Attorney-Verified Promissory Note Document for New York State

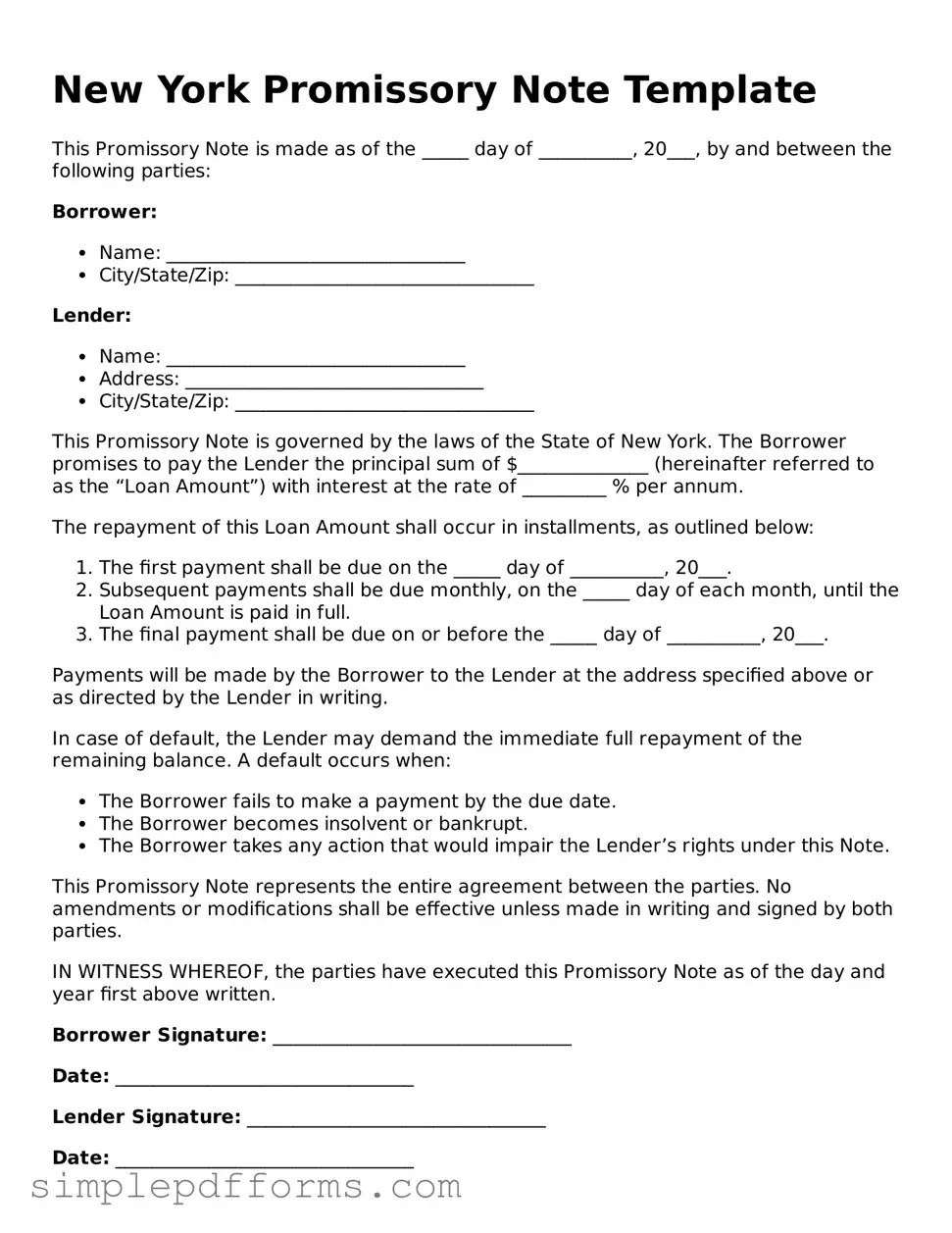

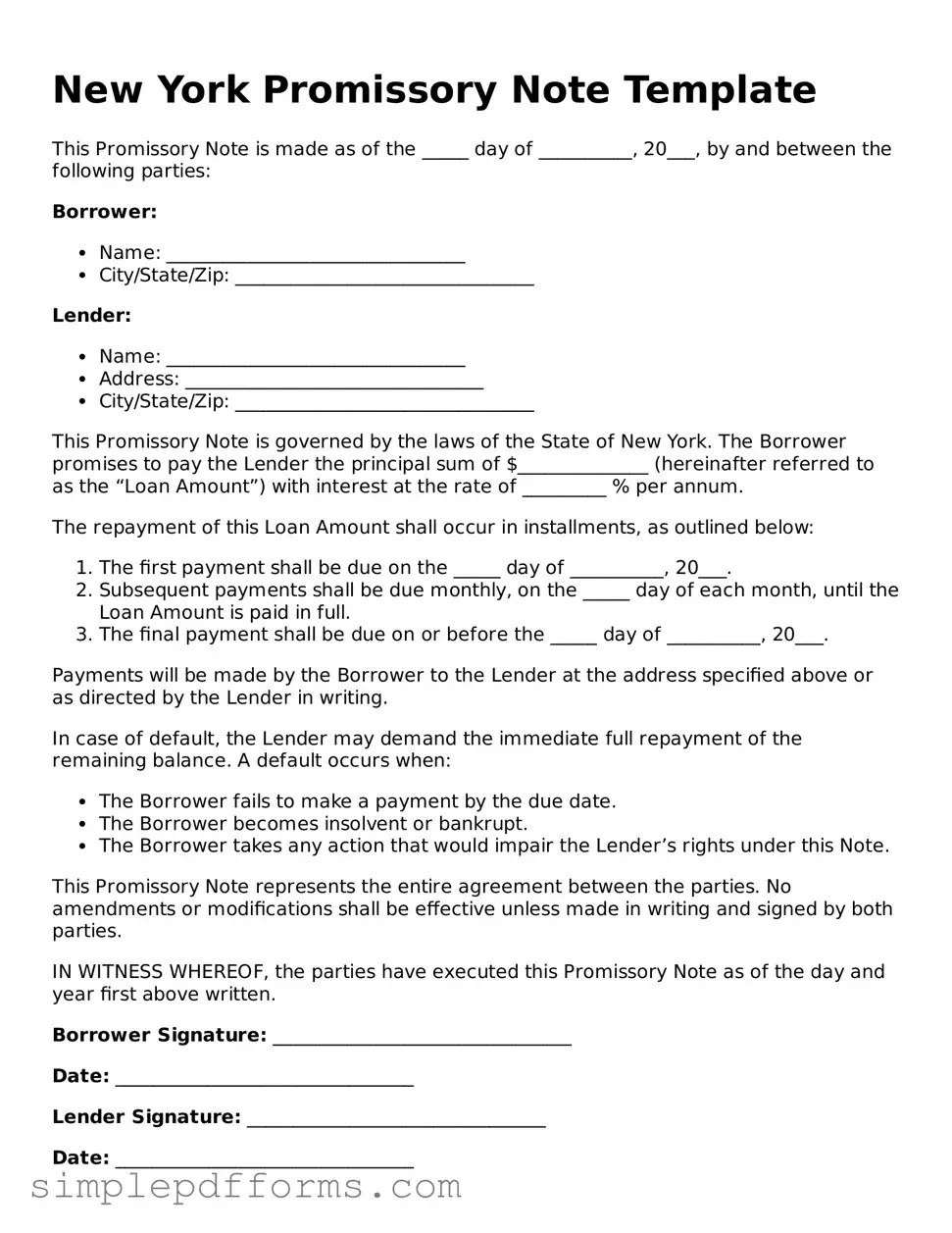

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a certain time or on demand. This financial instrument serves as a crucial tool in various lending scenarios, ensuring both the lender and borrower understand their obligations. Understanding the components and legal implications of this form is essential for anyone involved in a loan agreement in New York.

Open Promissory Note Editor Now

Attorney-Verified Promissory Note Document for New York State

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

Get Promissory Note PDF Form

Your form is waiting for completion

Complete Promissory Note online in minutes with ease.