Attorney-Verified Tractor Bill of Sale Document for California State

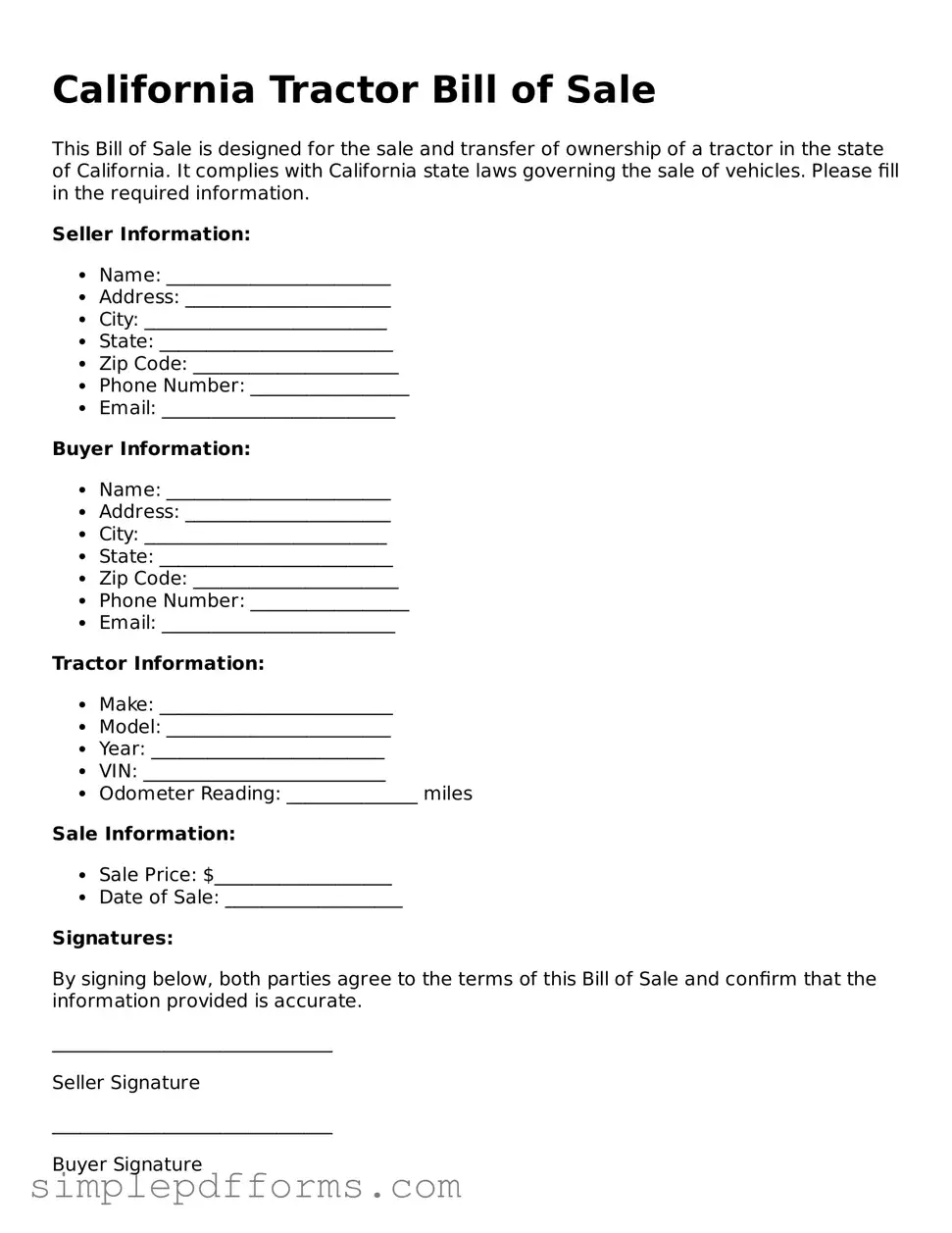

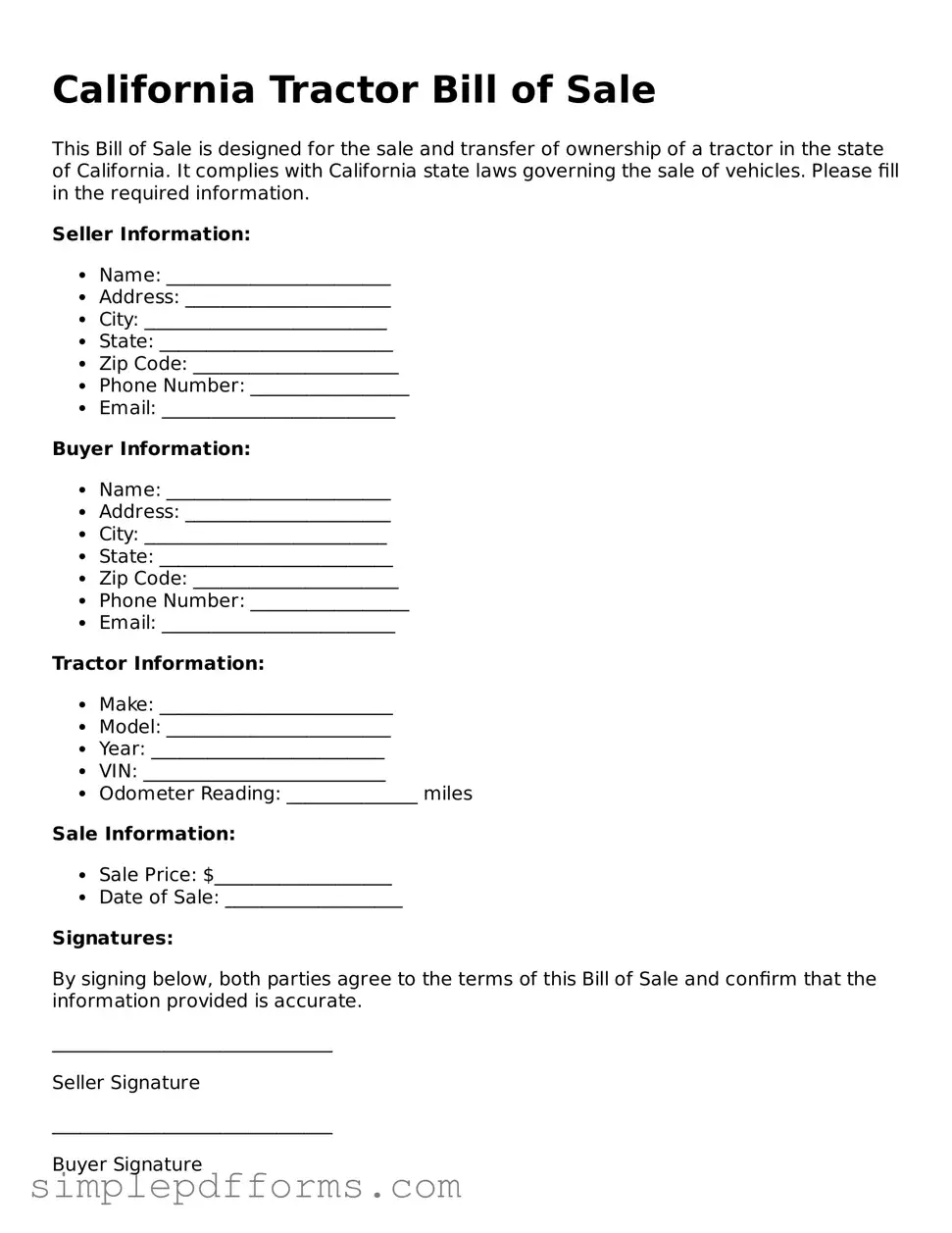

The California Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in California. This form provides essential details about the transaction, including the buyer, seller, and specifics of the tractor being sold. Understanding its importance can help ensure a smooth and lawful transfer of property.

Open Tractor Bill of Sale Editor Now

Attorney-Verified Tractor Bill of Sale Document for California State

Open Tractor Bill of Sale Editor Now

Open Tractor Bill of Sale Editor Now

or

Get Tractor Bill of Sale PDF Form

Your form is waiting for completion

Complete Tractor Bill of Sale online in minutes with ease.