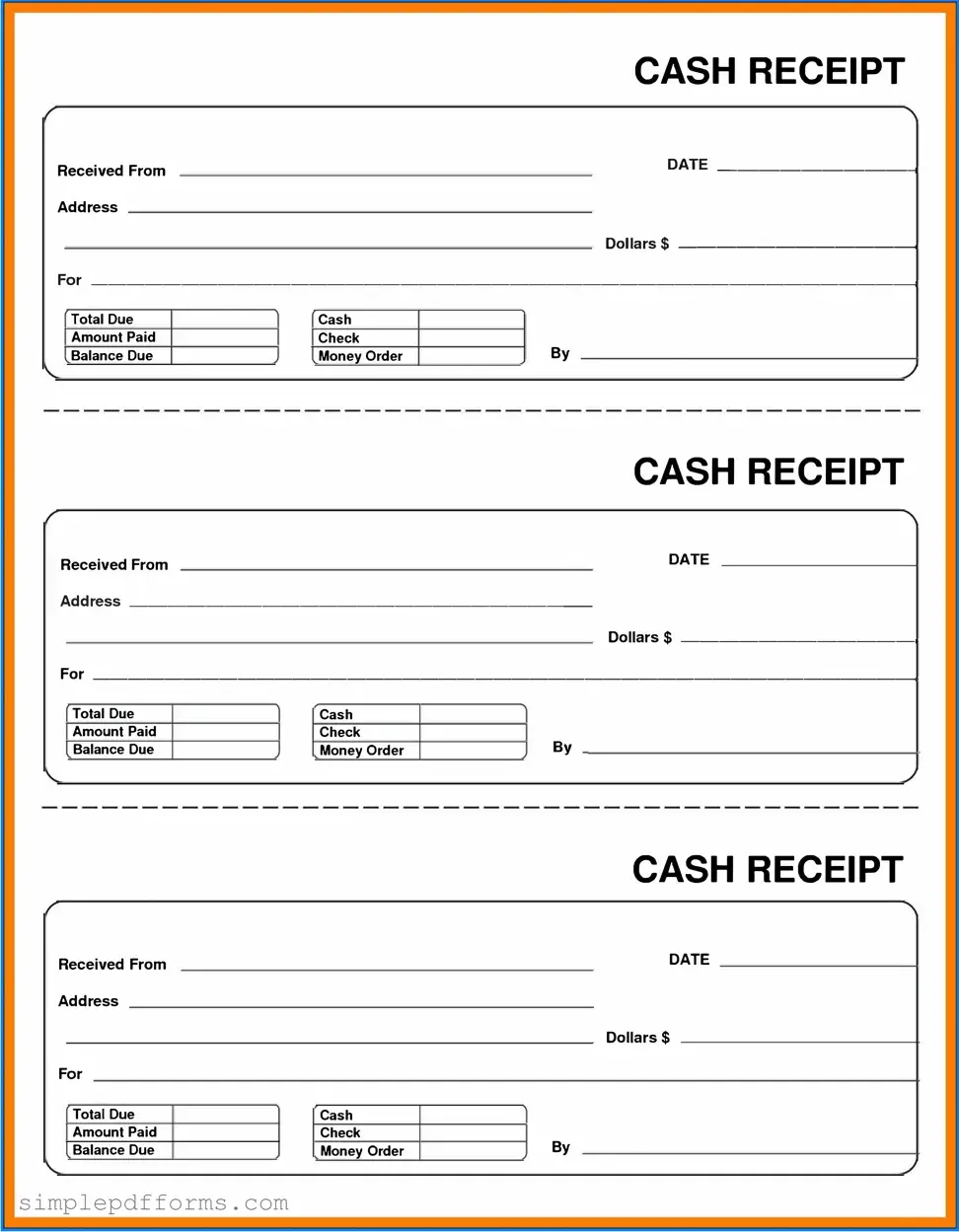

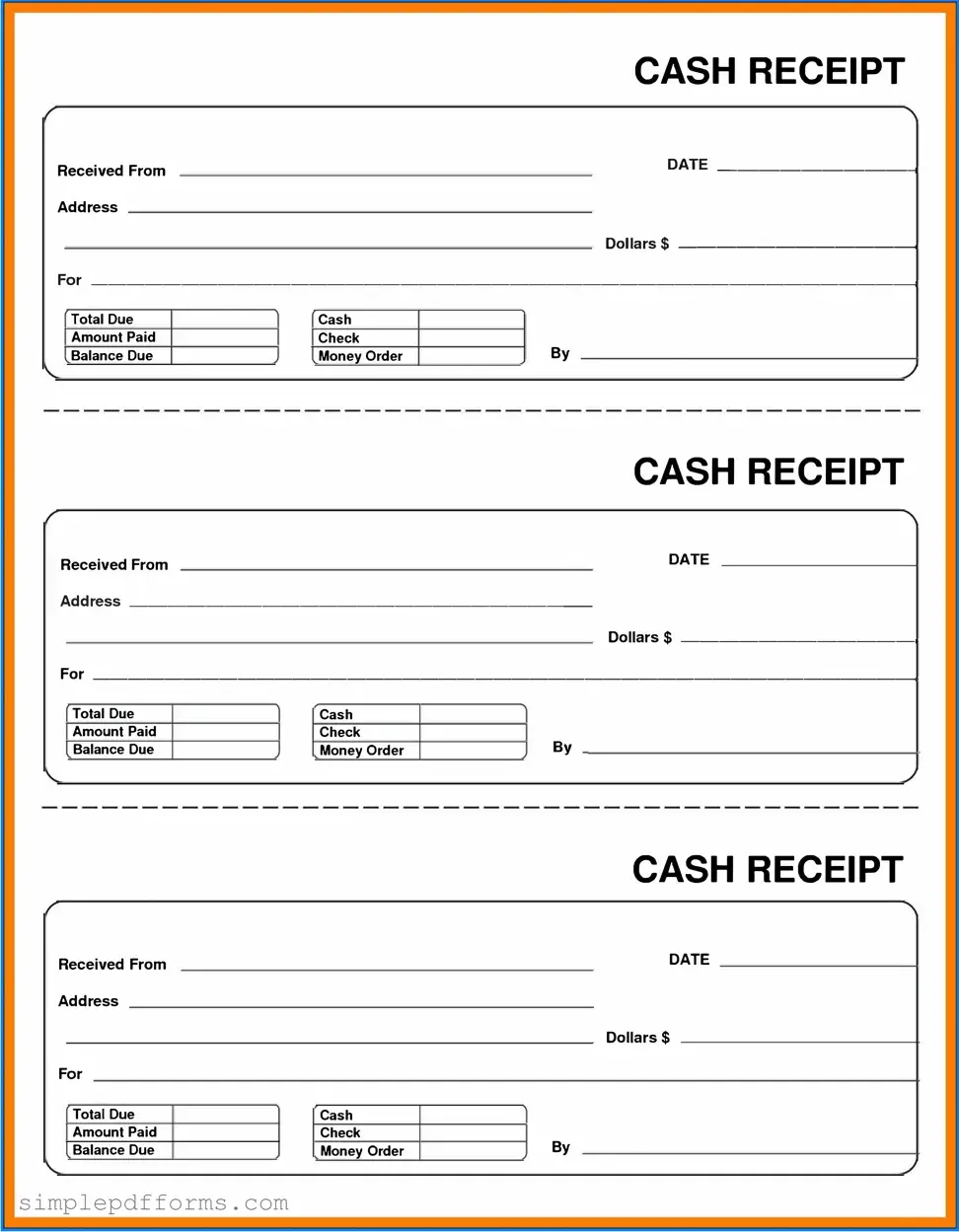

Fill a Valid Cash Receipt Form

The Cash Receipt form is a crucial document used to acknowledge the receipt of cash payments. This form serves as proof of transaction for both the payer and the recipient, ensuring transparency in financial exchanges. By clearly detailing the amount received and the purpose of the payment, it helps maintain accurate financial records.

Open Cash Receipt Editor Now

Fill a Valid Cash Receipt Form

Open Cash Receipt Editor Now

Open Cash Receipt Editor Now

or

Get Cash Receipt PDF Form

Your form is waiting for completion

Complete Cash Receipt online in minutes with ease.