Attorney-Verified Promissory Note Document for California State

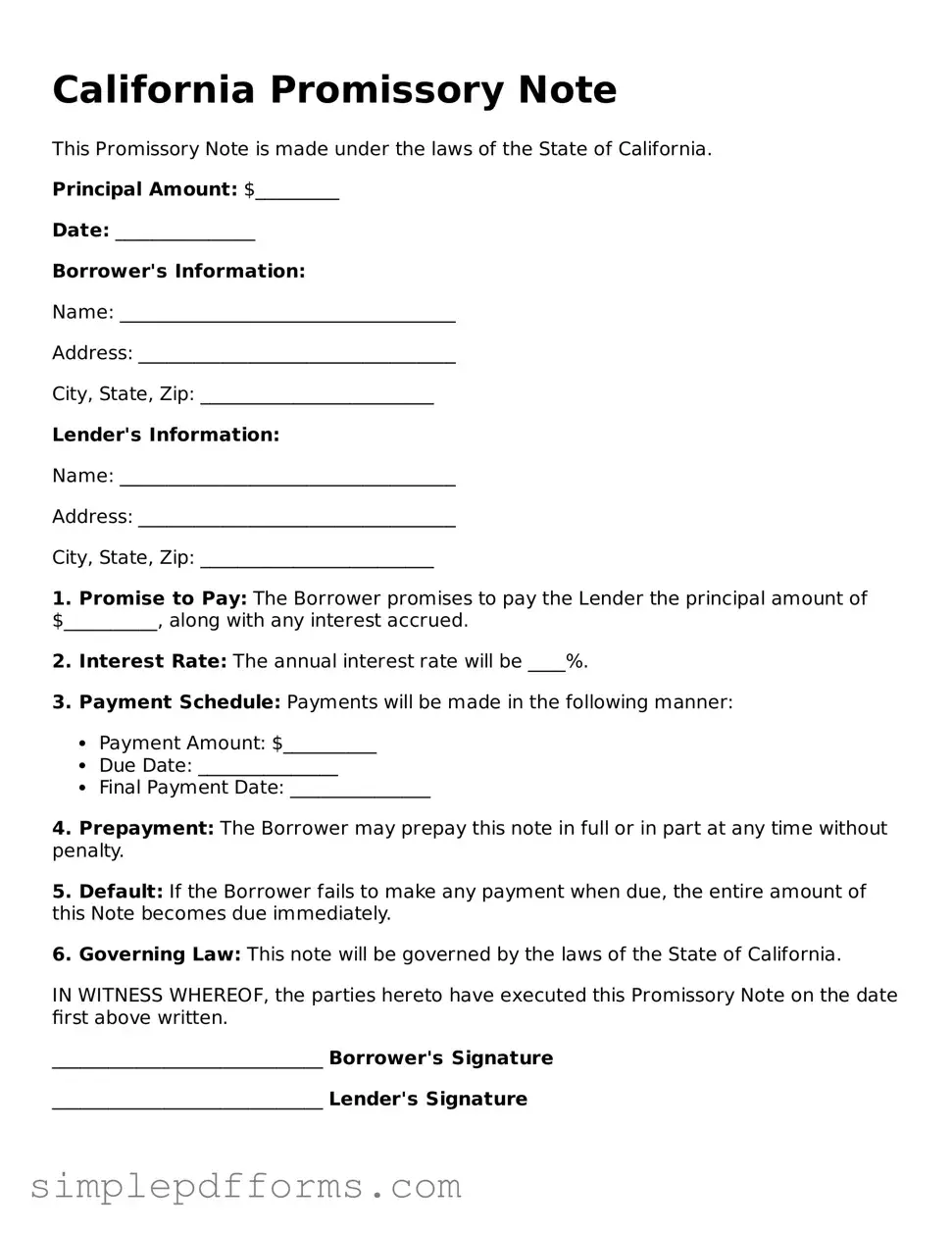

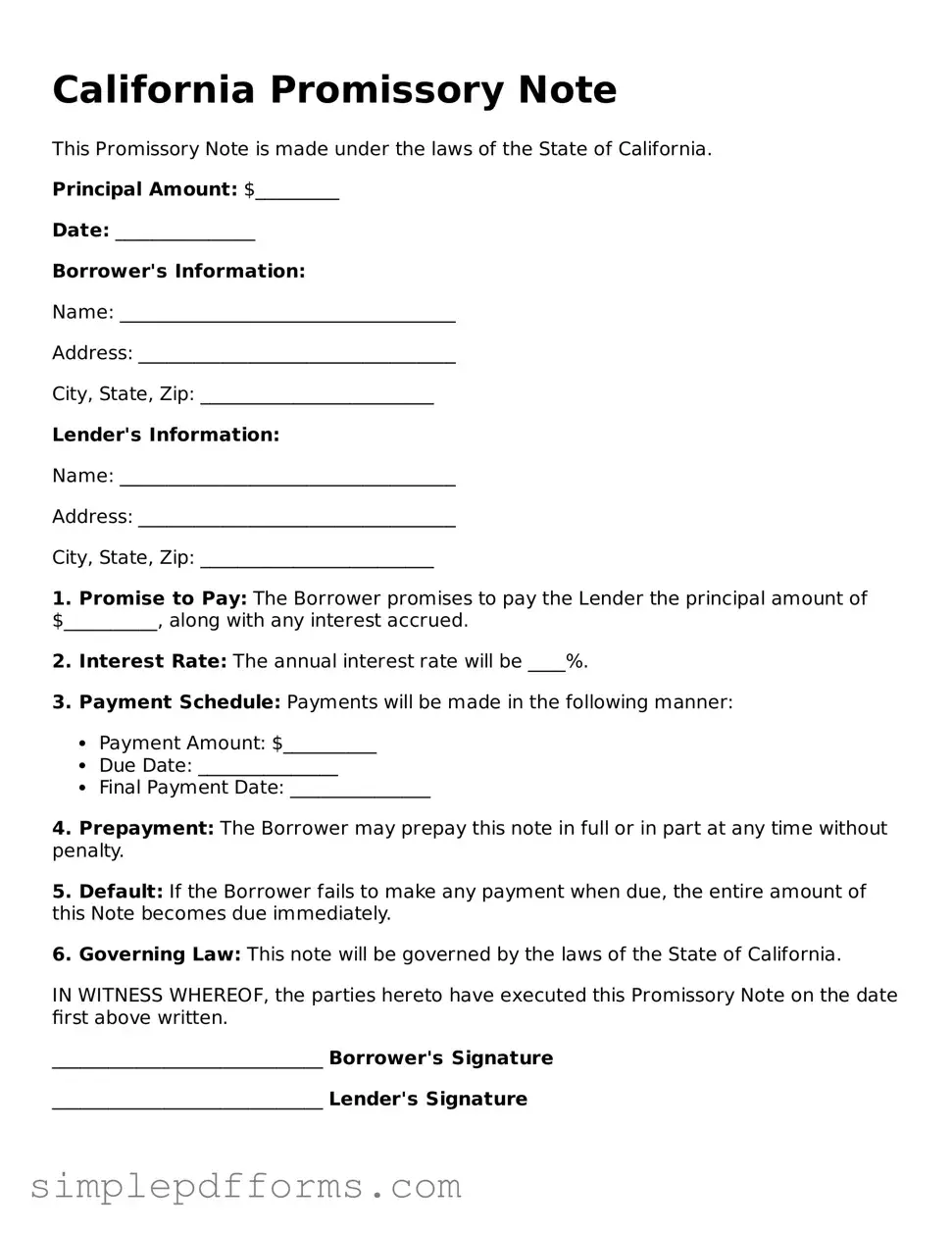

A California Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. This legal document serves as a crucial tool for borrowers and lenders, outlining the terms of the loan and ensuring that both parties understand their obligations. Understanding the elements of this form can help individuals navigate the lending process more effectively.

Open Promissory Note Editor Now

Attorney-Verified Promissory Note Document for California State

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

Get Promissory Note PDF Form

Your form is waiting for completion

Complete Promissory Note online in minutes with ease.