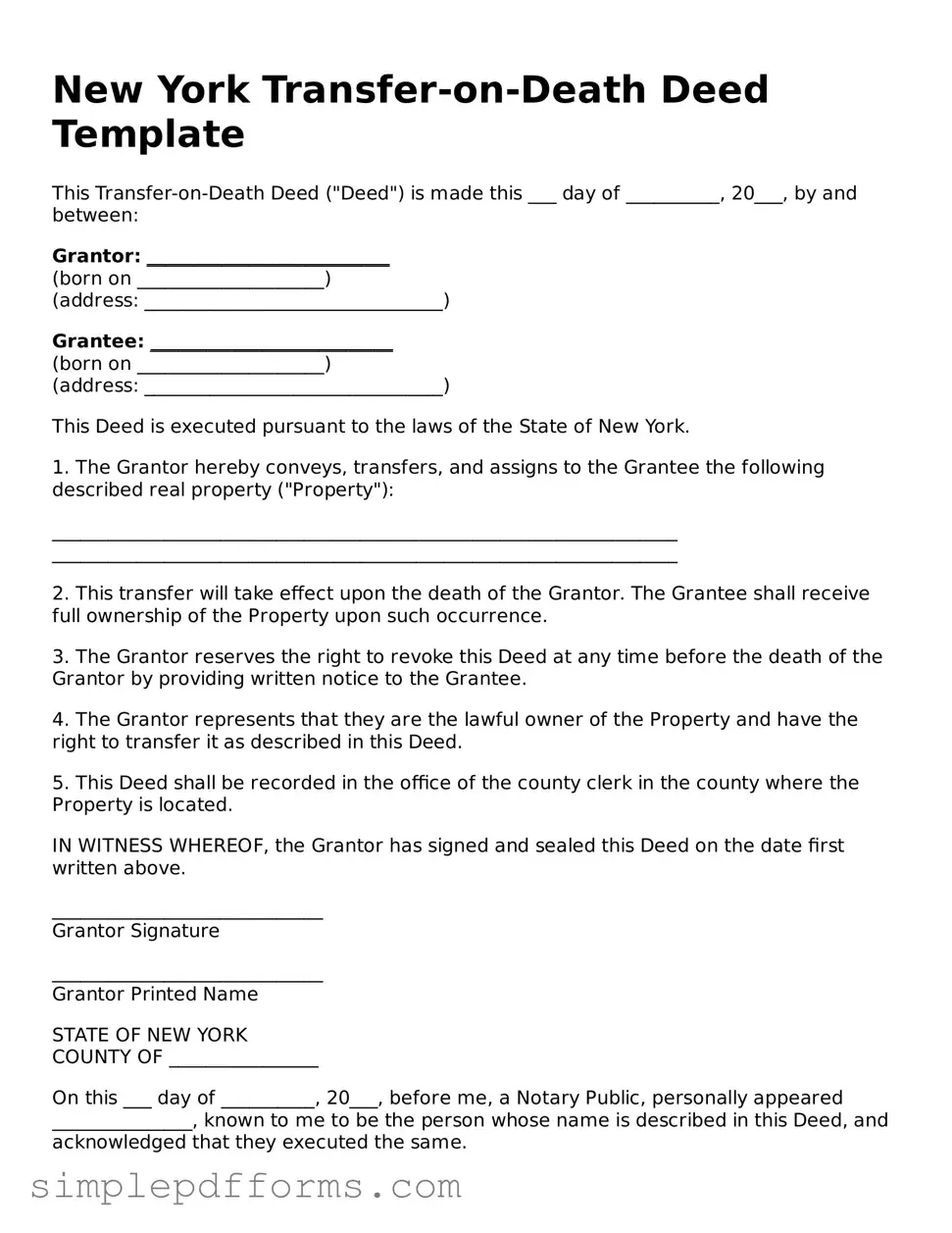

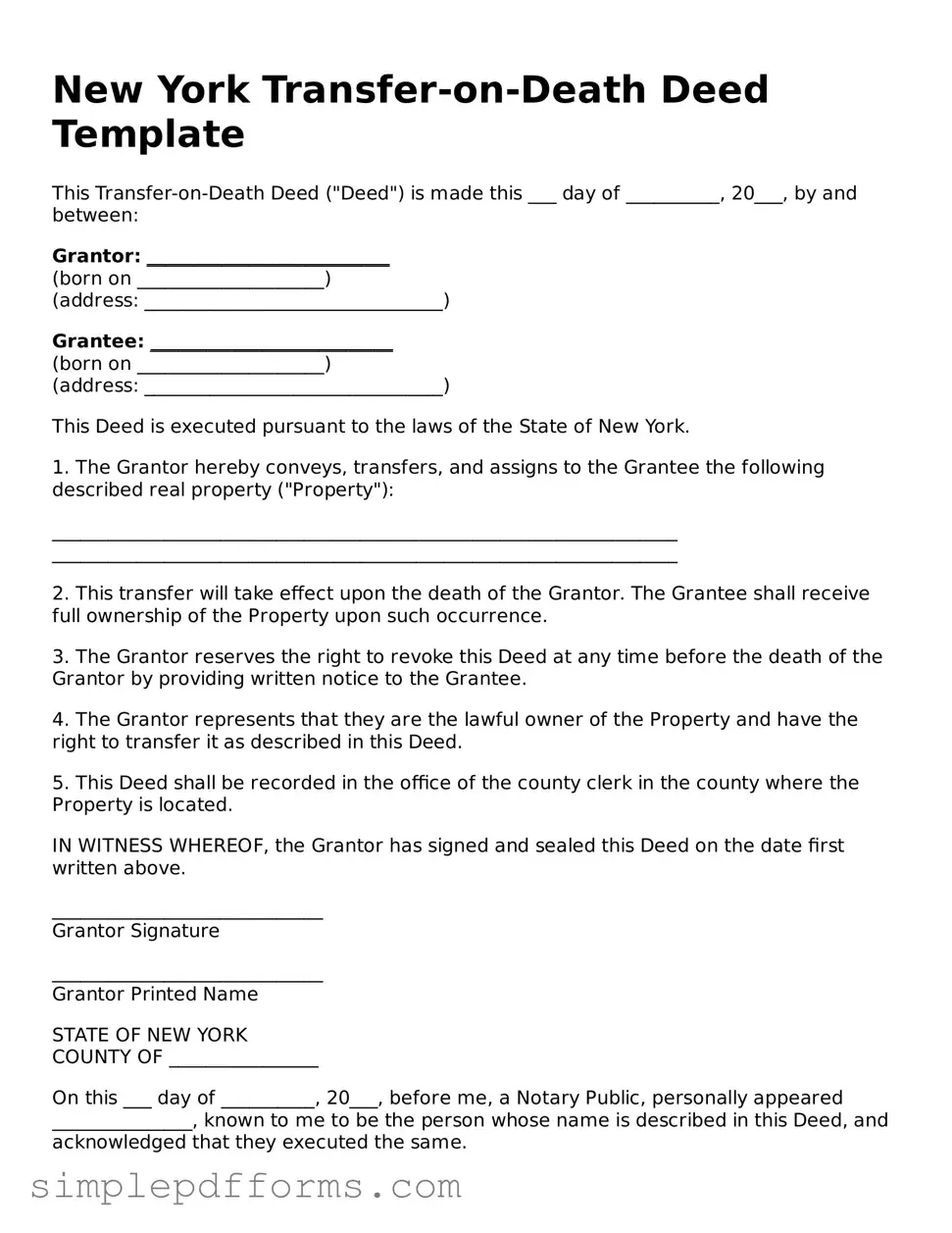

Attorney-Verified Transfer-on-Death Deed Document for New York State

The New York Transfer-on-Death Deed form is a legal document that allows property owners to designate a beneficiary who will receive their real estate upon the owner's death, bypassing the probate process. This form provides a straightforward method for transferring property, ensuring that the owner's wishes are honored while minimizing complications for the heirs. Understanding how to properly utilize this deed can facilitate a smoother transition of assets and provide peace of mind for property owners.

Open Transfer-on-Death Deed Editor Now

Attorney-Verified Transfer-on-Death Deed Document for New York State

Open Transfer-on-Death Deed Editor Now

Open Transfer-on-Death Deed Editor Now

or

Get Transfer-on-Death Deed PDF Form

Your form is waiting for completion

Complete Transfer-on-Death Deed online in minutes with ease.