Fill a Valid Employee Advance Form

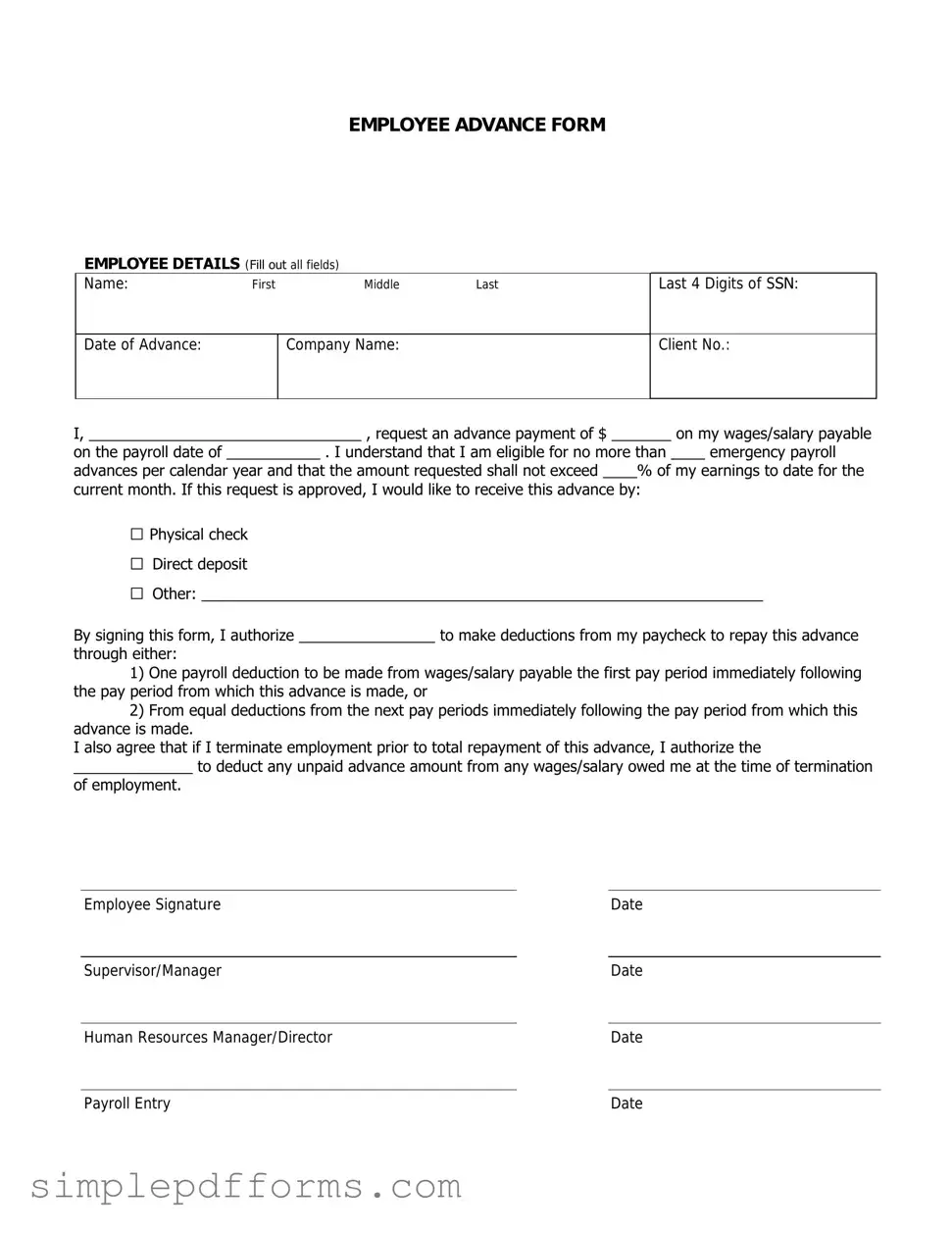

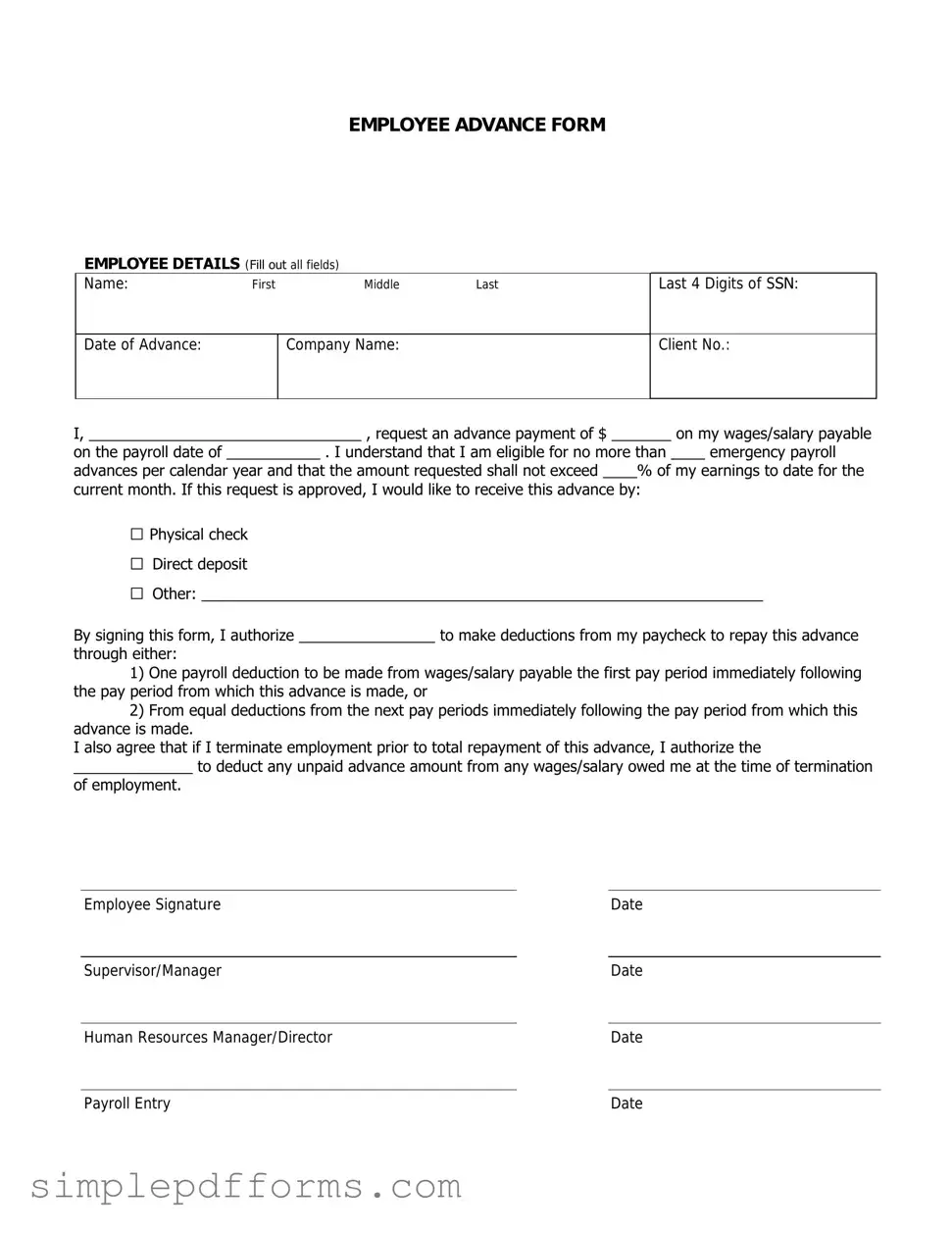

The Employee Advance form is a document used by employers to request funds for employees before their regular pay period. This form helps streamline the process of providing financial assistance to employees in need. Understanding its purpose and proper usage can benefit both employers and employees alike.

Open Employee Advance Editor Now

Fill a Valid Employee Advance Form

Open Employee Advance Editor Now

Open Employee Advance Editor Now

or

Get Employee Advance PDF Form

Your form is waiting for completion

Complete Employee Advance online in minutes with ease.