Attorney-Verified Loan Agreement Document for Georgia State

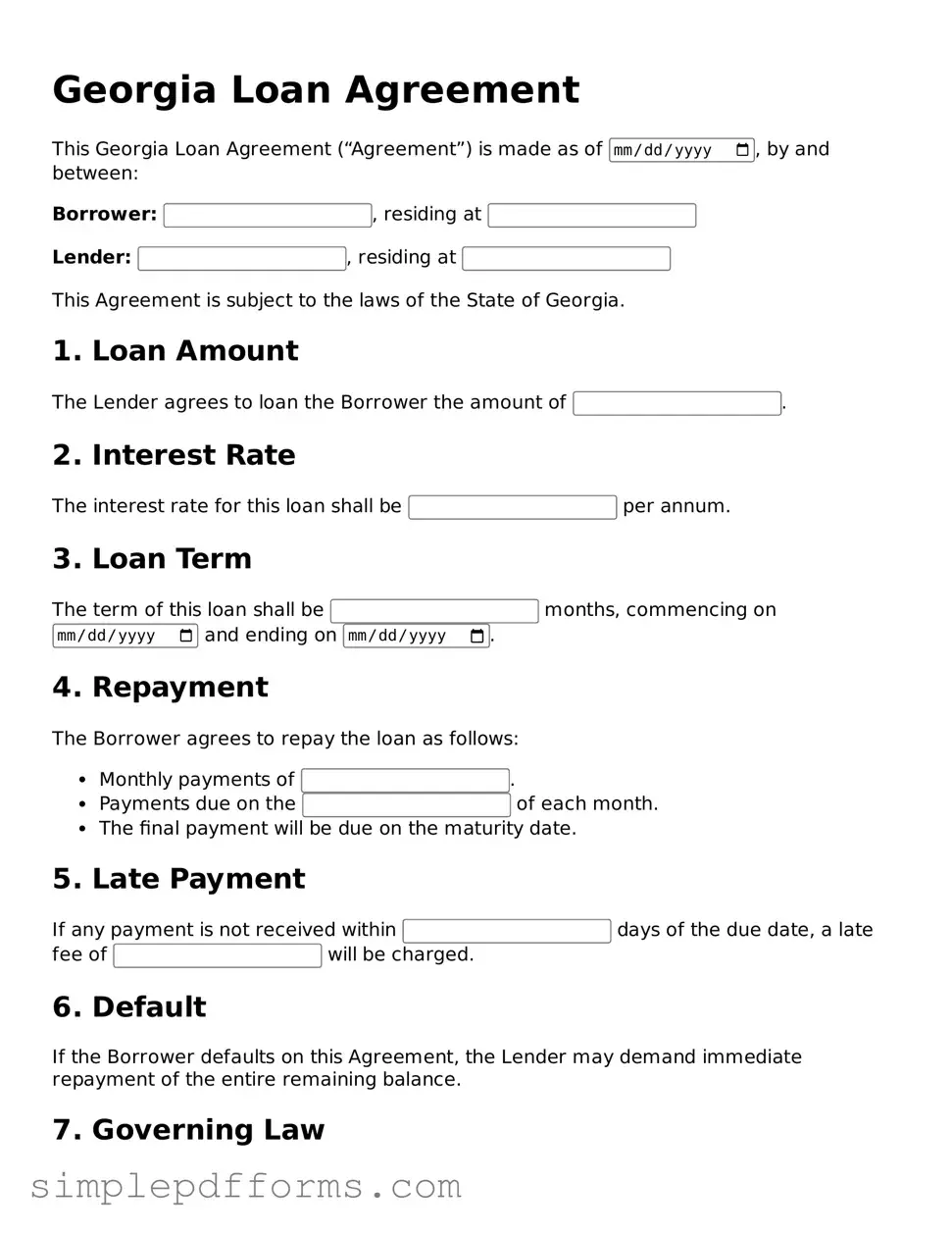

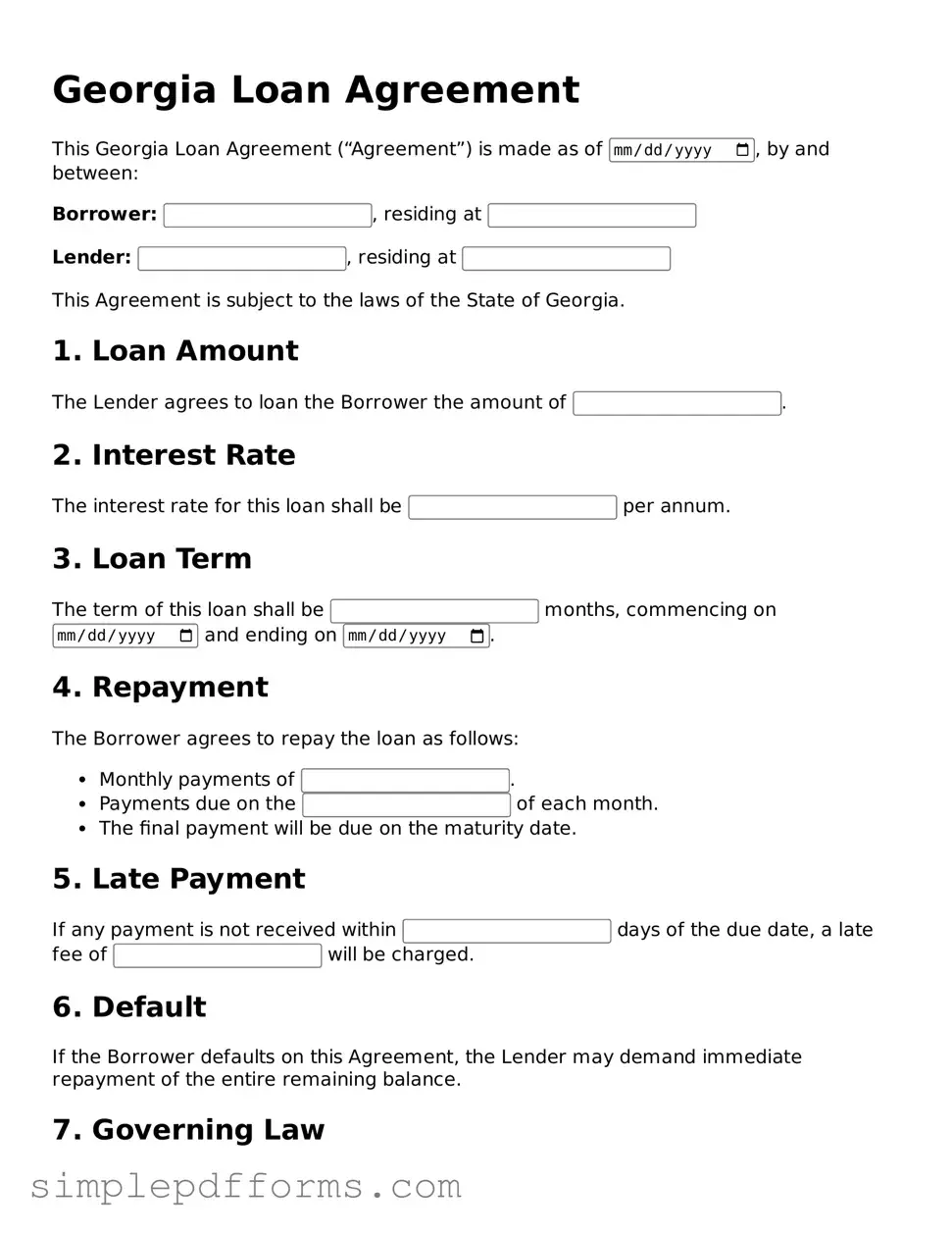

The Georgia Loan Agreement form is a legal document that outlines the terms and conditions under which a lender provides funds to a borrower. This form serves as a binding contract, ensuring both parties understand their rights and responsibilities. Clarity in this agreement helps prevent disputes and fosters a transparent lending process.

Open Loan Agreement Editor Now

Attorney-Verified Loan Agreement Document for Georgia State

Open Loan Agreement Editor Now

Open Loan Agreement Editor Now

or

Get Loan Agreement PDF Form

Your form is waiting for completion

Complete Loan Agreement online in minutes with ease.