Fill a Valid Independent Contractor Pay Stub Form

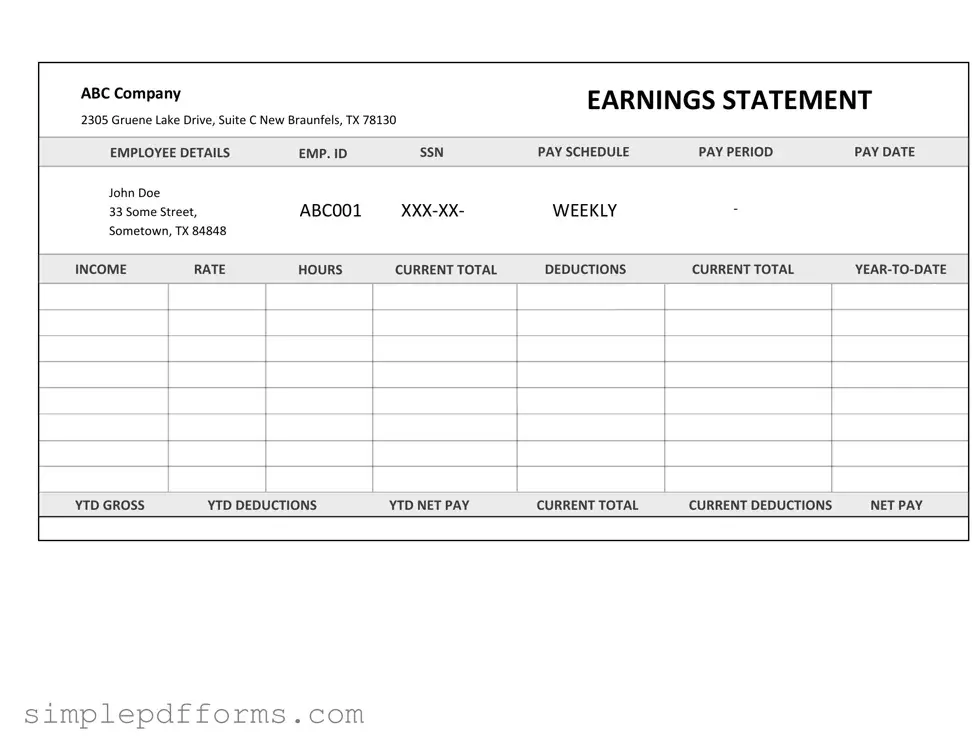

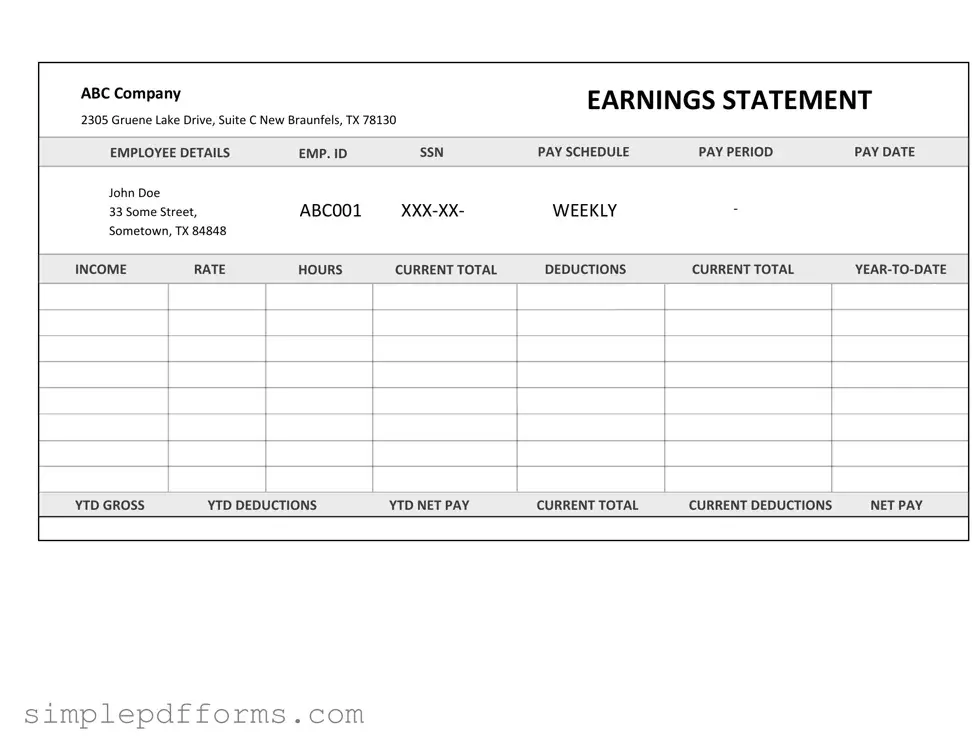

The Independent Contractor Pay Stub form is a document that outlines the payment details for services rendered by an independent contractor. It serves as a record for both the contractor and the hiring entity, detailing earnings, deductions, and payment dates. Understanding this form is essential for ensuring accurate financial reporting and compliance with tax obligations.

Open Independent Contractor Pay Stub Editor Now

Fill a Valid Independent Contractor Pay Stub Form

Open Independent Contractor Pay Stub Editor Now

Open Independent Contractor Pay Stub Editor Now

or

Get Independent Contractor Pay Stub PDF Form

Your form is waiting for completion

Complete Independent Contractor Pay Stub online in minutes with ease.