Fill a Valid Cash Drawer Count Sheet Form

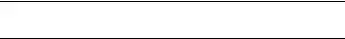

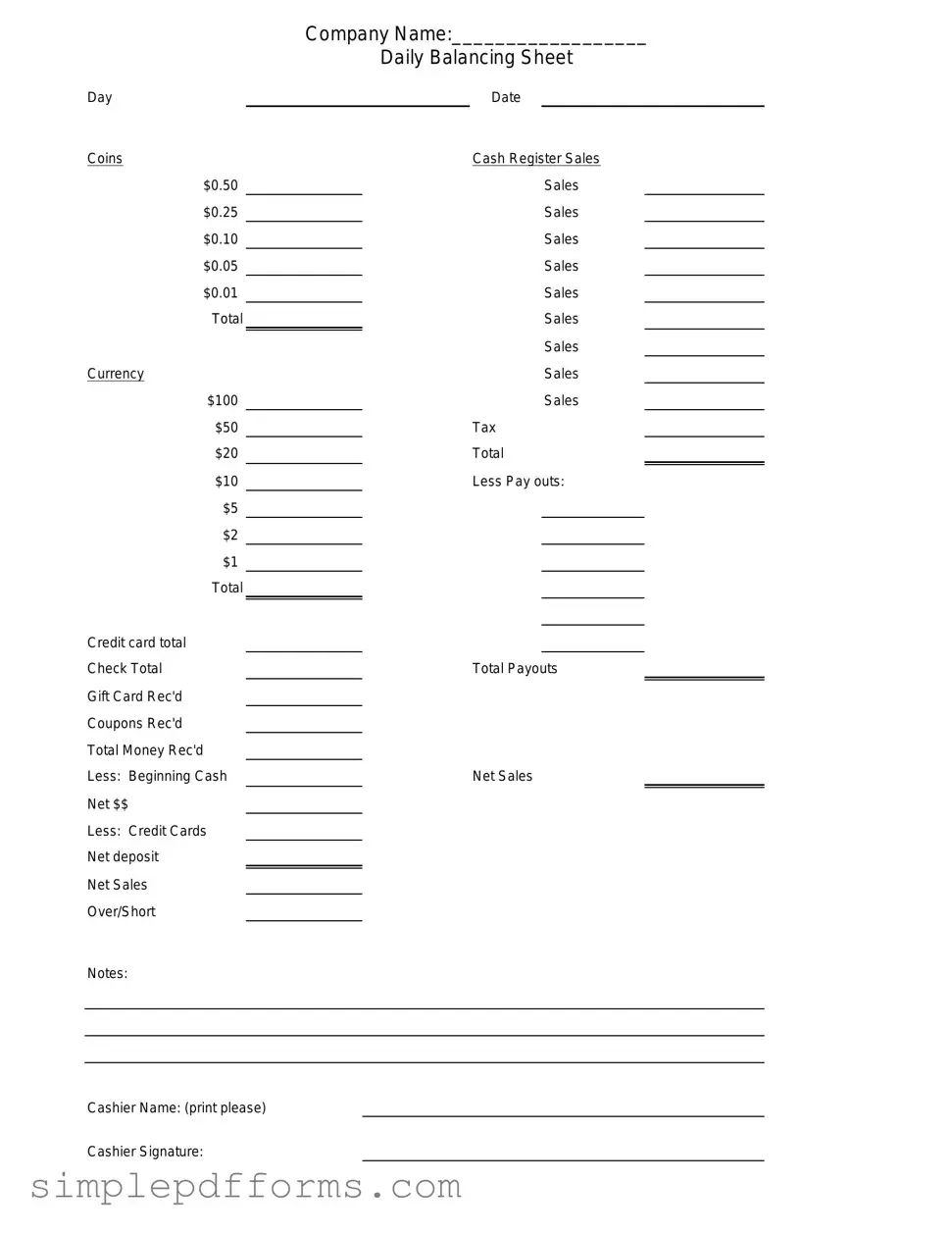

The Cash Drawer Count Sheet is a crucial document used by businesses to track the amount of cash in a cash drawer at the end of a shift or business day. This form helps ensure accuracy in financial reporting and accountability for cash handling. By maintaining a clear record, businesses can identify discrepancies and enhance their overall financial management practices.

Open Cash Drawer Count Sheet Editor Now

Fill a Valid Cash Drawer Count Sheet Form

Open Cash Drawer Count Sheet Editor Now

Open Cash Drawer Count Sheet Editor Now

or

Get Cash Drawer Count Sheet PDF Form

Your form is waiting for completion

Complete Cash Drawer Count Sheet online in minutes with ease.