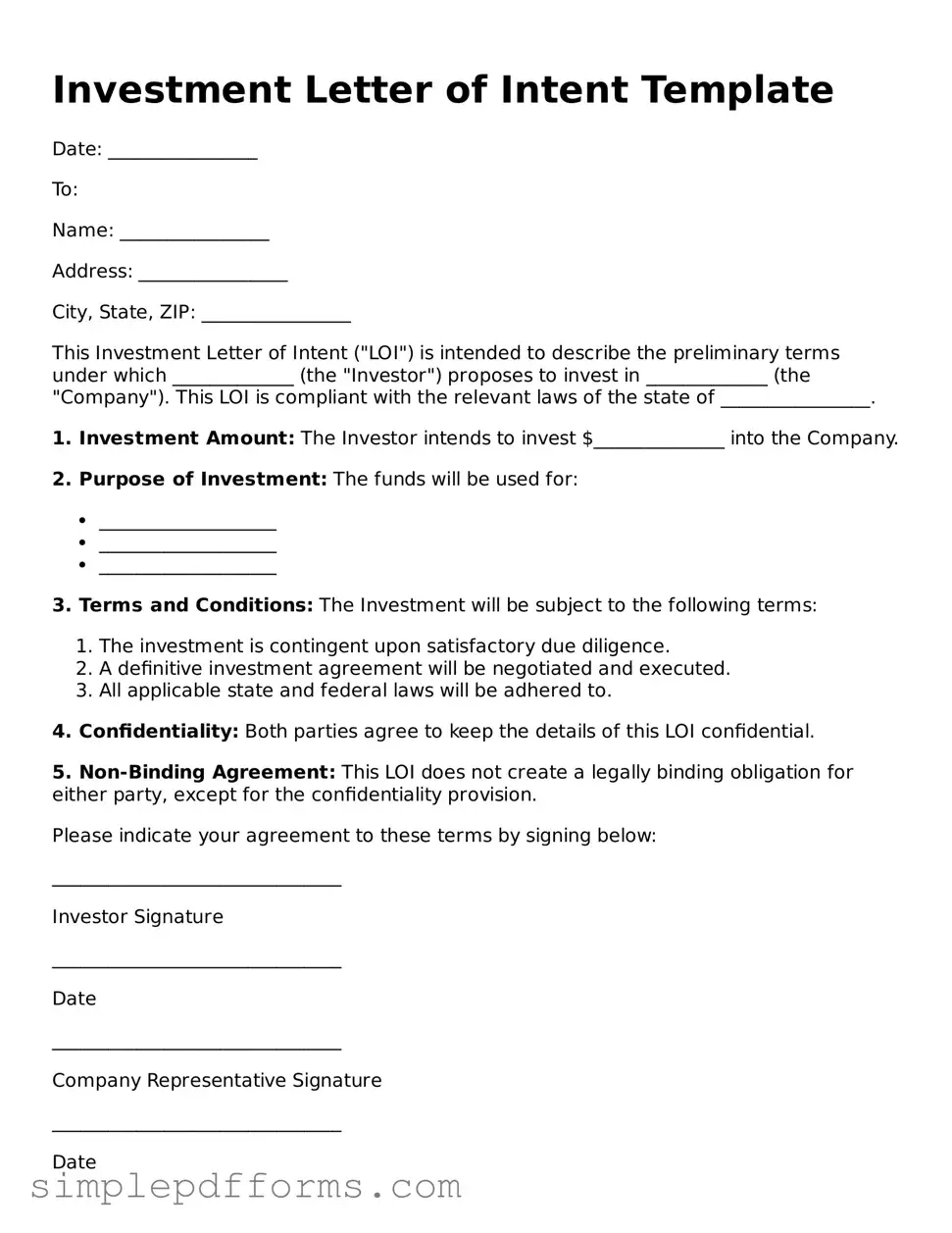

Free Investment Letter of Intent Form

An Investment Letter of Intent (LOI) is a preliminary document that outlines the intentions of parties involved in a potential investment deal. This form serves as a roadmap for negotiations, detailing key terms and conditions that both parties agree to consider. By establishing a mutual understanding, the LOI can facilitate smoother discussions and pave the way for a formal agreement.

Open Investment Letter of Intent Editor Now

Free Investment Letter of Intent Form

Open Investment Letter of Intent Editor Now

Open Investment Letter of Intent Editor Now

or

Get Investment Letter of Intent PDF Form

Your form is waiting for completion

Complete Investment Letter of Intent online in minutes with ease.