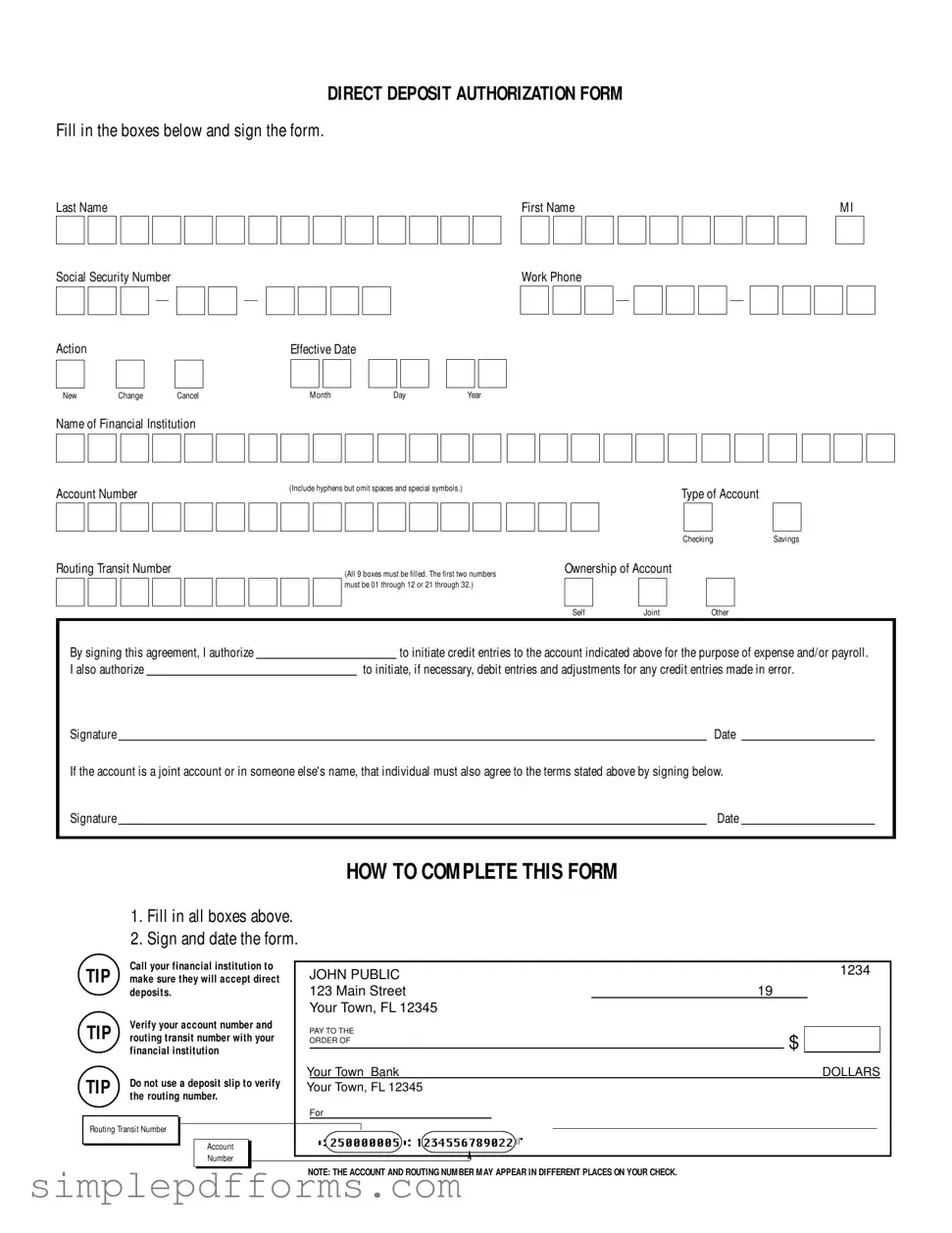

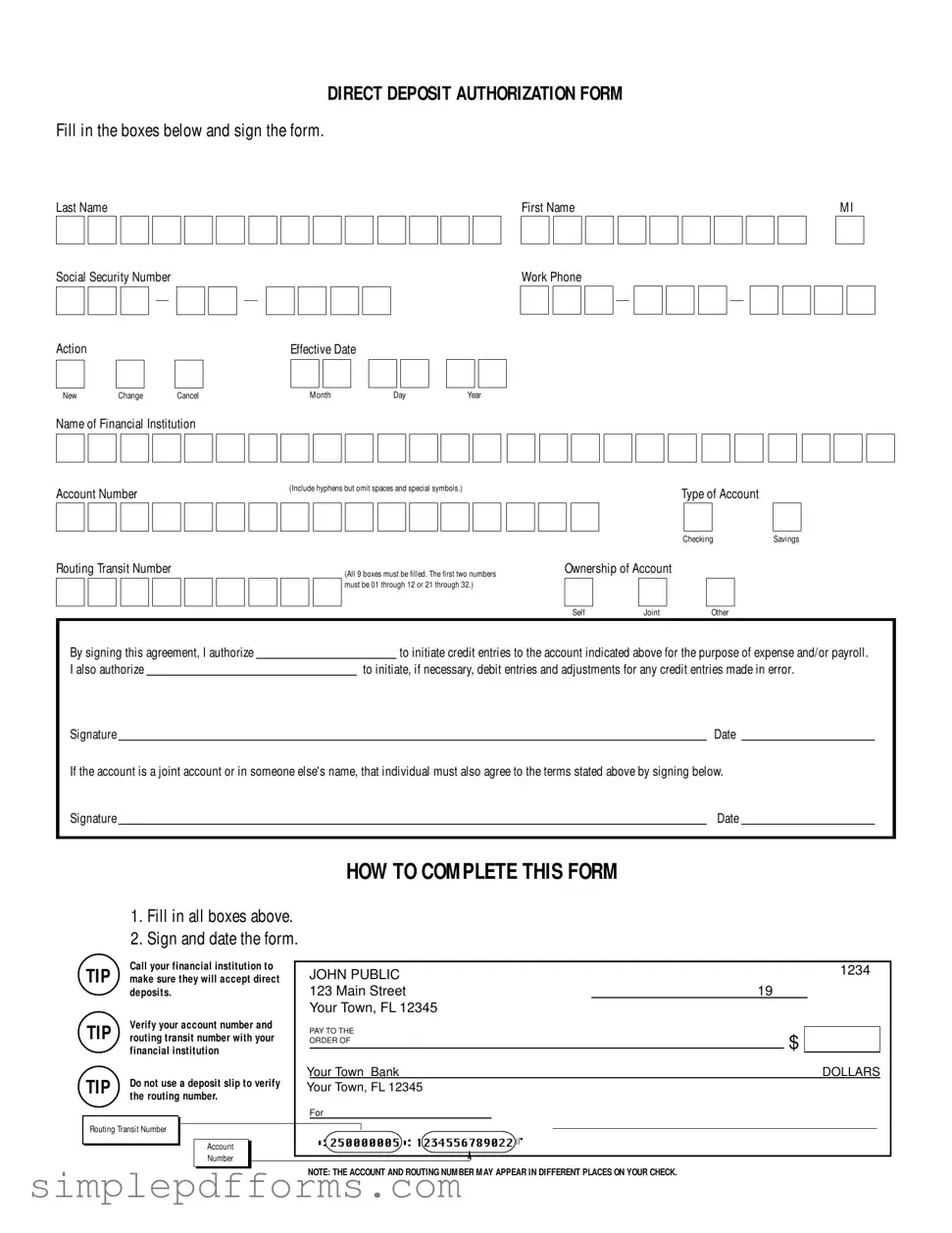

Fill a Valid Generic Direct Deposit Form

The Generic Direct Deposit Authorization Form is a simple document that allows you to set up direct deposit for your paycheck or other payments. By completing this form, you give your employer or payment provider permission to deposit funds directly into your bank account. It’s a convenient way to manage your finances and ensure timely payments.

Open Generic Direct Deposit Editor Now

Fill a Valid Generic Direct Deposit Form

Open Generic Direct Deposit Editor Now

Open Generic Direct Deposit Editor Now

or

Get Generic Direct Deposit PDF Form

Your form is waiting for completion

Complete Generic Direct Deposit online in minutes with ease.

□

□