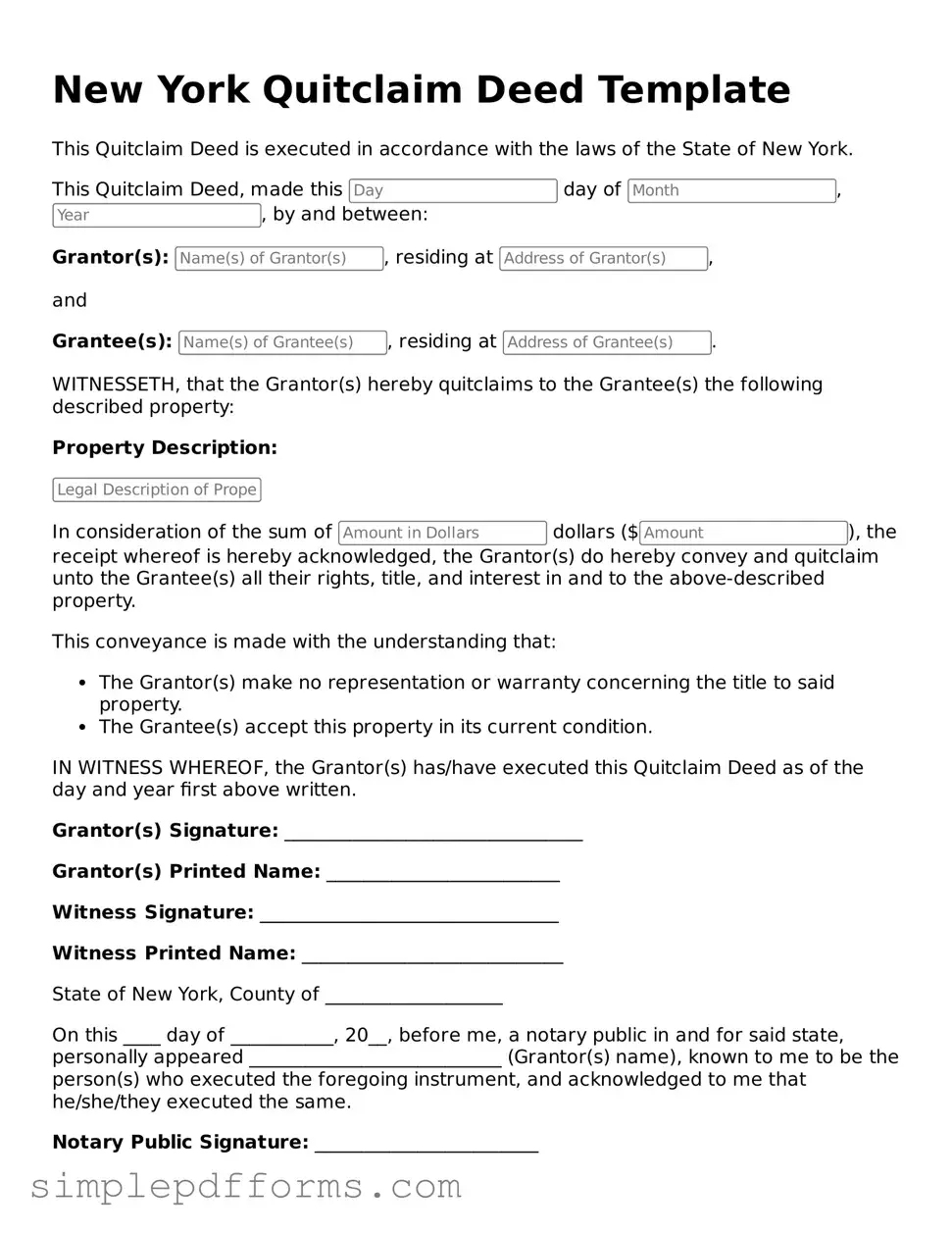

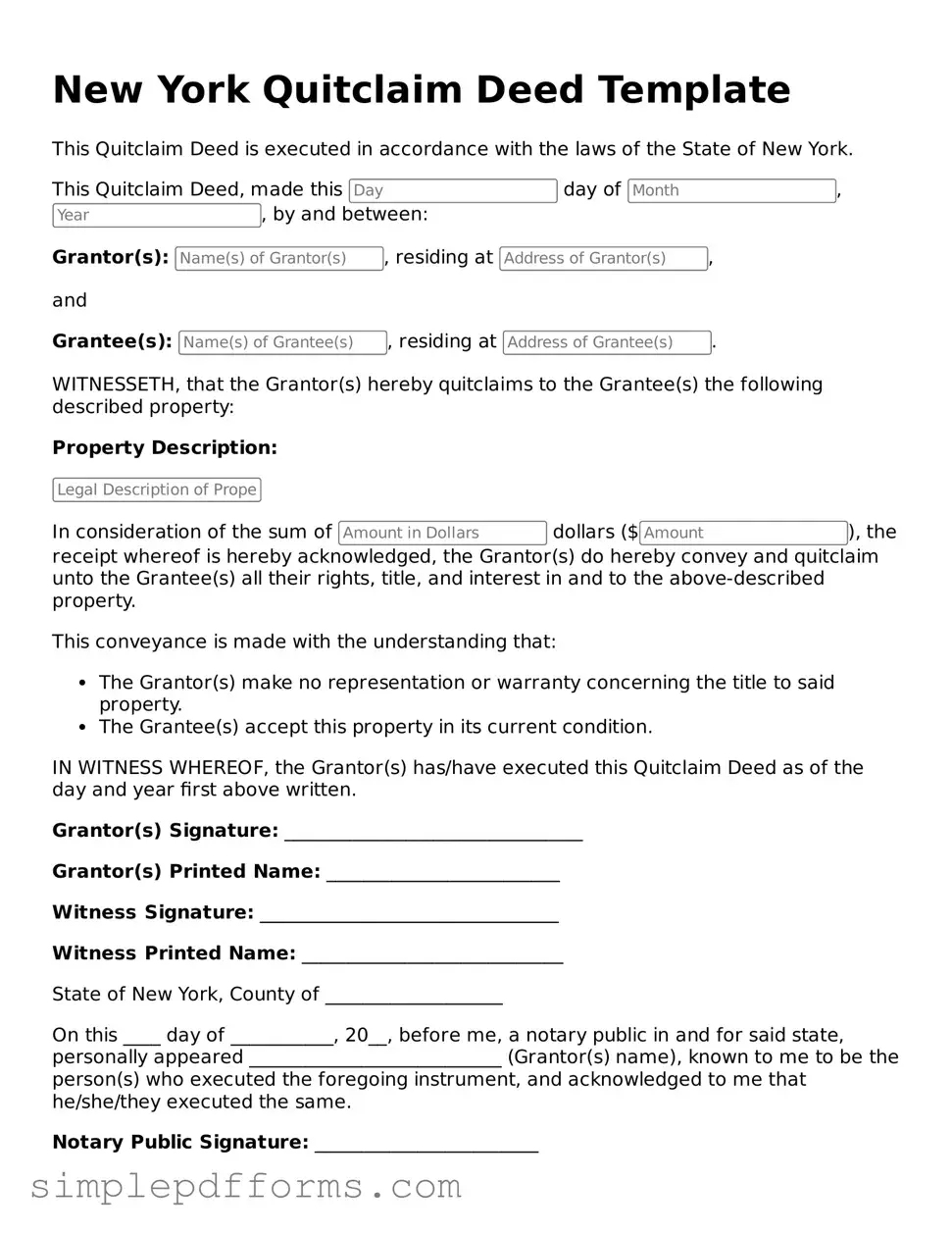

Attorney-Verified Quitclaim Deed Document for New York State

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any guarantees regarding the property’s title. This form allows the grantor to relinquish any interest they may have in the property, making it a straightforward option for property transfers. Understanding the Quitclaim Deed is essential for anyone involved in real estate transactions in New York.

Open Quitclaim Deed Editor Now

Attorney-Verified Quitclaim Deed Document for New York State

Open Quitclaim Deed Editor Now

Open Quitclaim Deed Editor Now

or

Get Quitclaim Deed PDF Form

Your form is waiting for completion

Complete Quitclaim Deed online in minutes with ease.