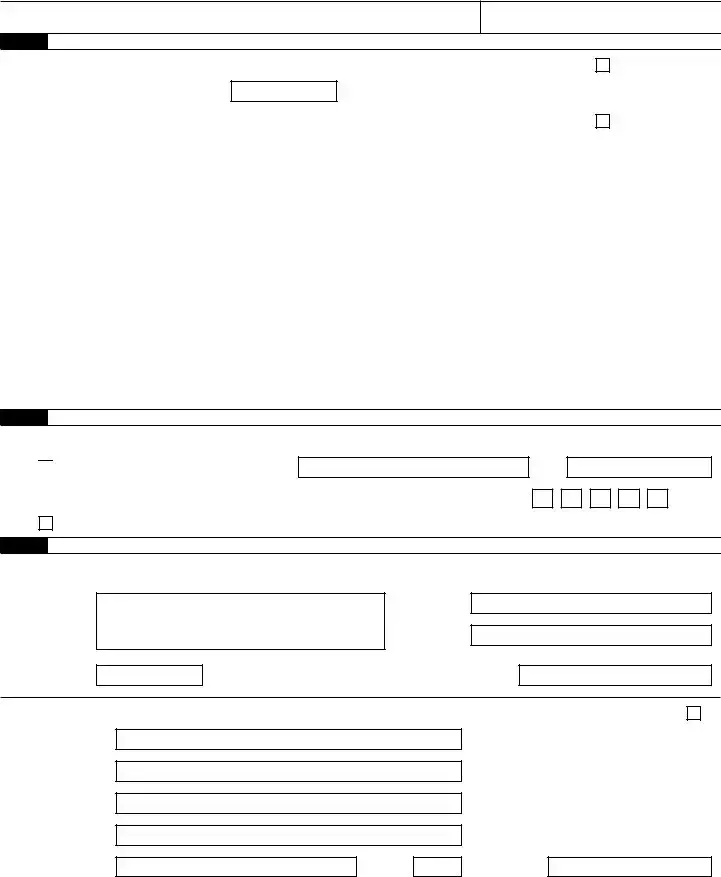

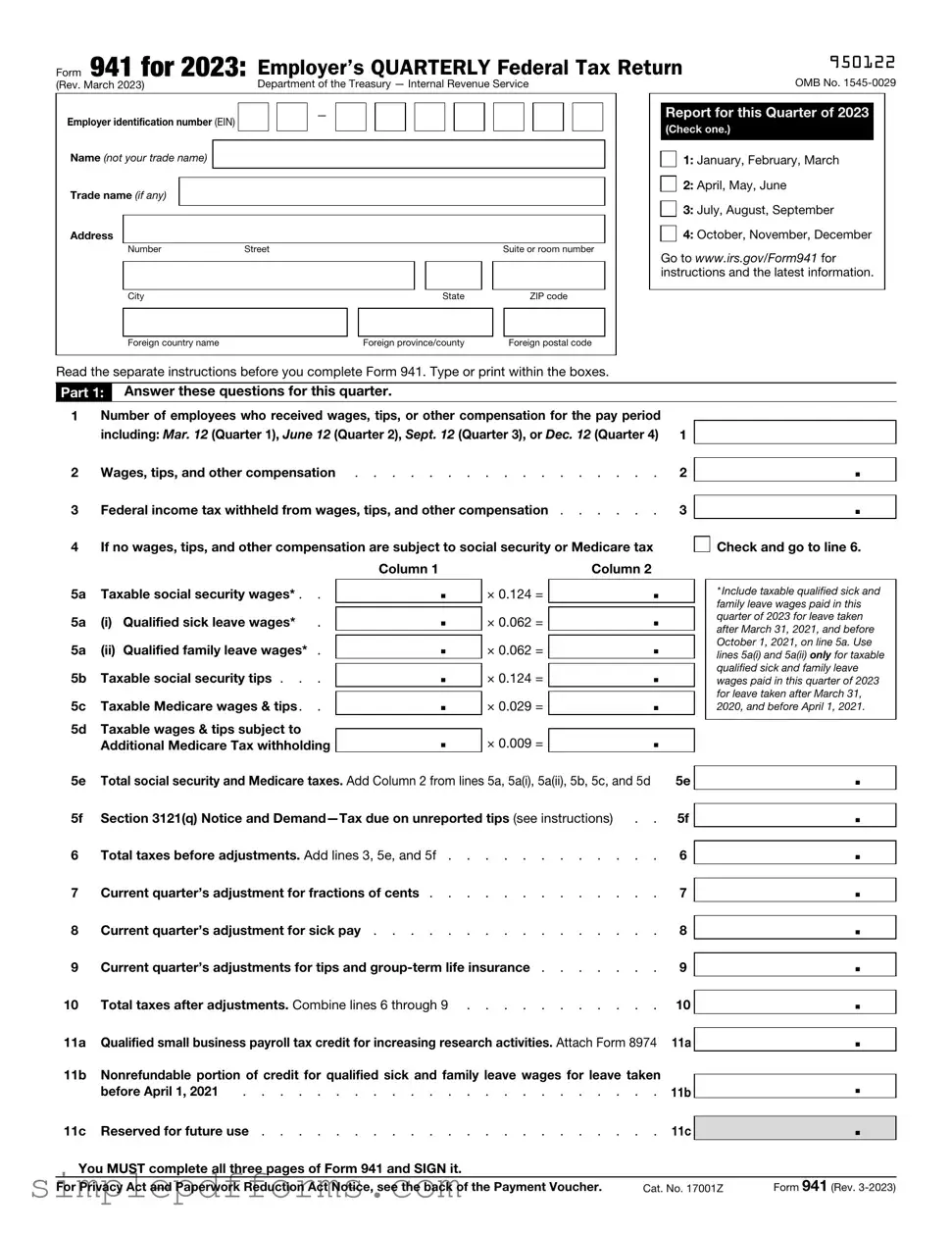

Filling out the IRS Form 941 can be a daunting task for many business owners. This form is crucial for reporting income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. However, mistakes can lead to penalties or delays. Here are nine common errors people make when completing this important document.

One frequent mistake is incorrect reporting of employee wages. It's essential to accurately calculate the total wages paid to employees during the quarter. Misreporting these figures can lead to discrepancies and potential audits. Always double-check the payroll records before entering numbers on the form.

Another common error involves failing to include all employees. Some employers mistakenly think they only need to report wages for full-time employees. In reality, all employees, including part-time and seasonal workers, must be accounted for. Omitting any employee can result in an incomplete form.

Many individuals also overlook the importance of timely filing. The IRS requires Form 941 to be submitted quarterly. Missing the deadline can lead to penalties and interest on unpaid taxes. Setting reminders for filing dates can help avoid this mistake.

Inaccurate calculations of tax liabilities are another issue. Employers must ensure they correctly calculate the amounts owed for Social Security and Medicare taxes. Errors in these calculations can lead to underpayment or overpayment, both of which can complicate future tax filings.

Some people forget to sign and date the form. An unsigned form is considered incomplete, which can delay processing and lead to additional penalties. Always remember to sign and date the form before submitting it to the IRS.

Using outdated forms is also a common pitfall. The IRS updates Form 941 periodically, and using an old version can result in incorrect information being submitted. Always download the latest version from the IRS website to ensure compliance.

Another mistake involves not keeping adequate records. Employers are required to maintain records supporting the information reported on Form 941. Failing to do so can make it difficult to verify information if the IRS conducts an audit.

Some individuals neglect to check for errors before submission. Simple mistakes, such as typos or incorrect figures, can lead to significant issues. A thorough review of the completed form can help catch these errors before they become a problem.

Lastly, misunderstanding the instructions can lead to misfiling. The IRS provides detailed instructions for completing Form 941. Taking the time to read and understand these guidelines can prevent many of the common mistakes that occur.

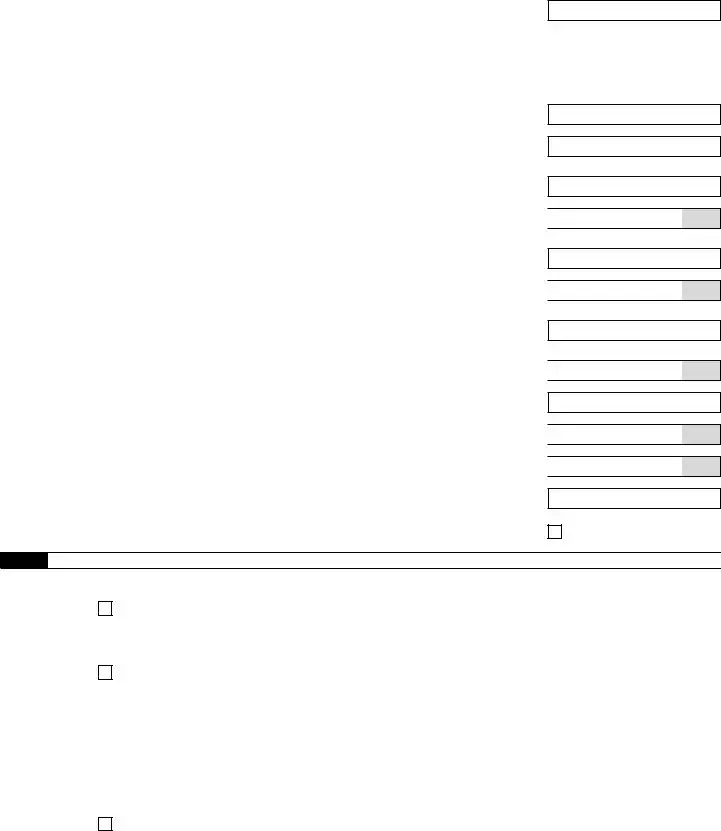

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

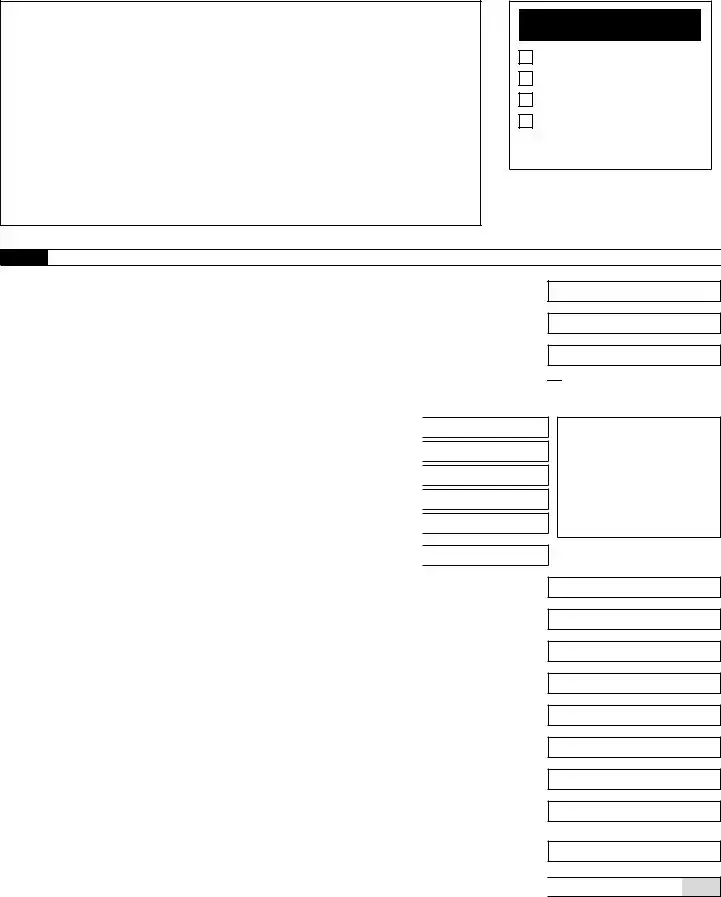

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number