Fill a Valid Intent To Lien Florida Form

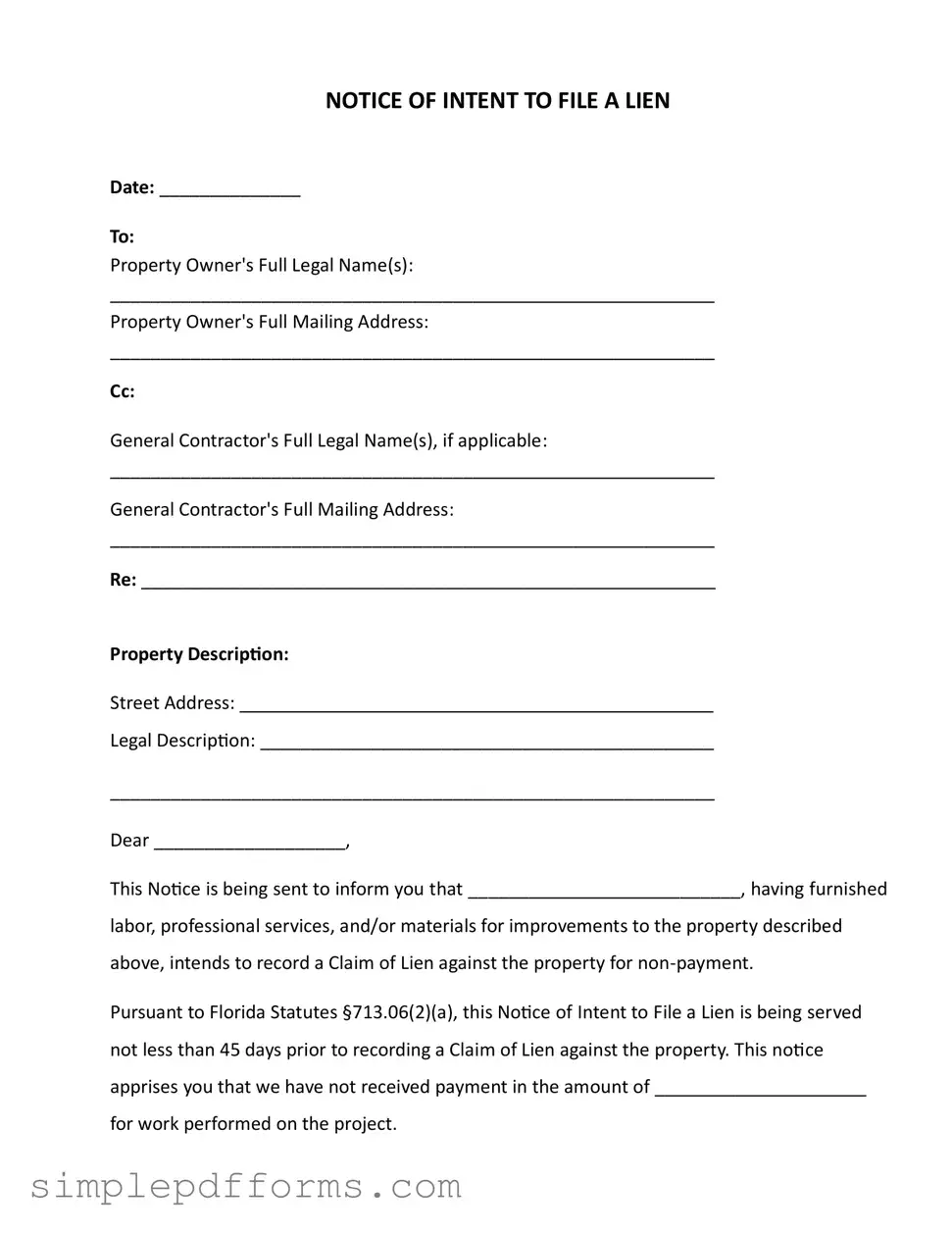

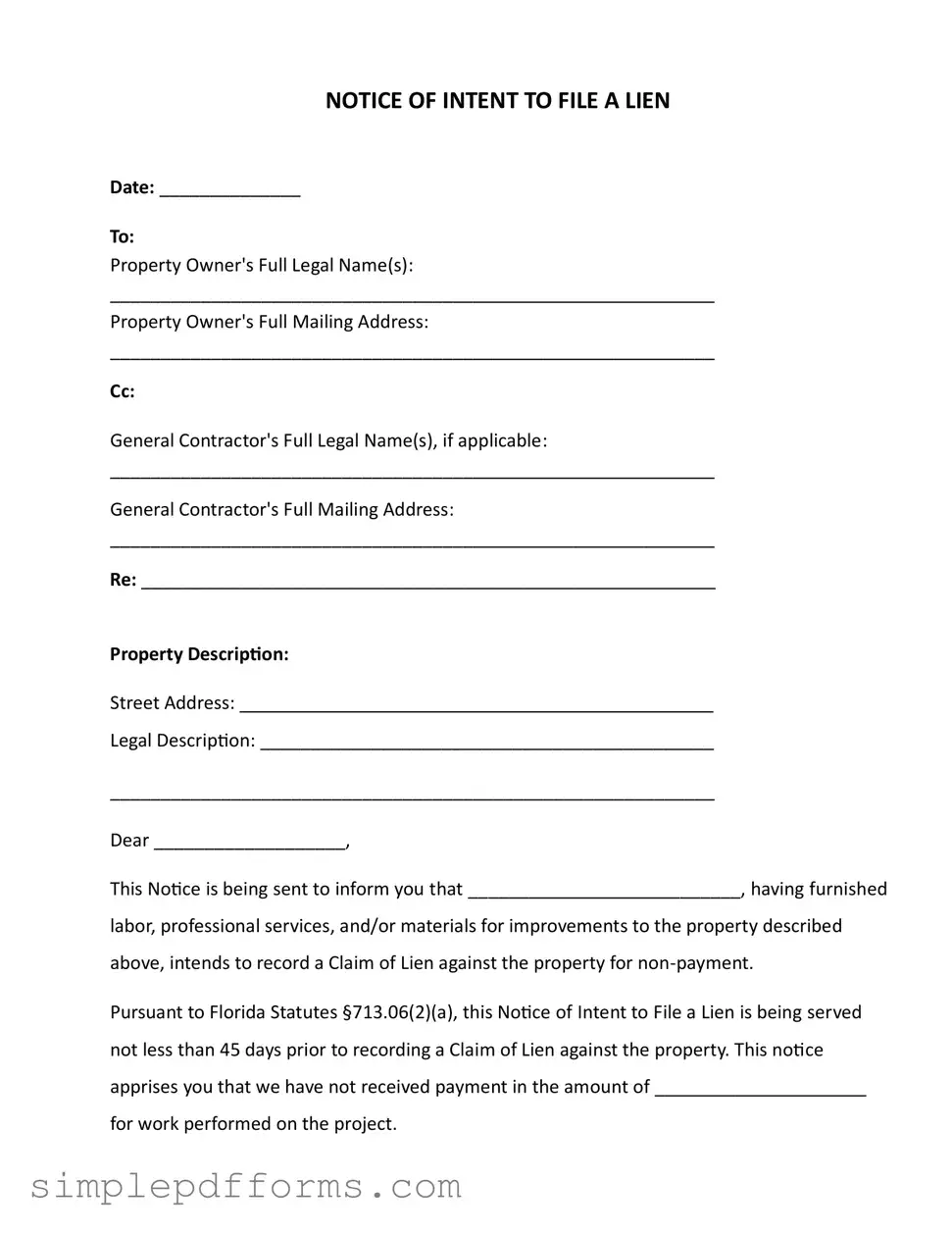

The Intent To Lien Florida form is a legal document that notifies property owners of an impending lien against their property due to unpaid labor, materials, or services. This notice serves as a warning, allowing property owners to address payment issues before a lien is officially recorded. Understanding this form is crucial for both contractors and property owners to protect their rights and avoid potential foreclosure proceedings.

Open Intent To Lien Florida Editor Now

Fill a Valid Intent To Lien Florida Form

Open Intent To Lien Florida Editor Now

Open Intent To Lien Florida Editor Now

or

Get Intent To Lien Florida PDF Form

Your form is waiting for completion

Complete Intent To Lien Florida online in minutes with ease.