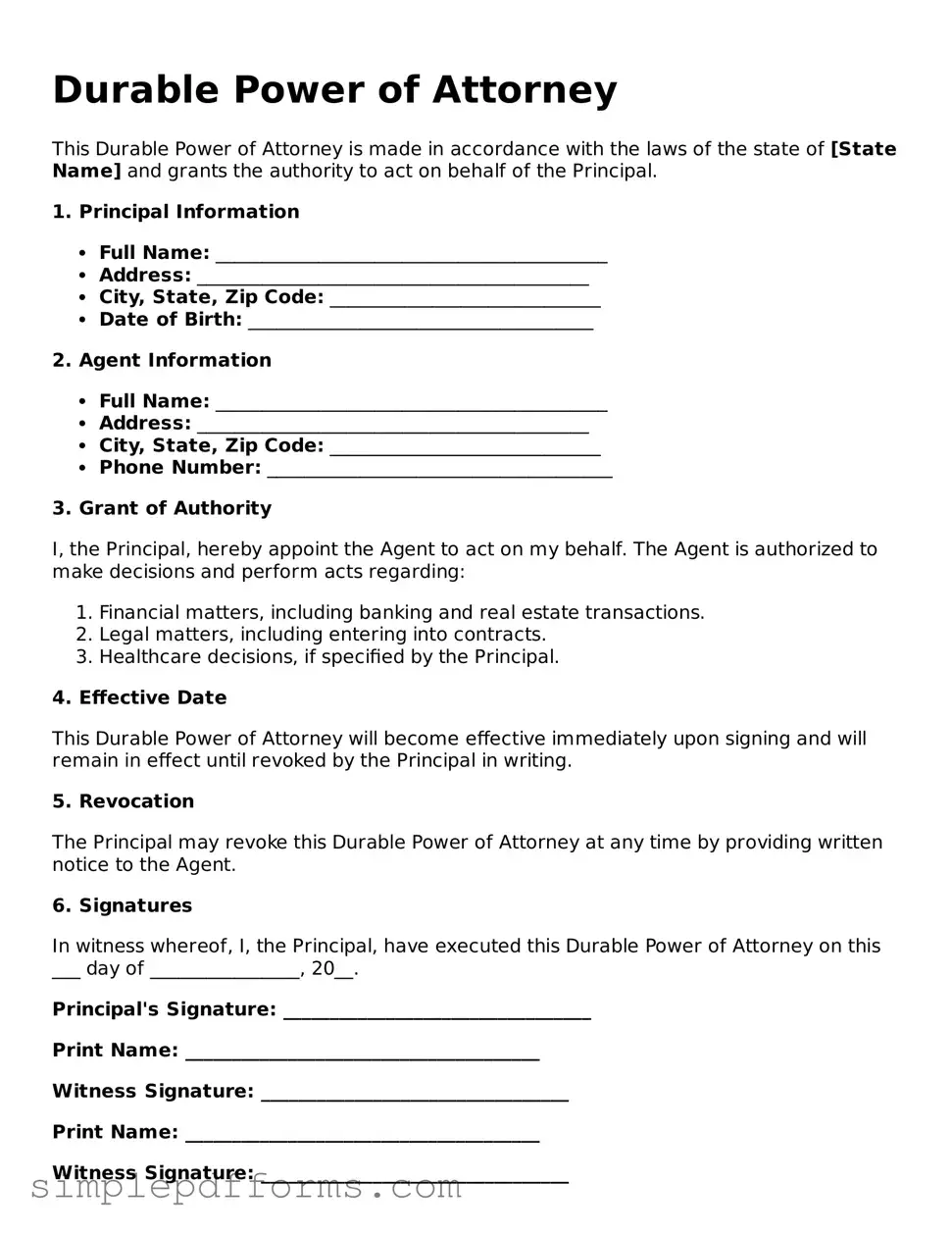

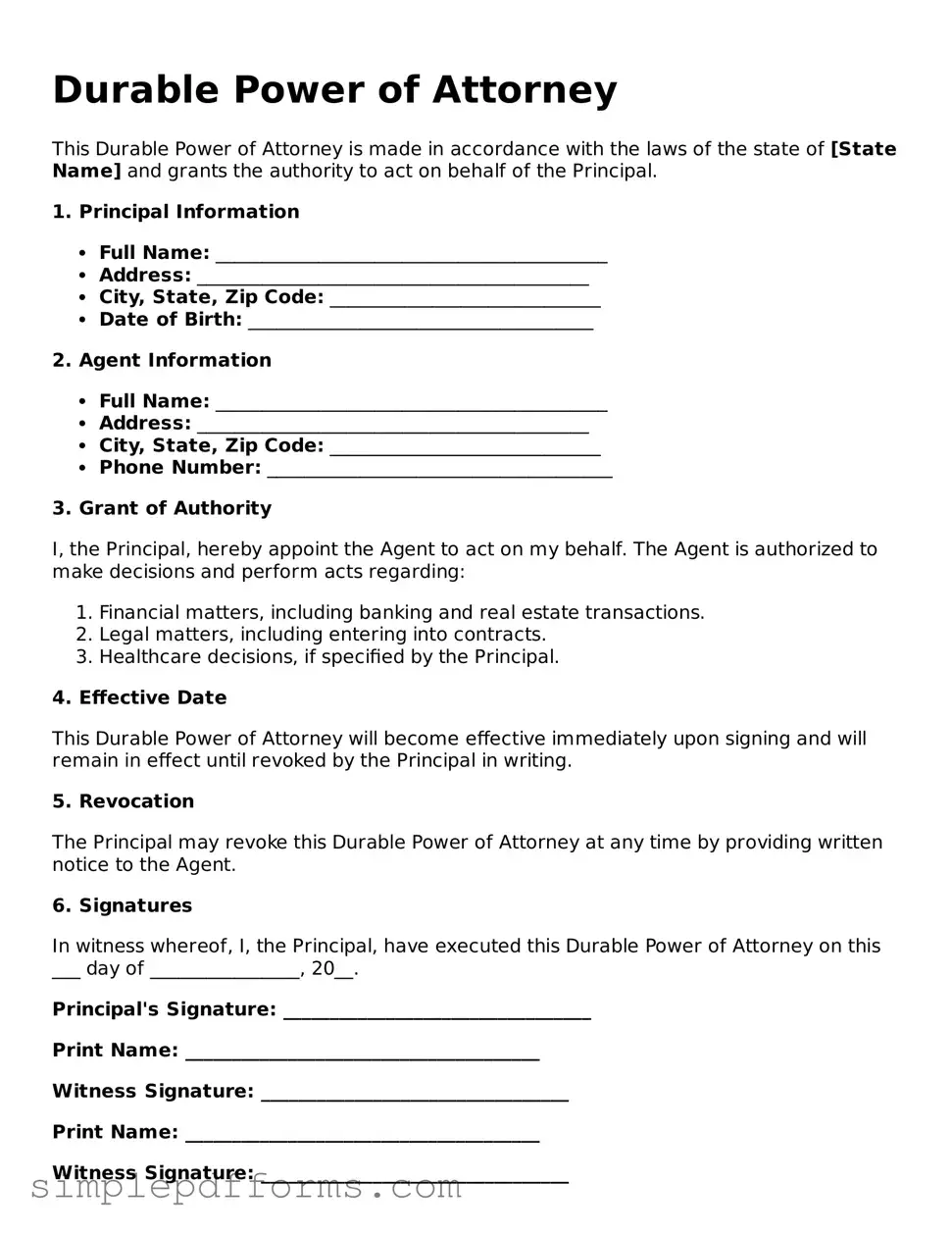

Free Durable Power of Attorney Form

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf if they become incapacitated. This form remains effective even if the principal is unable to make decisions due to illness or injury. Understanding this important tool can help ensure that your wishes are honored during challenging times.

Open Durable Power of Attorney Editor Now

Free Durable Power of Attorney Form

Open Durable Power of Attorney Editor Now

Open Durable Power of Attorney Editor Now

or

Get Durable Power of Attorney PDF Form

Your form is waiting for completion

Complete Durable Power of Attorney online in minutes with ease.