Attorney-Verified Operating Agreement Document for Illinois State

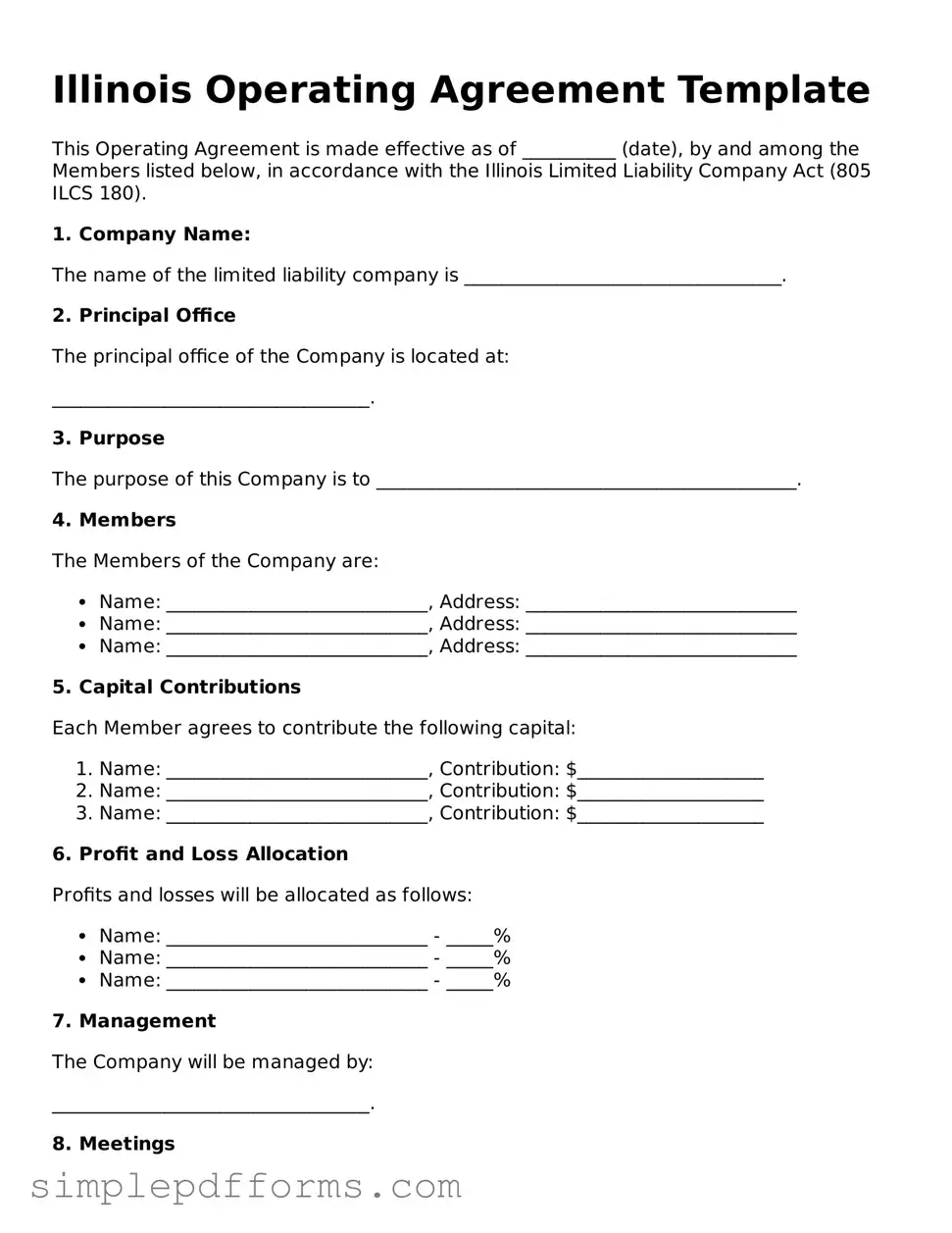

The Illinois Operating Agreement form is a crucial document for Limited Liability Companies (LLCs) in the state of Illinois. This form outlines the internal operations, management structure, and member responsibilities of the LLC. Having a well-drafted operating agreement can help prevent disputes and provide clarity for all members involved.

Open Operating Agreement Editor Now

Attorney-Verified Operating Agreement Document for Illinois State

Open Operating Agreement Editor Now

Open Operating Agreement Editor Now

or

Get Operating Agreement PDF Form

Your form is waiting for completion

Complete Operating Agreement online in minutes with ease.