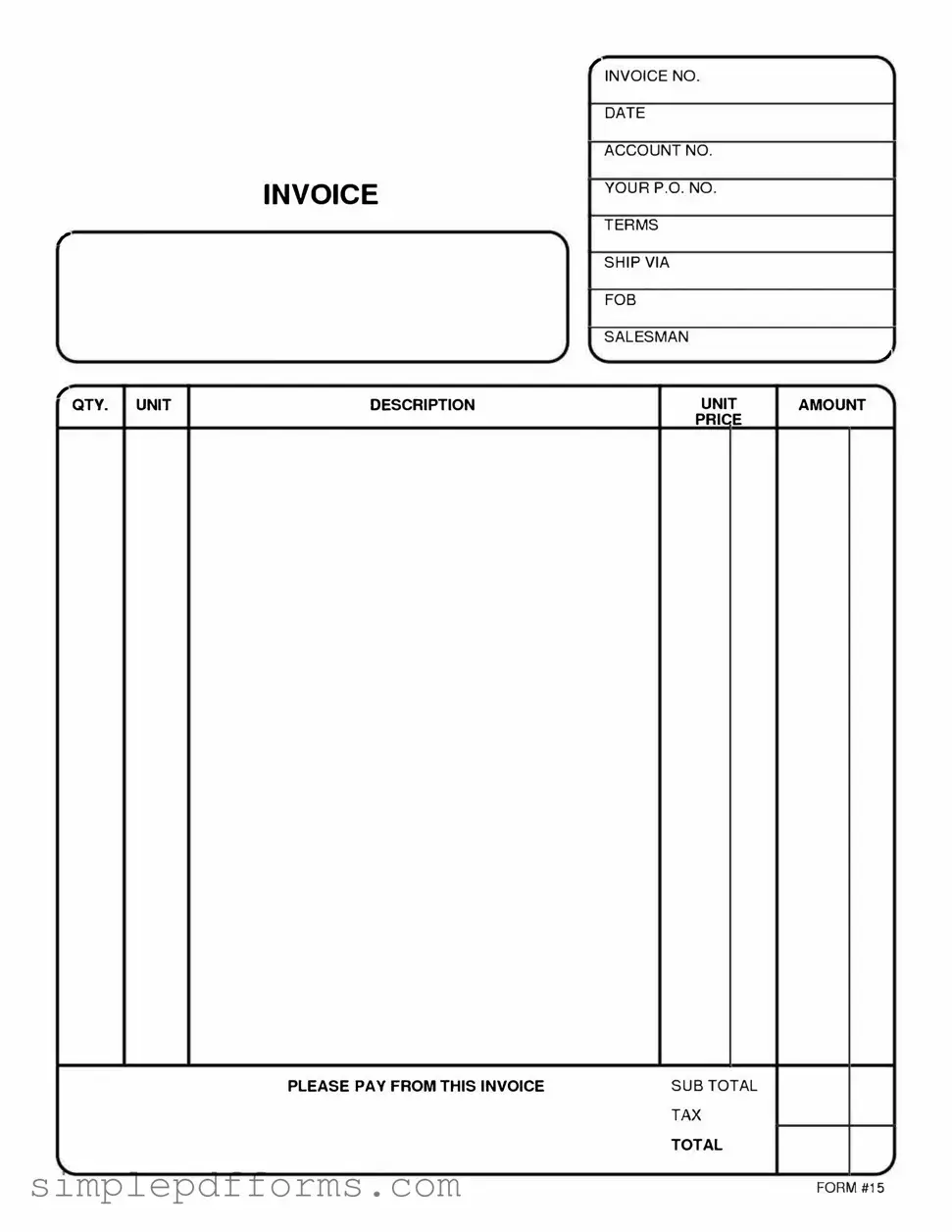

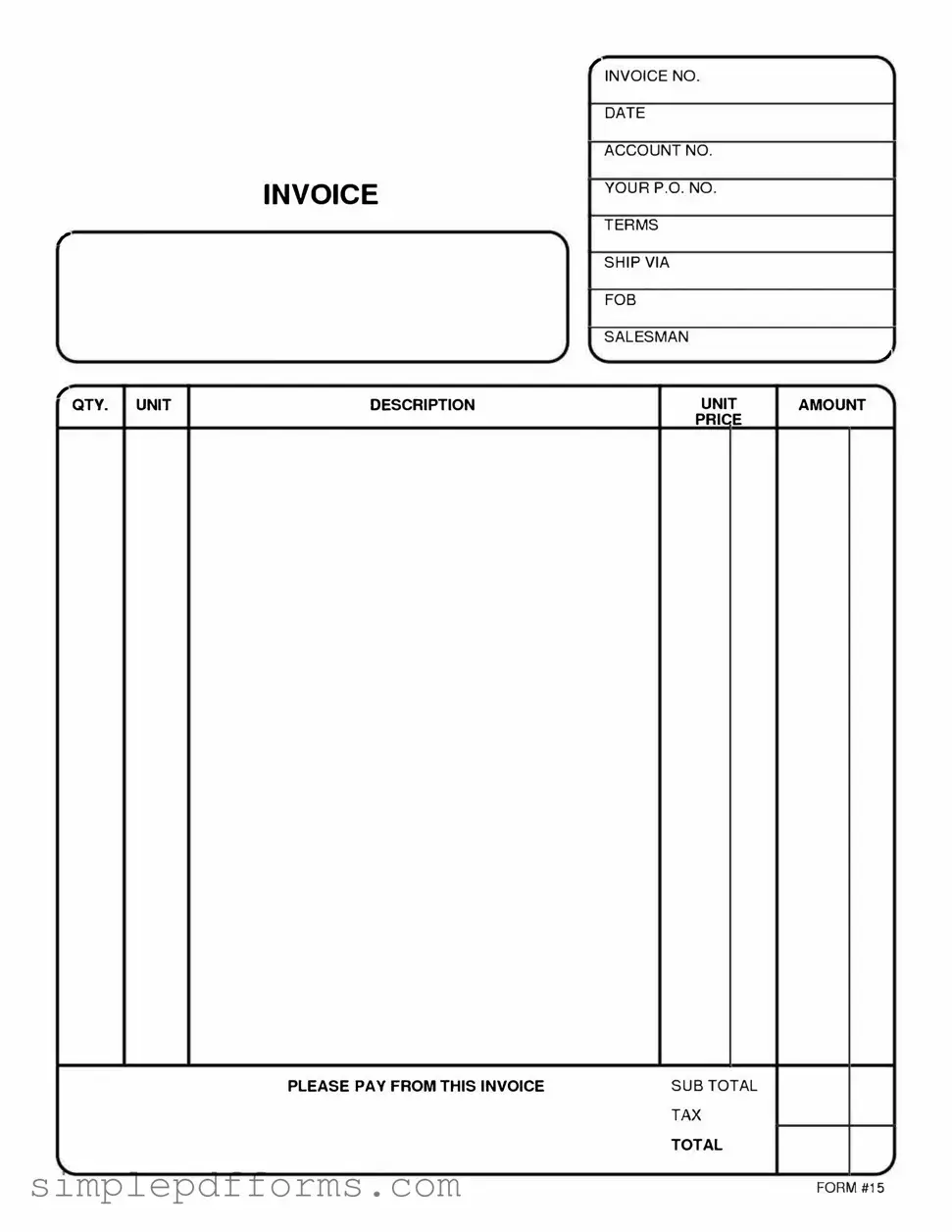

Fill a Valid Free And Invoice Pdf Form

The Free And Invoice PDF form is a versatile document designed to streamline the invoicing process for businesses and freelancers alike. By providing a clear and professional template, it allows users to easily create and send invoices to clients. This form not only saves time but also enhances the overall efficiency of financial transactions.

Open Free And Invoice Pdf Editor Now

Fill a Valid Free And Invoice Pdf Form

Open Free And Invoice Pdf Editor Now

Open Free And Invoice Pdf Editor Now

or

Get Free And Invoice Pdf PDF Form

Your form is waiting for completion

Complete Free And Invoice Pdf online in minutes with ease.