Fill a Valid Goodwill donation receipt Form

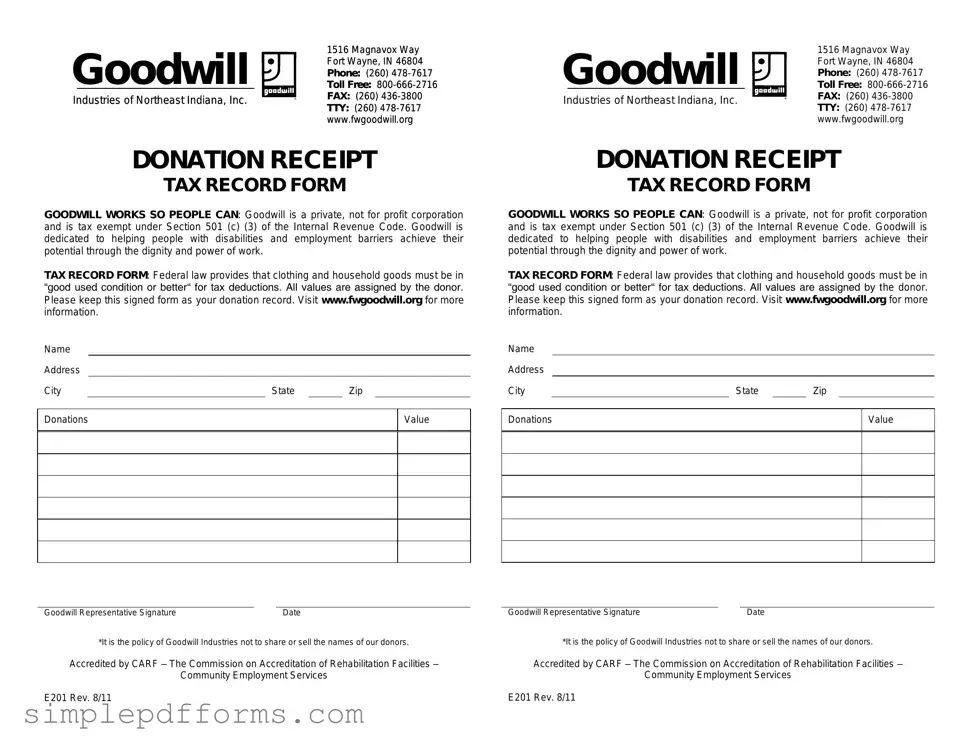

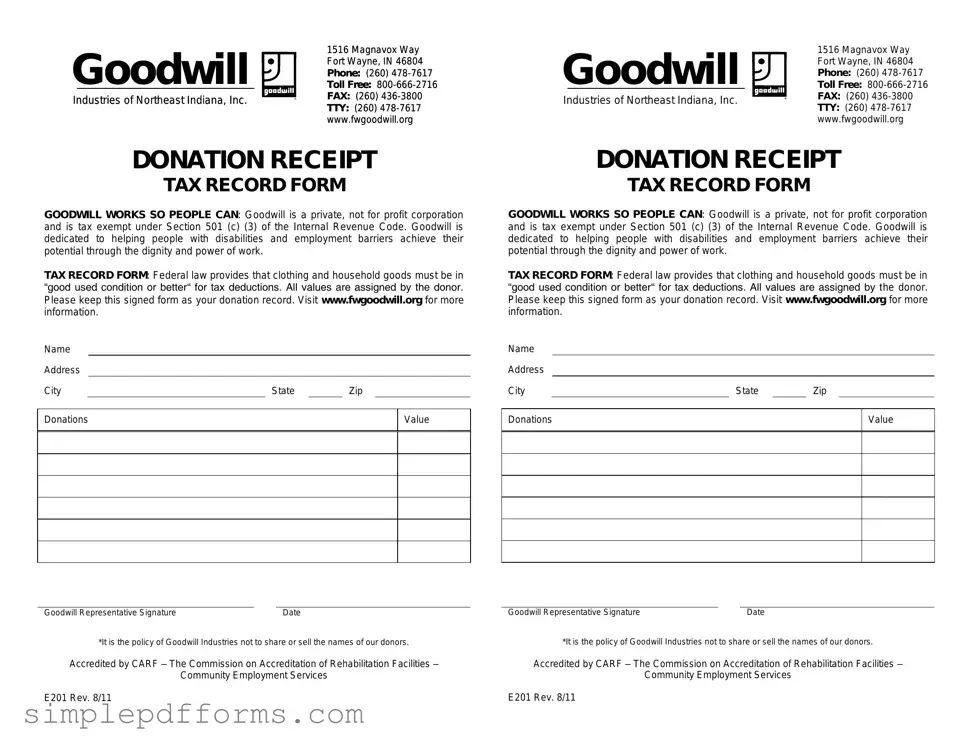

The Goodwill donation receipt form serves as a vital document for individuals who wish to claim tax deductions on their charitable contributions. This form not only provides a record of the items donated but also indicates their estimated value, ensuring that donors have the necessary proof for tax purposes. Understanding how to properly fill out and utilize this form can enhance the donation experience and maximize potential tax benefits.

Open Goodwill donation receipt Editor Now

Fill a Valid Goodwill donation receipt Form

Open Goodwill donation receipt Editor Now

Open Goodwill donation receipt Editor Now

or

Get Goodwill donation receipt PDF Form

Your form is waiting for completion

Complete Goodwill donation receipt online in minutes with ease.