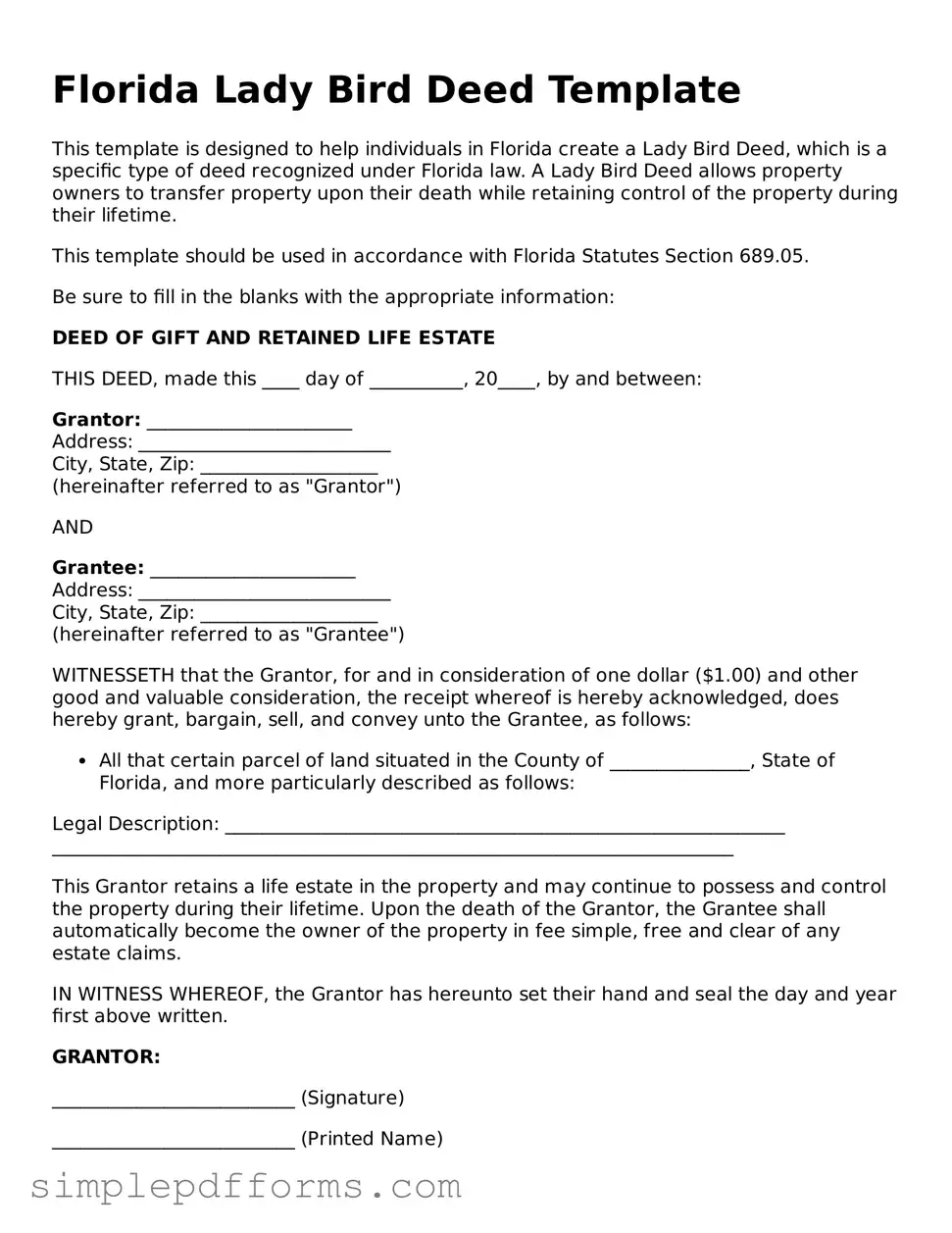

Attorney-Verified Lady Bird Deed Document for Florida State

The Florida Lady Bird Deed form is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining the right to live on and use the property during their lifetime. This deed not only simplifies the transfer process but also helps avoid probate, ensuring a smoother transition for loved ones. Understanding how to effectively utilize this form can empower you to make informed decisions about your property and legacy.

Open Lady Bird Deed Editor Now

Attorney-Verified Lady Bird Deed Document for Florida State

Open Lady Bird Deed Editor Now

Open Lady Bird Deed Editor Now

or

Get Lady Bird Deed PDF Form

Your form is waiting for completion

Complete Lady Bird Deed online in minutes with ease.