Filling out a Deed form is a crucial step in transferring property ownership, but many individuals make common mistakes that can lead to complications down the line. One frequent error is not including all necessary parties in the document. If there are multiple owners or beneficiaries, it’s vital to list everyone involved. Omitting a name can create legal disputes or even invalidate the deed.

Another mistake often seen is incorrect property description. The legal description of the property must be precise and detailed. This includes the lot number, block number, and any relevant landmarks. A vague or inaccurate description can lead to confusion about the property being transferred.

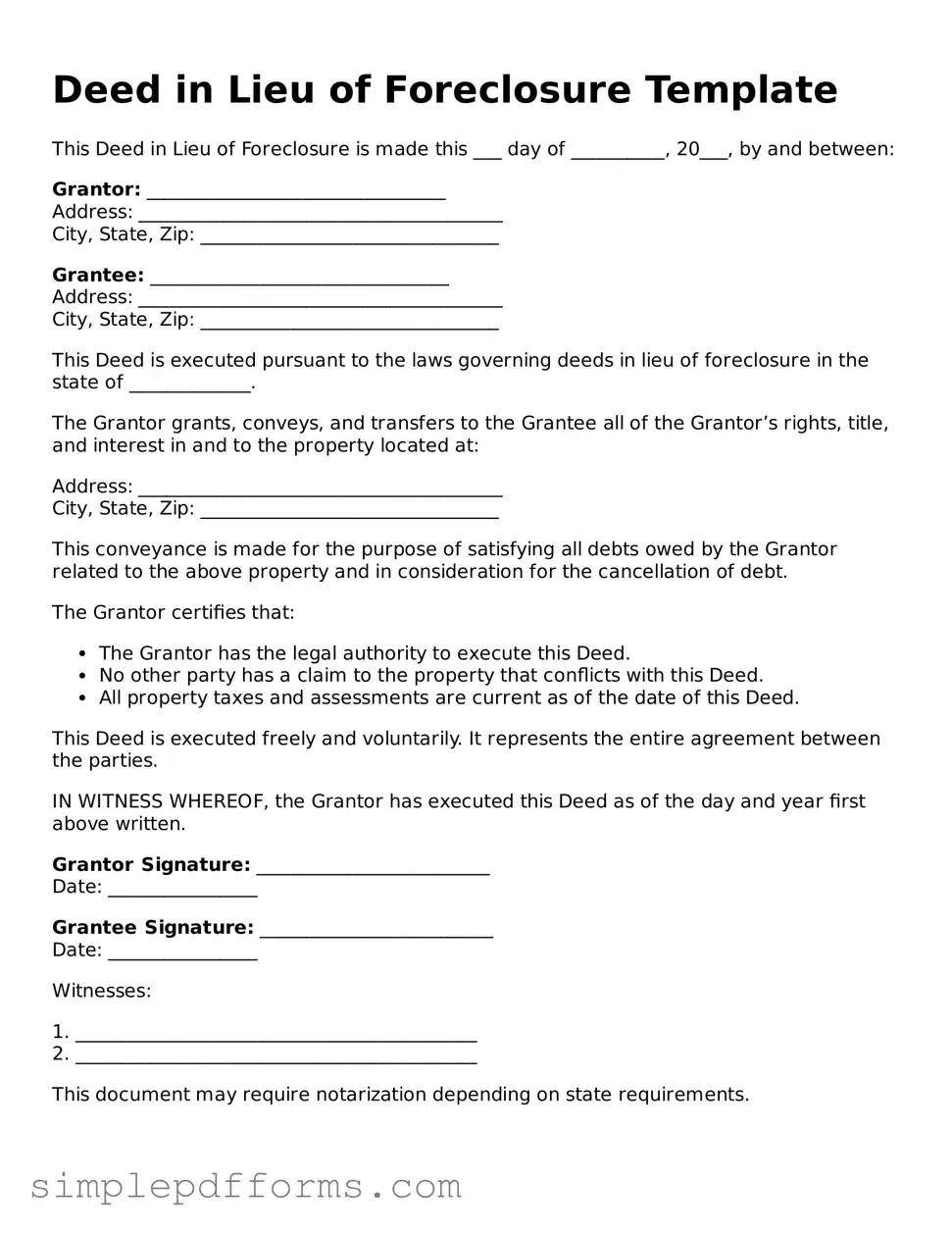

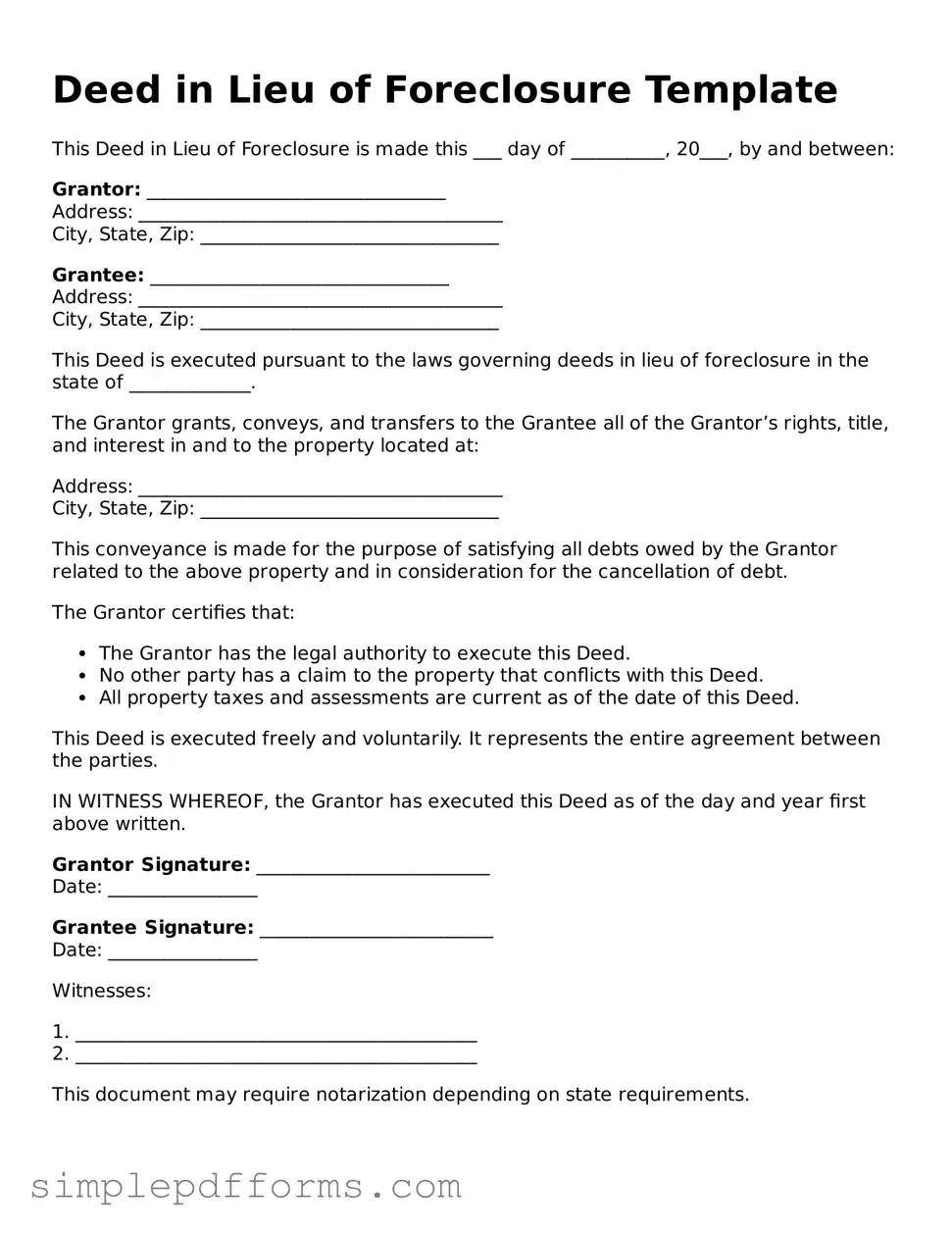

Many people also overlook the importance of signing the deed correctly. All parties involved must sign the document, and it should be done in the presence of a notary public. Failing to have the deed notarized can render it unenforceable, meaning the transfer of ownership may not be legally recognized.

Additionally, some individuals forget to date the deed. A missing date can lead to questions about when the transfer took place, which can be crucial for tax purposes and establishing a timeline of ownership. Always ensure that the date is clearly written on the document.

Another common oversight is not checking local requirements. Different states and counties may have specific rules regarding deed forms, including additional information that must be included. Ignoring these local regulations can result in delays or rejections of the deed.

People sometimes fail to consider the implications of the type of deed they are using. For example, a warranty deed offers more protection to the buyer compared to a quitclaim deed. Understanding the differences and selecting the right type is essential for safeguarding interests in the property.

Furthermore, some individuals neglect to make copies of the completed deed. It’s important to keep a record of the signed document for personal files and future reference. Without copies, tracking the ownership history can become problematic.

Another mistake is not informing relevant parties about the transfer. For instance, mortgage lenders, homeowners’ associations, or local tax authorities may need to be notified. Failure to communicate can lead to unexpected fees or issues later on.

Finally, many individuals rush through the process without thoroughly reviewing the completed deed. Taking the time to double-check all information can prevent costly mistakes. A careful review ensures that everything is accurate and complete, paving the way for a smooth property transfer.