Attorney-Verified Durable Power of Attorney Document for Florida State

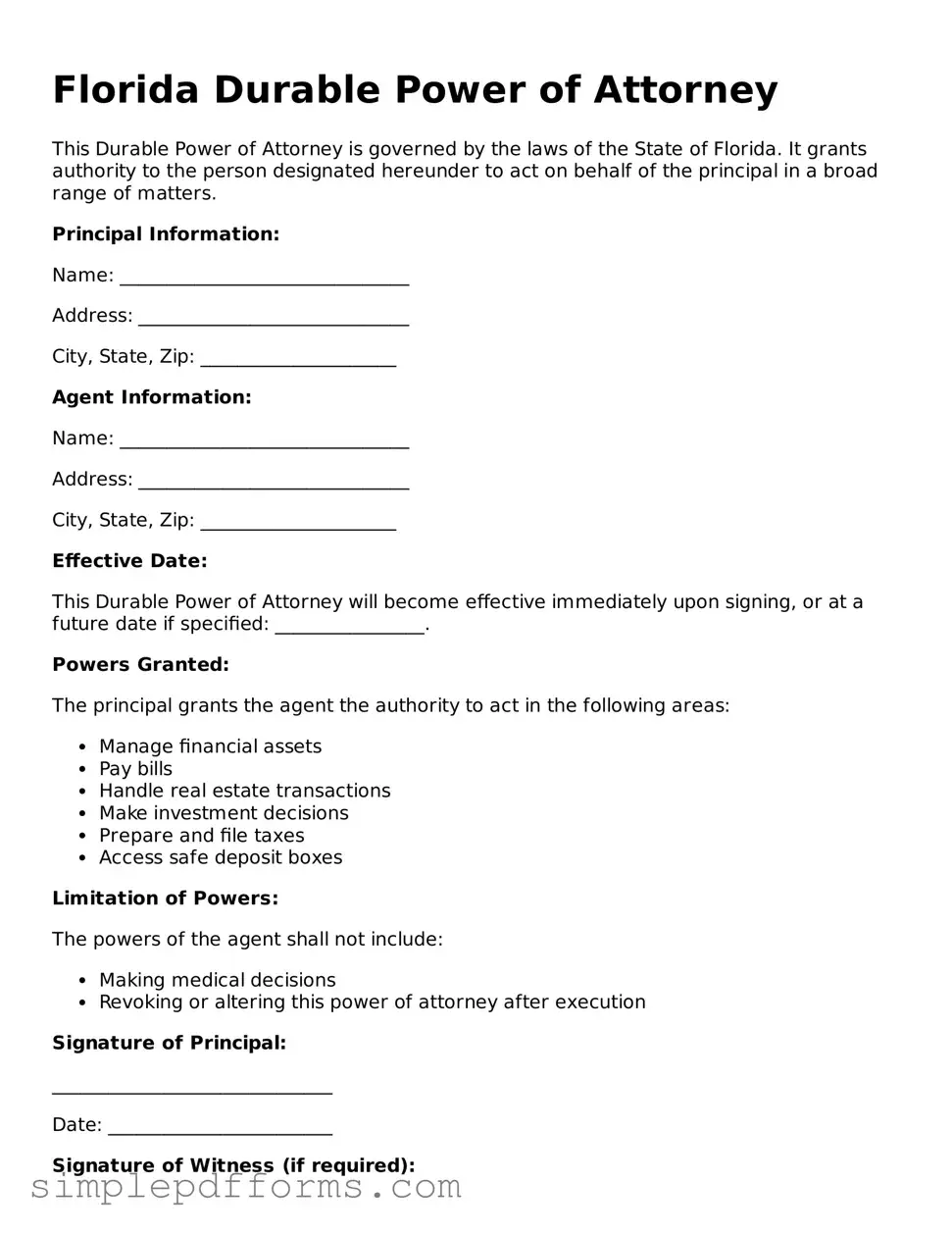

A Florida Durable Power of Attorney form is a legal document that allows an individual to appoint someone else to manage their financial and legal affairs when they are unable to do so themselves. This form remains effective even if the person who created it becomes incapacitated. Understanding how to properly complete and use this form is essential for ensuring that your wishes are honored in times of need.

Open Durable Power of Attorney Editor Now

Attorney-Verified Durable Power of Attorney Document for Florida State

Open Durable Power of Attorney Editor Now

Open Durable Power of Attorney Editor Now

or

Get Durable Power of Attorney PDF Form

Your form is waiting for completion

Complete Durable Power of Attorney online in minutes with ease.