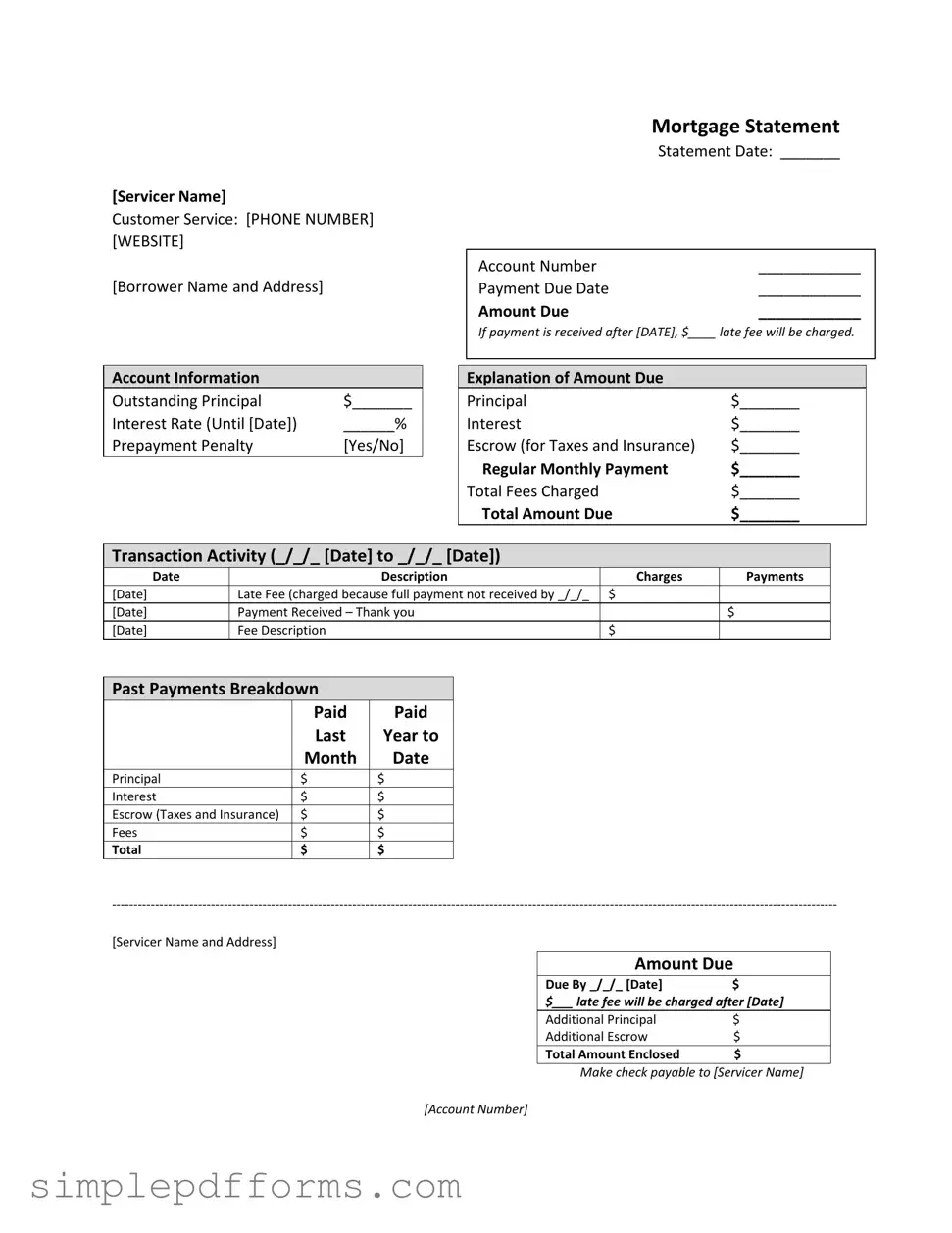

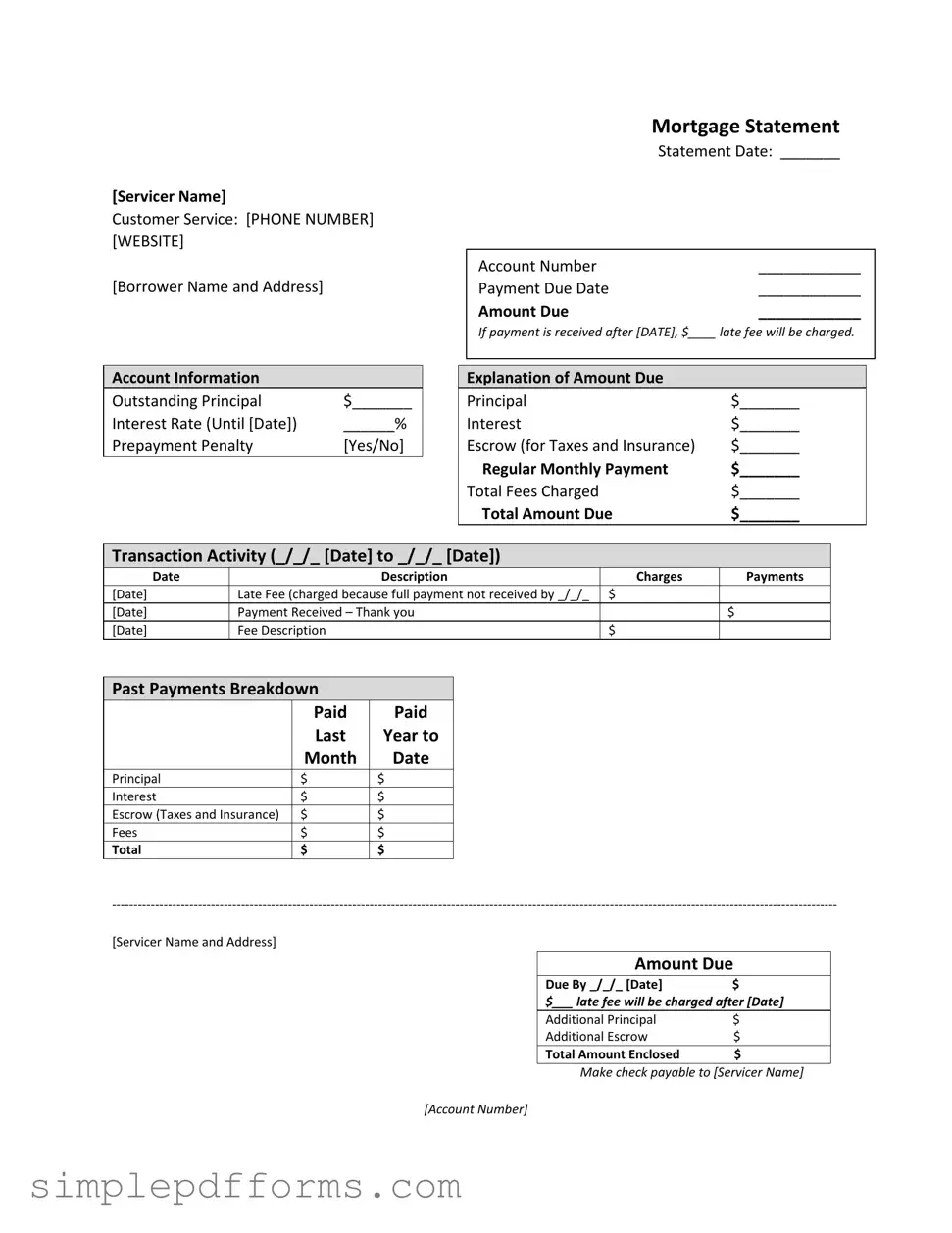

Fill a Valid Mortgage Statement Form

The Mortgage Statement form is an important document that provides homeowners with a detailed overview of their mortgage account. It outlines key information such as the amount due, payment history, and any applicable fees. Understanding this form can help borrowers manage their mortgage payments effectively.

Open Mortgage Statement Editor Now

Fill a Valid Mortgage Statement Form

Open Mortgage Statement Editor Now

Open Mortgage Statement Editor Now

or

Get Mortgage Statement PDF Form

Your form is waiting for completion

Complete Mortgage Statement online in minutes with ease.