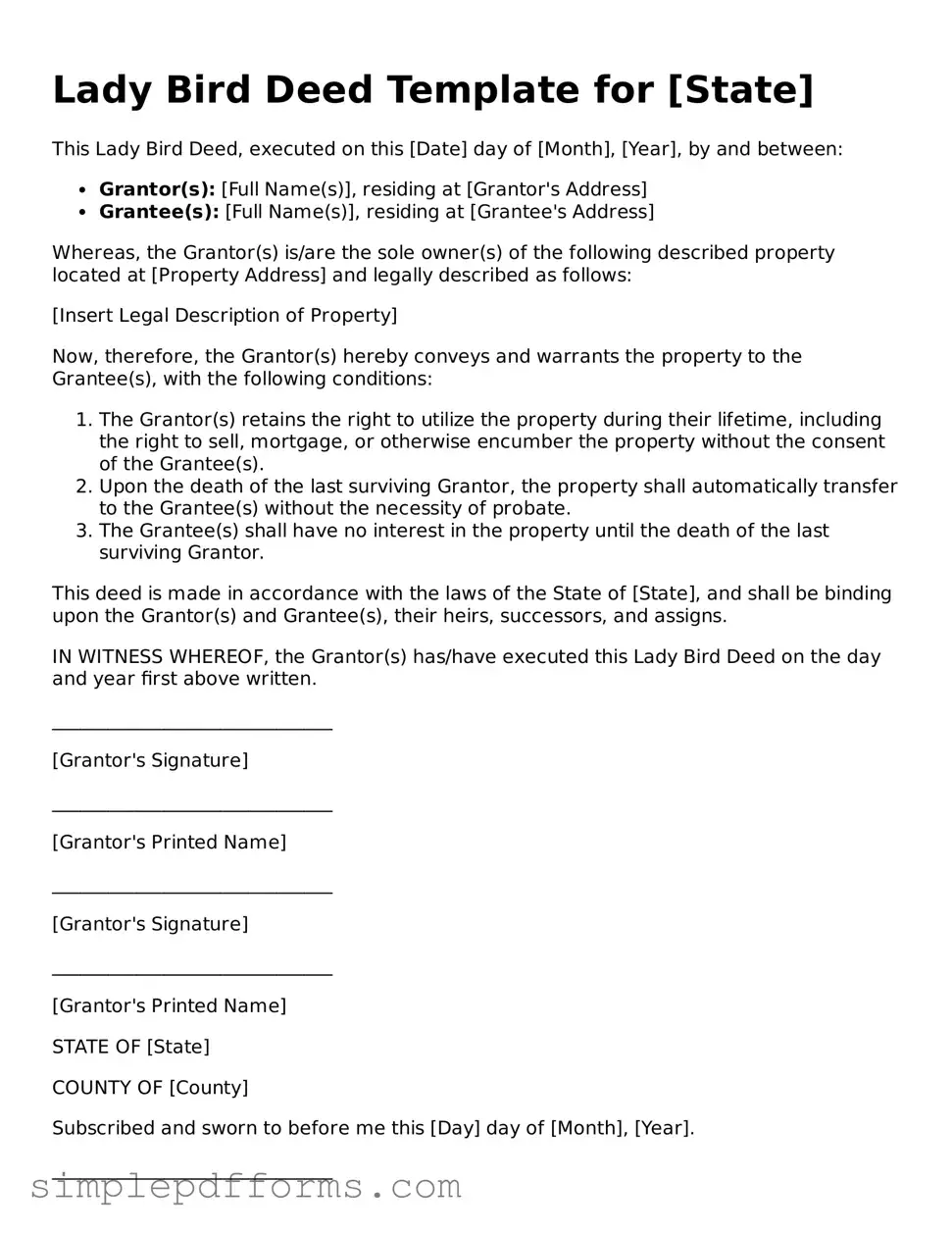

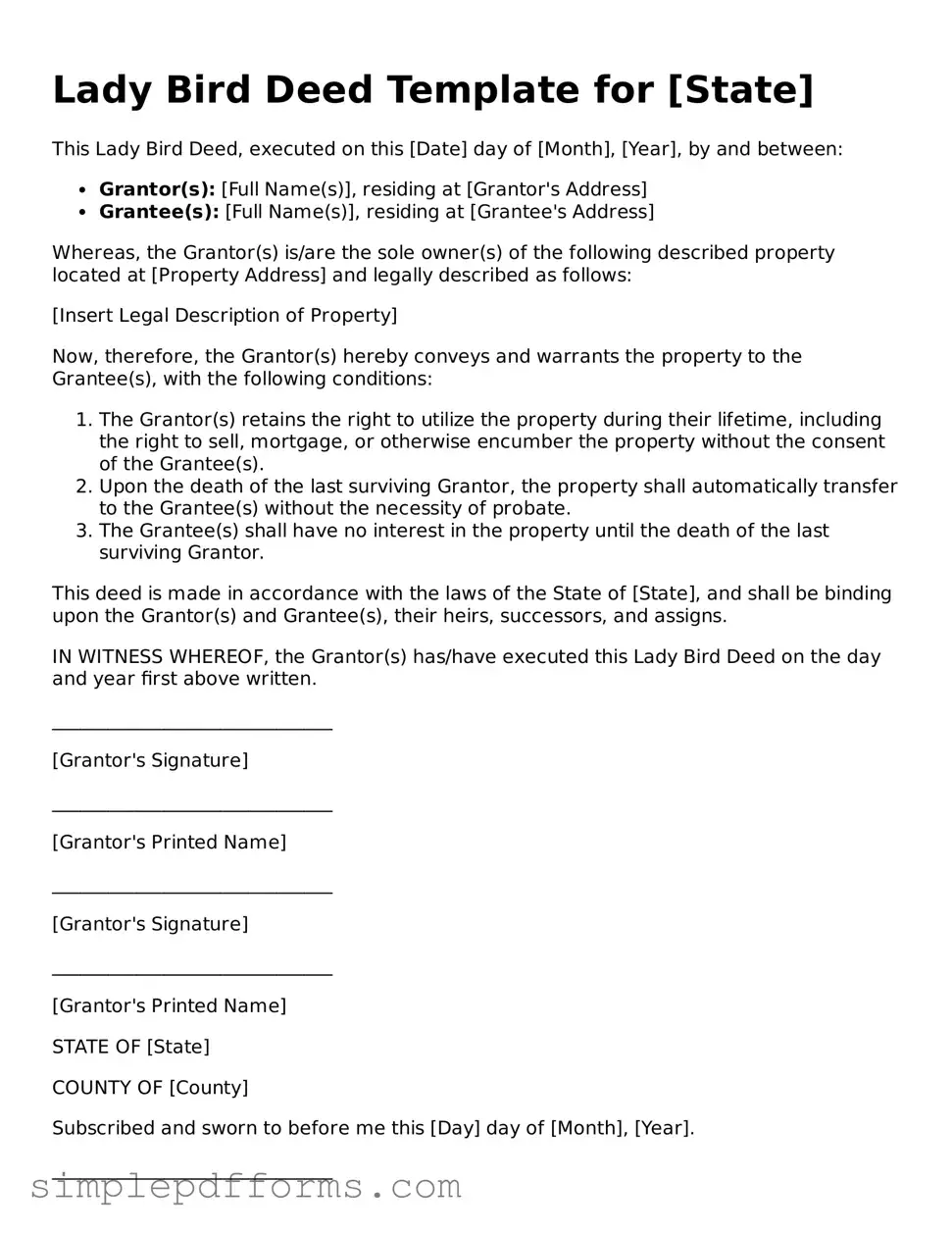

Free Lady Bird Deed Form

The Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form of deed provides flexibility and can help avoid probate, making it a popular choice for many. Understanding its benefits and limitations is essential for effective estate planning.

Open Lady Bird Deed Editor Now

Free Lady Bird Deed Form

Open Lady Bird Deed Editor Now

Open Lady Bird Deed Editor Now

or

Get Lady Bird Deed PDF Form

Your form is waiting for completion

Complete Lady Bird Deed online in minutes with ease.