Attorney-Verified Prenuptial Agreement Document for Florida State

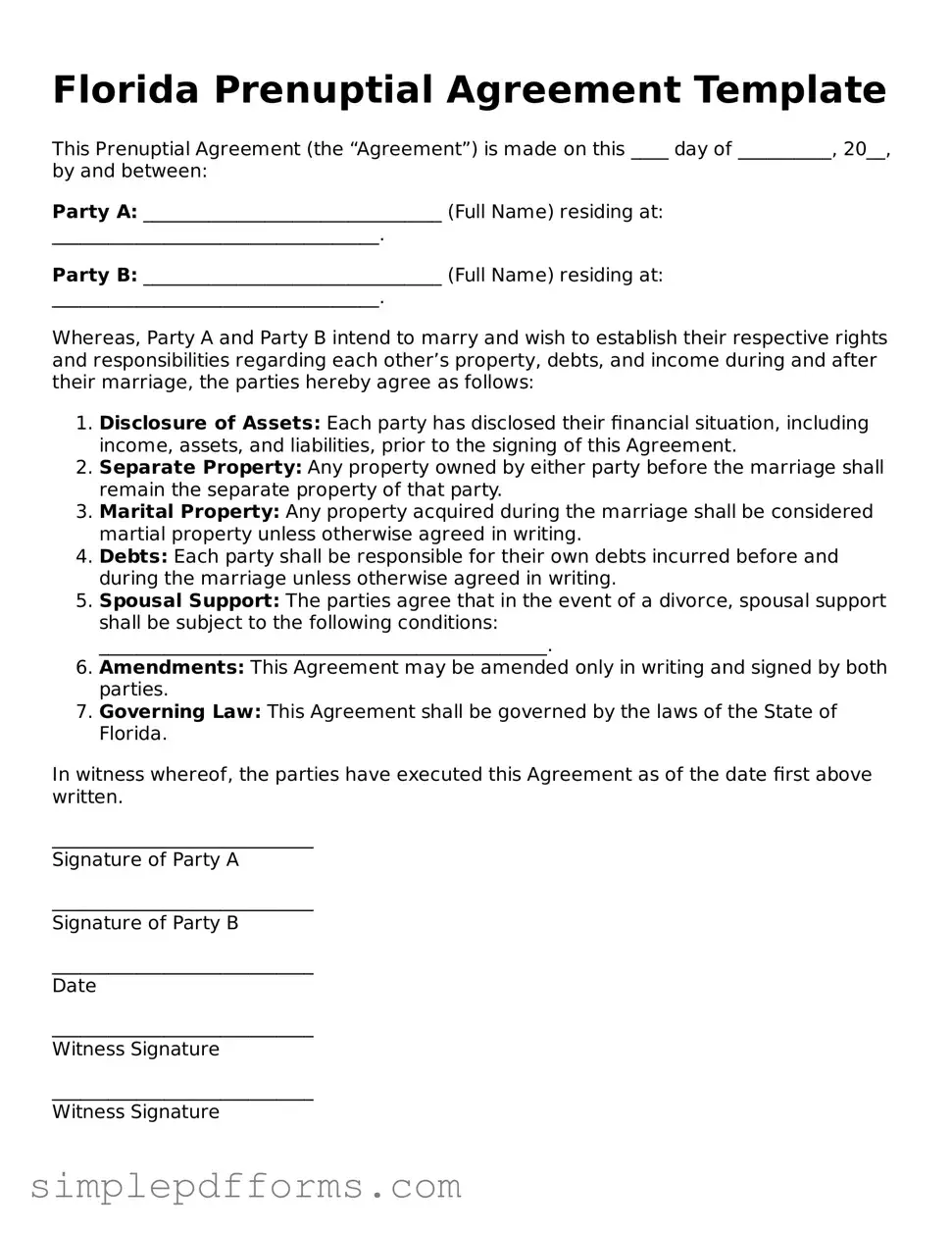

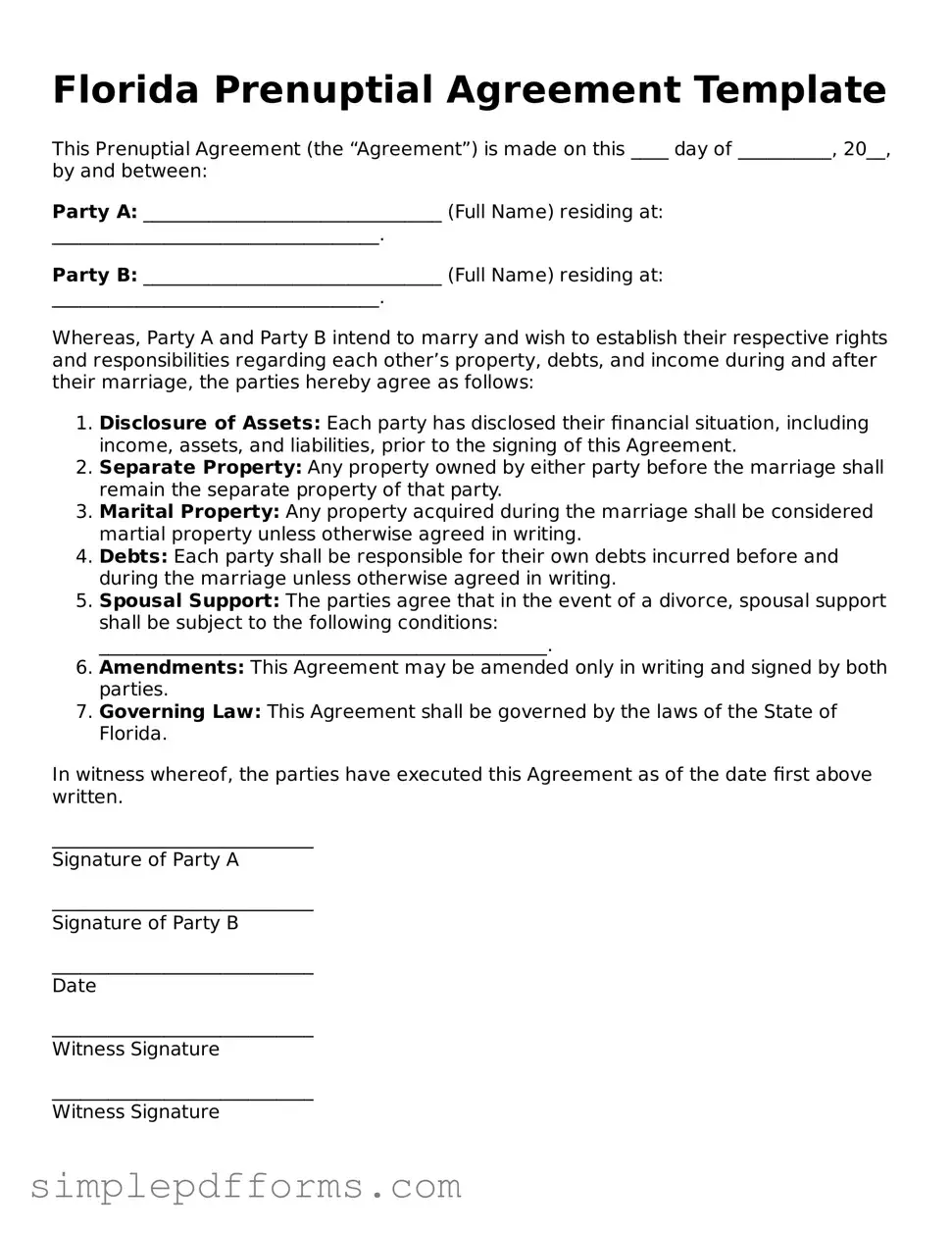

A Florida Prenuptial Agreement form is a legal document that couples use to outline the division of assets and responsibilities in the event of a divorce or separation. This agreement helps protect individual interests and can provide clarity and peace of mind before tying the knot. Understanding this form is essential for anyone considering marriage in Florida.

Open Prenuptial Agreement Editor Now

Attorney-Verified Prenuptial Agreement Document for Florida State

Open Prenuptial Agreement Editor Now

Open Prenuptial Agreement Editor Now

or

Get Prenuptial Agreement PDF Form

Your form is waiting for completion

Complete Prenuptial Agreement online in minutes with ease.