Fill a Valid Cg 20 10 07 04 Liability Endorsement Form

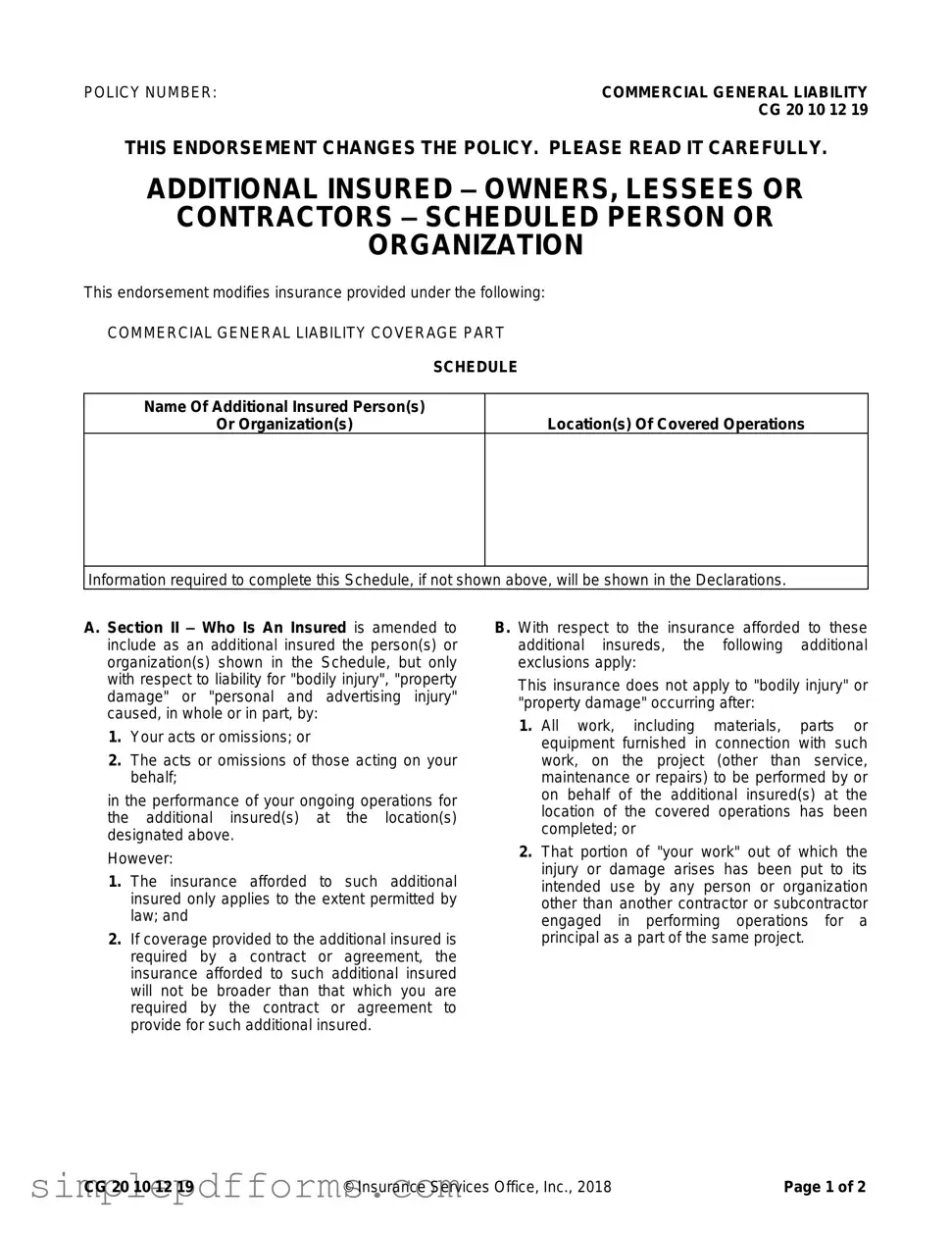

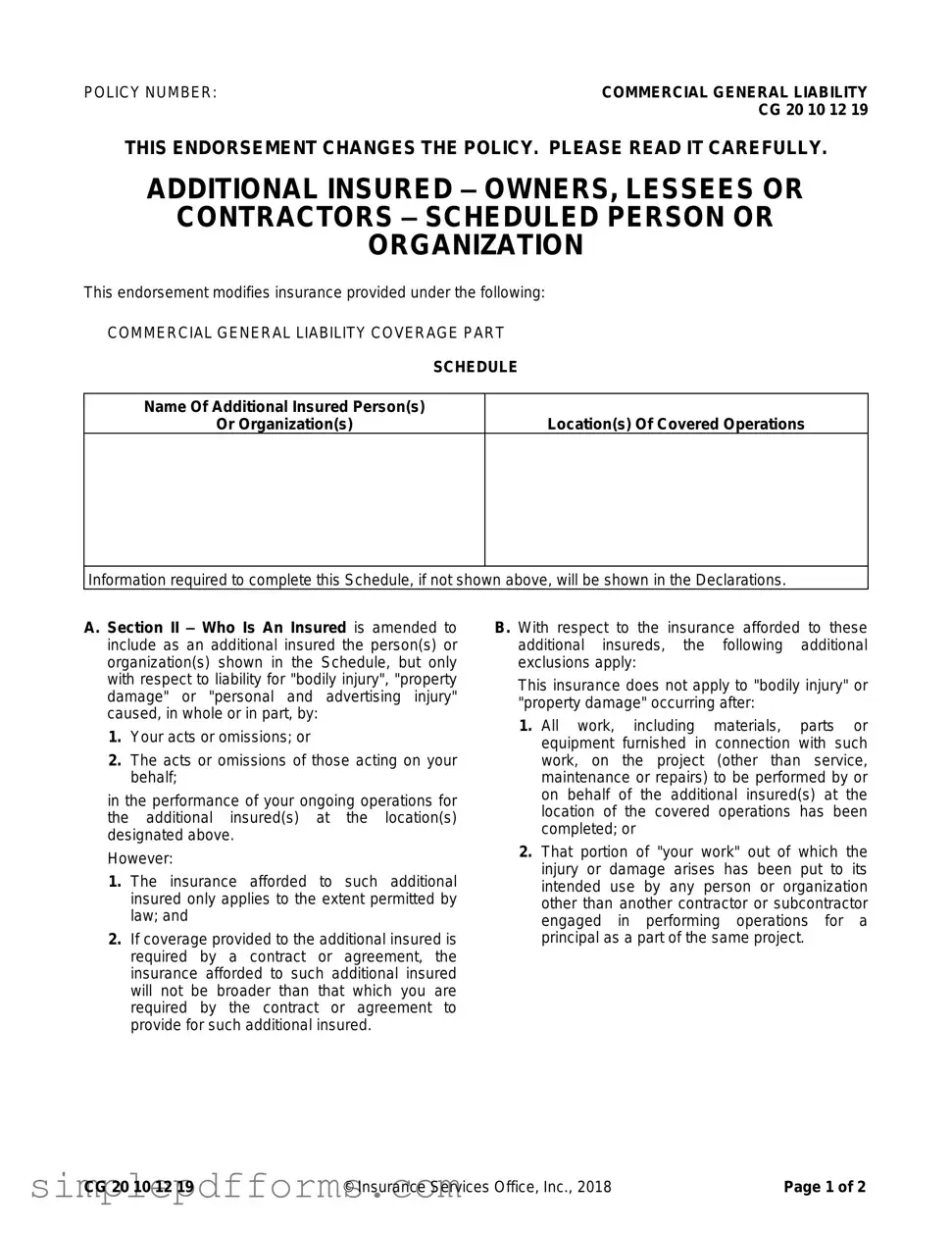

The CG 20 10 07 04 Liability Endorsement form is a document that modifies a Commercial General Liability policy to include additional insured parties. This endorsement ensures that specific individuals or organizations are protected against liability for bodily injury, property damage, or personal and advertising injury linked to your operations. Understanding this endorsement is crucial for anyone involved in contracts that require additional insured coverage.

Open Cg 20 10 07 04 Liability Endorsement Editor Now

Fill a Valid Cg 20 10 07 04 Liability Endorsement Form

Open Cg 20 10 07 04 Liability Endorsement Editor Now

Open Cg 20 10 07 04 Liability Endorsement Editor Now

or

Get Cg 20 10 07 04 Liability Endorsement PDF Form

Your form is waiting for completion

Complete Cg 20 10 07 04 Liability Endorsement online in minutes with ease.