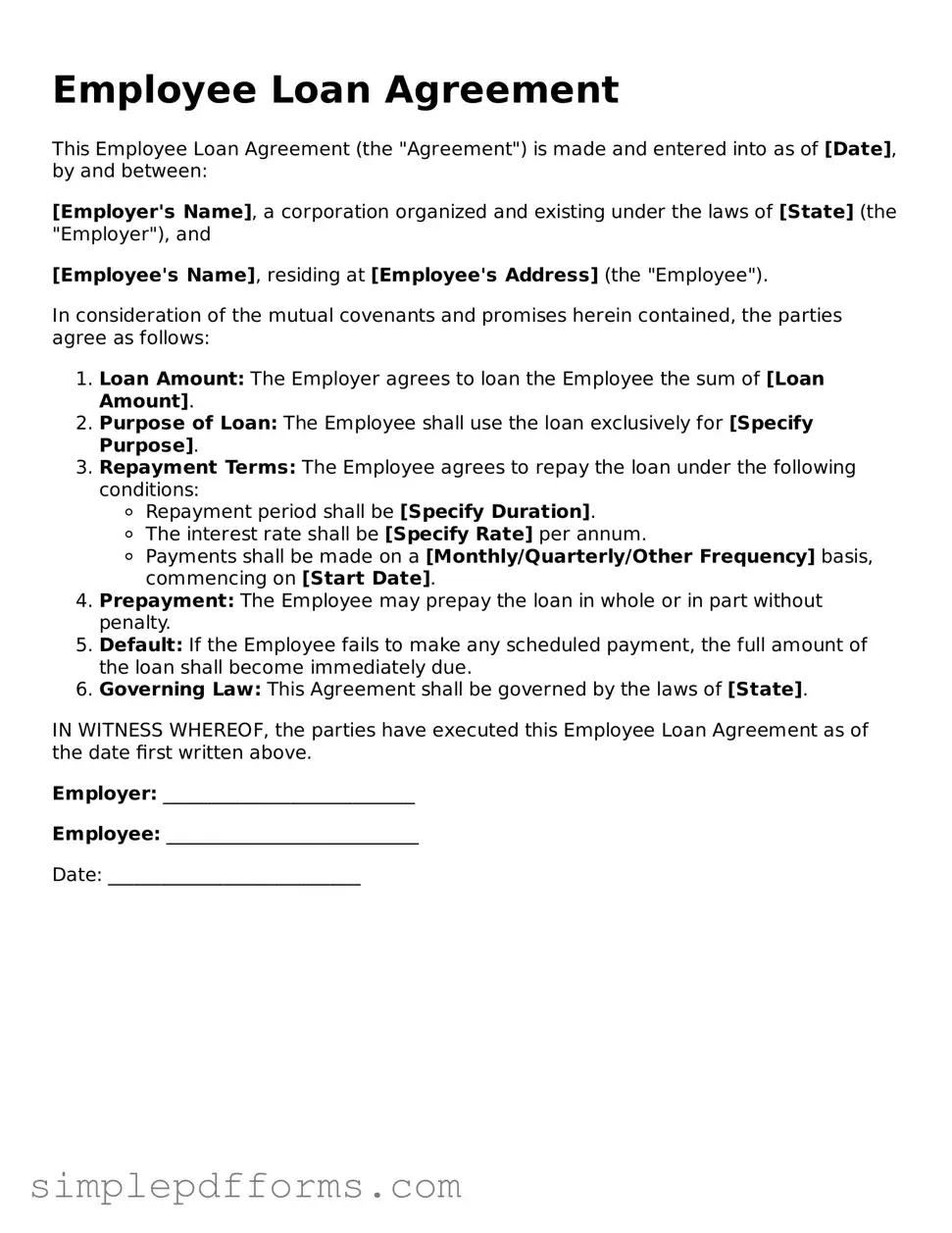

Filling out an Employee Loan Agreement form is a critical step for both employees and employers. However, mistakes can easily occur during this process. Understanding common pitfalls can help ensure that the agreement is completed accurately and effectively.

One frequent mistake is failing to provide accurate personal information. Employees may overlook details such as their full legal name, address, or social security number. This information is essential for identification and record-keeping purposes. Missing or incorrect details can lead to complications down the line.

Another common error is not specifying the loan amount clearly. Employees sometimes write ambiguous figures or forget to include decimals. A precise loan amount is crucial for both parties to understand the financial obligation involved. Miscommunication about the amount can lead to disputes later.

Many individuals also neglect to outline the repayment terms. This includes the interest rate, payment schedule, and duration of the loan. Without clear terms, misunderstandings may arise regarding when payments are due and how much is owed. Clarity in this area protects both the employee and employer.

Some employees fail to read the entire agreement before signing. This oversight can lead to unintentional acceptance of terms that may not be favorable. Taking the time to review the document ensures that all parties are aware of their rights and responsibilities.

In addition, individuals often forget to include signatures where required. Both the employee and employer must sign the agreement for it to be legally binding. Missing signatures can render the document invalid, leading to potential issues with enforcement.

Another mistake involves not keeping a copy of the signed agreement. Employees may assume that the employer will retain a copy, but having one for personal records is essential. This ensures that both parties can refer back to the terms of the loan if necessary.

People sometimes misinterpret the implications of defaulting on the loan. It is vital to understand what happens if payments are missed. Clarity about consequences can help employees make informed decisions about their financial commitments.

Lastly, some individuals overlook the importance of discussing the loan with their employer before filling out the form. Open communication can clarify expectations and help address any concerns. A collaborative approach fosters a better understanding of the agreement.

By being aware of these common mistakes, employees can fill out the Employee Loan Agreement form with greater confidence. Taking care to avoid these pitfalls helps ensure a smooth and transparent process for both parties involved.