Attorney-Verified Promissory Note Document for Georgia State

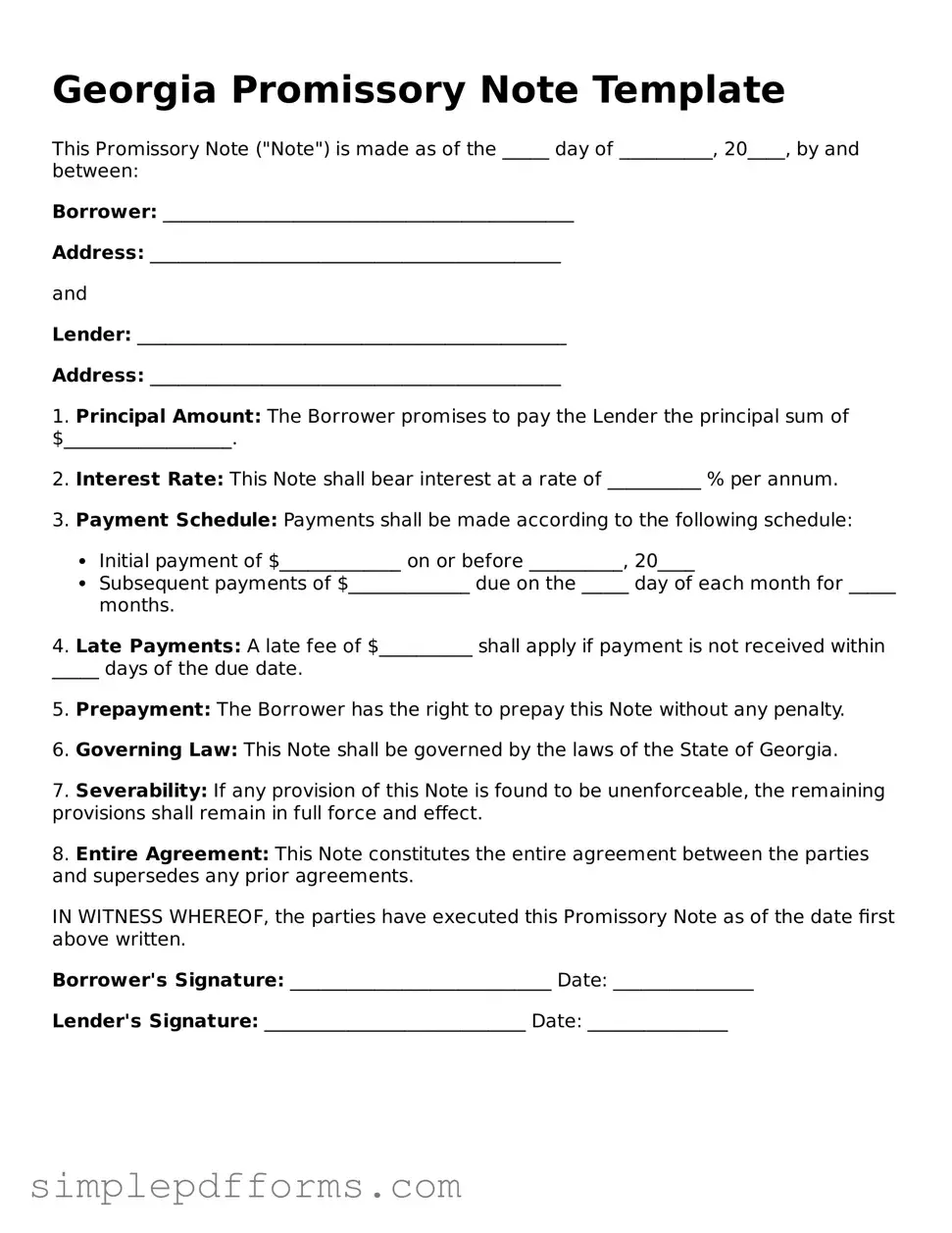

A Georgia Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for establishing clear financial obligations between parties. Understanding its components is essential for both borrowers and lenders to ensure compliance and protect their interests.

Open Promissory Note Editor Now

Attorney-Verified Promissory Note Document for Georgia State

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

Get Promissory Note PDF Form

Your form is waiting for completion

Complete Promissory Note online in minutes with ease.