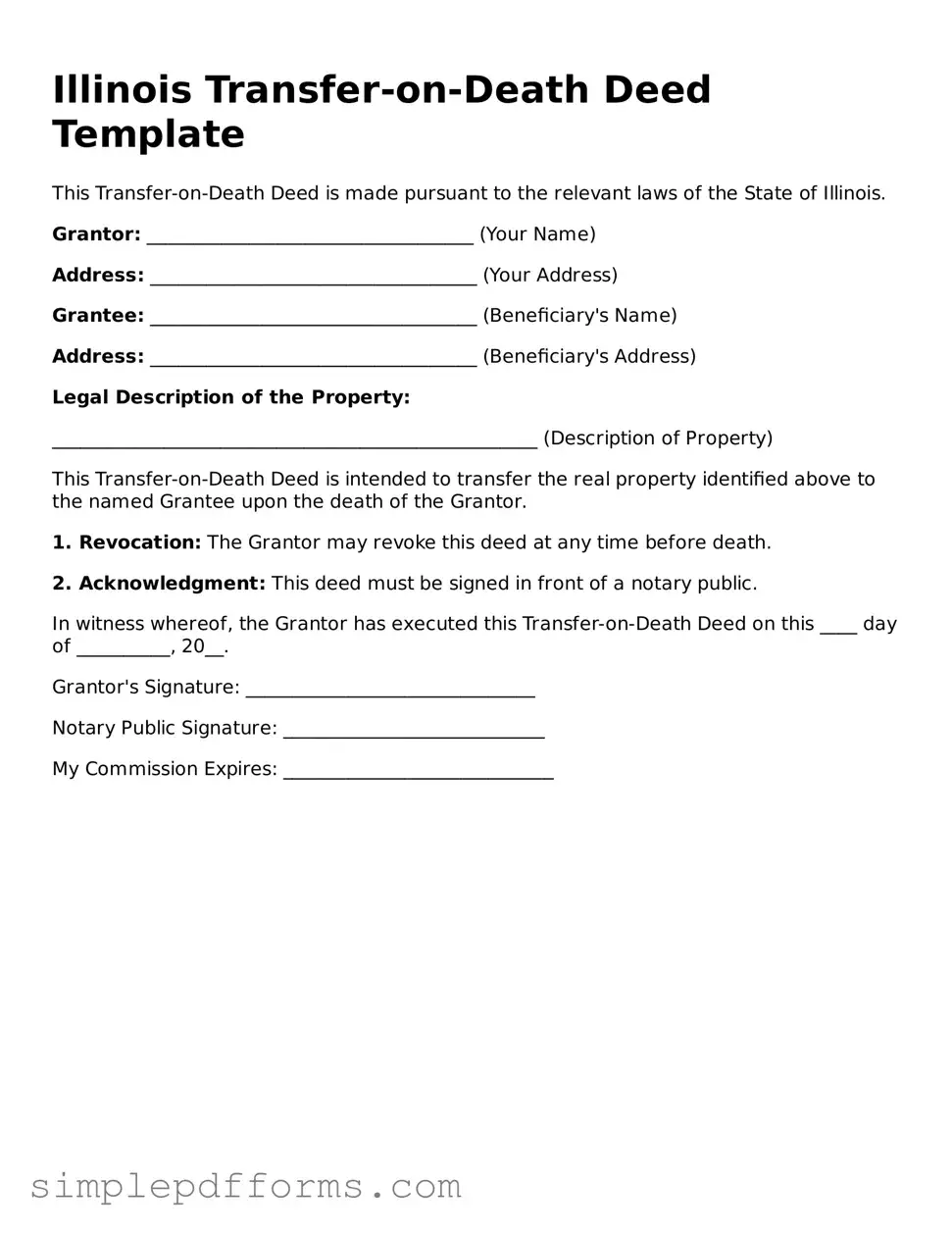

Attorney-Verified Transfer-on-Death Deed Document for Illinois State

The Illinois Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This legal tool provides a straightforward way to ensure that assets are passed on according to the owner's wishes. Understanding how to properly utilize this form can simplify estate planning and facilitate a smoother transition for heirs.

Open Transfer-on-Death Deed Editor Now

Attorney-Verified Transfer-on-Death Deed Document for Illinois State

Open Transfer-on-Death Deed Editor Now

Open Transfer-on-Death Deed Editor Now

or

Get Transfer-on-Death Deed PDF Form

Your form is waiting for completion

Complete Transfer-on-Death Deed online in minutes with ease.