Attorney-Verified Deed Document for Florida State

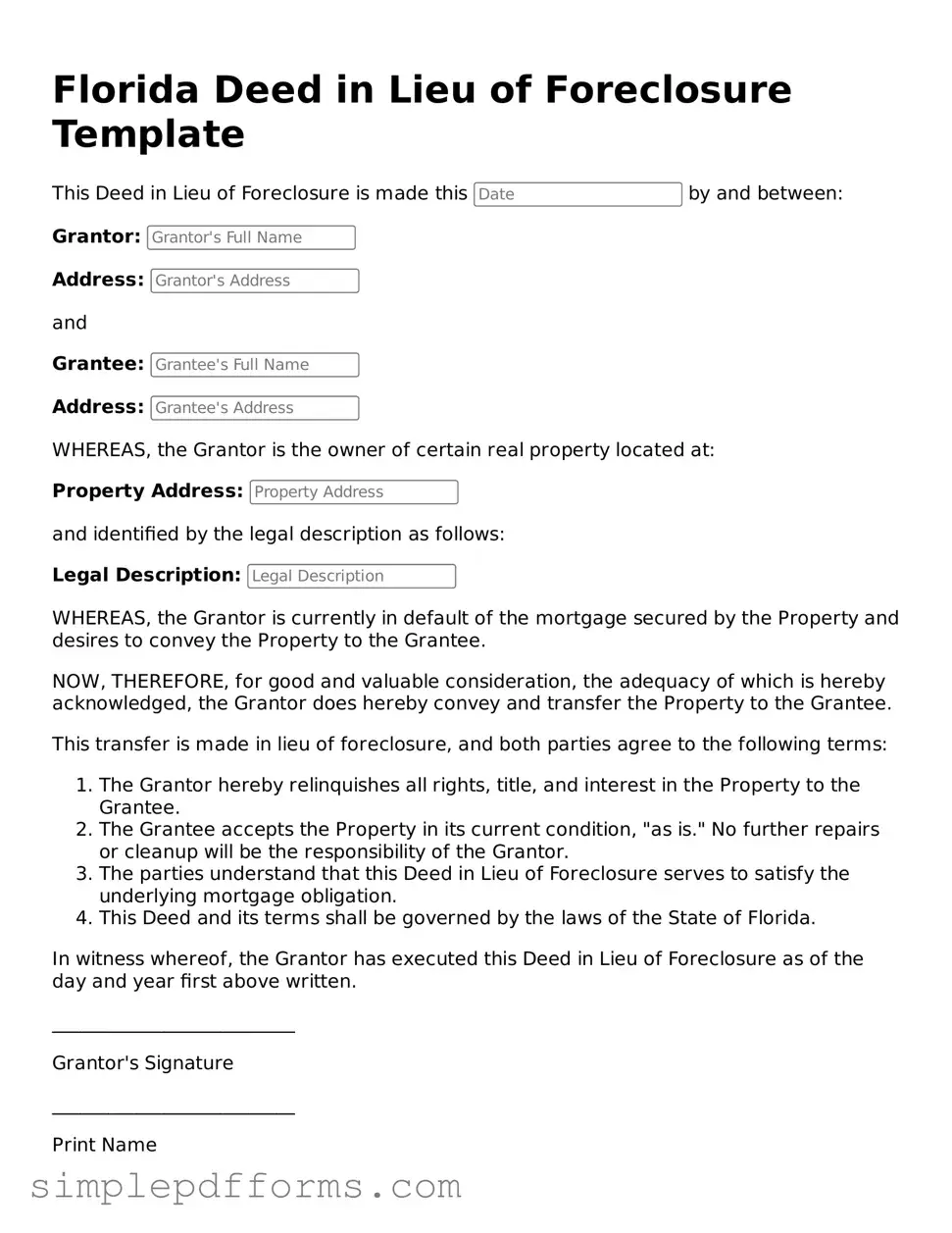

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Florida. This essential form outlines the details of the transaction, including the names of the parties involved and a description of the property. Understanding how to properly complete and file this document is crucial for ensuring a smooth transfer of property rights.

Open Deed Editor Now

Attorney-Verified Deed Document for Florida State

Open Deed Editor Now

Open Deed Editor Now

or

Get Deed PDF Form

Your form is waiting for completion

Complete Deed online in minutes with ease.