|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

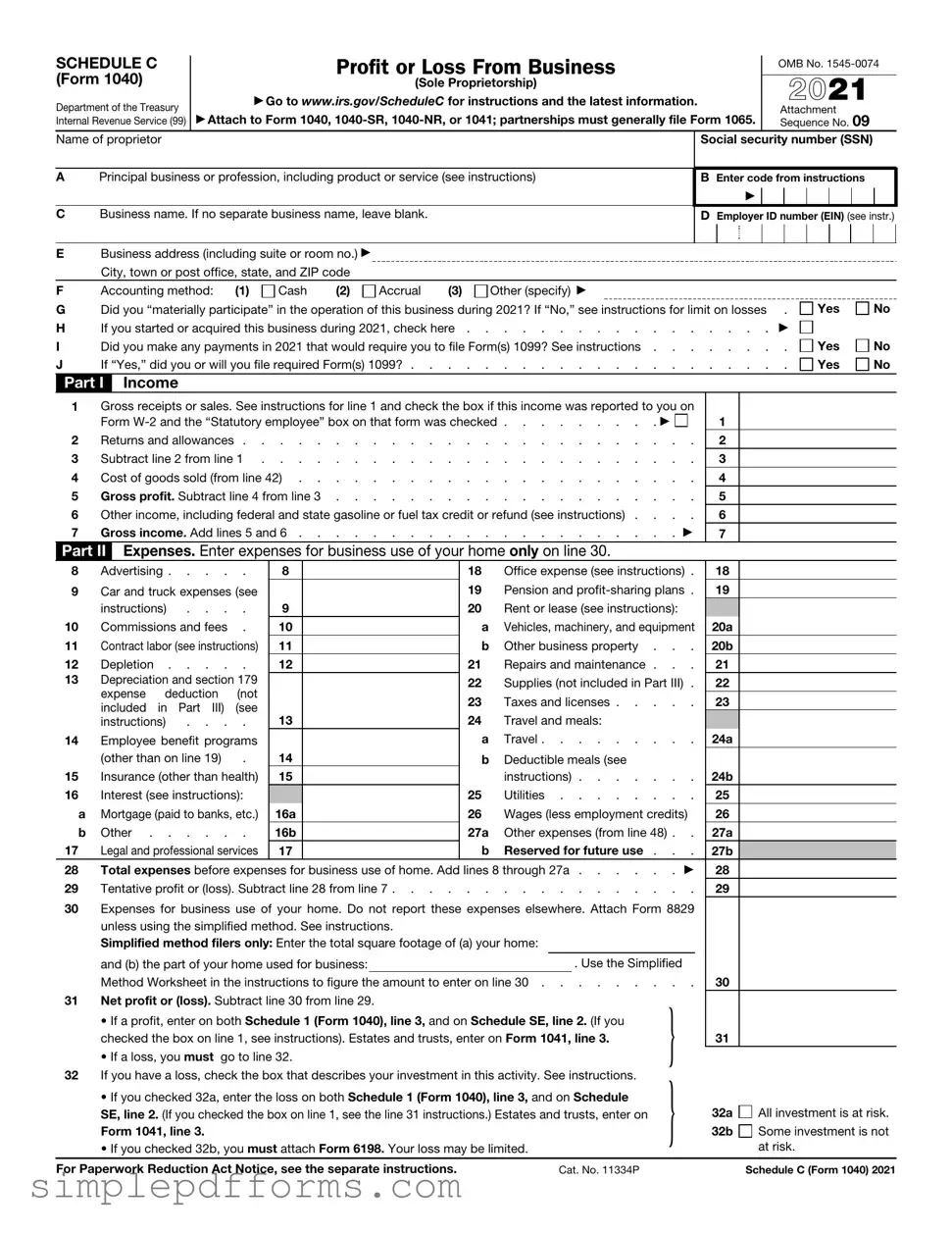

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|

Form W-2 and the “Statutory employee” box on that form was checked |

. . . . . . . . . ▶ |

1 |

|

|

|

|

2 |

Returns and allowances |

2 |

|

|

|

|

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and profit-sharing plans . |

19 |

|

|

|

|

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

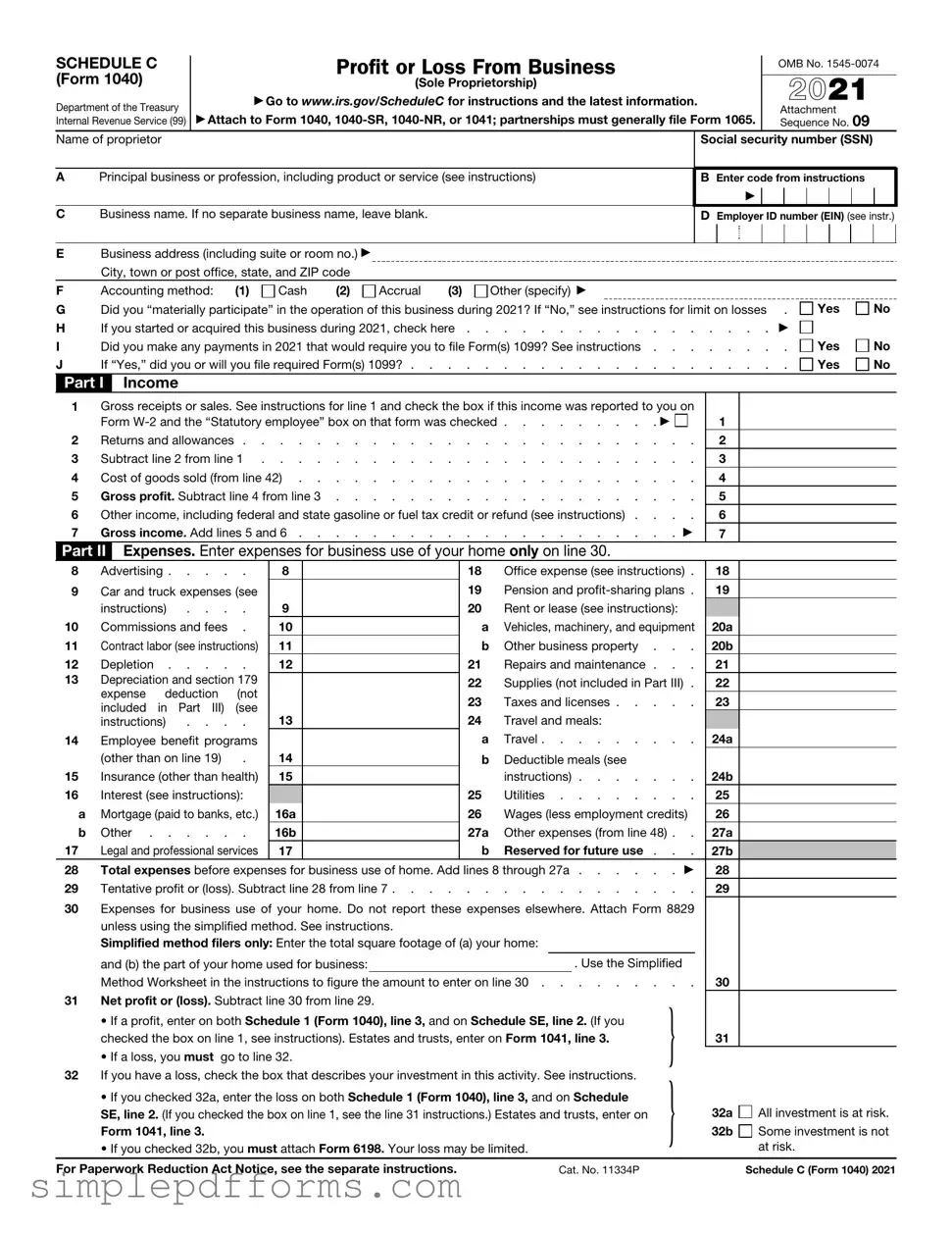

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |